Like the automobile industry in days of yore when U.S. carmakers numbered in the hundreds—but can now be counted on one hand—so too is consolidation expected to change the midstream industry.

Trends in midstream mergers and acquisitions (M&A) during 2014 seem to back up that thesis, and history shows us that while competition is good, it does thin the herd.

“That [automotive industry] consolidation just gobbled up everybody. Some survived; some didn’t, and now you just have a handful of big players,” said Jed Shreve, a principal at Deloitte LLP in Houston, of the historic industry. “I think that’s way down the road [for midstream]. Maybe we’ll look back in 100 years and say, ‘There it was again—just the natural life cycle of businesses.’”

For the foreseeable future, though, Shreve told Midstream Business, consolidation in the form of M&A won’t dramatically diminish the players in the midstream space, but it will have an impact. The landscape of oil and gas basins throughout the U.S. will continue to be drawn through multiple angles.

As Ryan Maierson, a partner in the Houston office of law firm Latham & Watkins LLP, explained it, consolidation just caught up to the midstream in 2014. And while there is certainly more where that came from, sluggish commodity prices may slow down the deal making.

“What we saw in the midstream space was that the long-anticipated wave of midstream consolidation seems to finally have arrived,” Maierson told Midstream Business. “Folks have talked for years about the number of midstream MLPs, and the likelihood there would emerge some buyers and some sellers. There really was very little public-to-public midstream M&A for several years after that observation was made, up until [2014].”

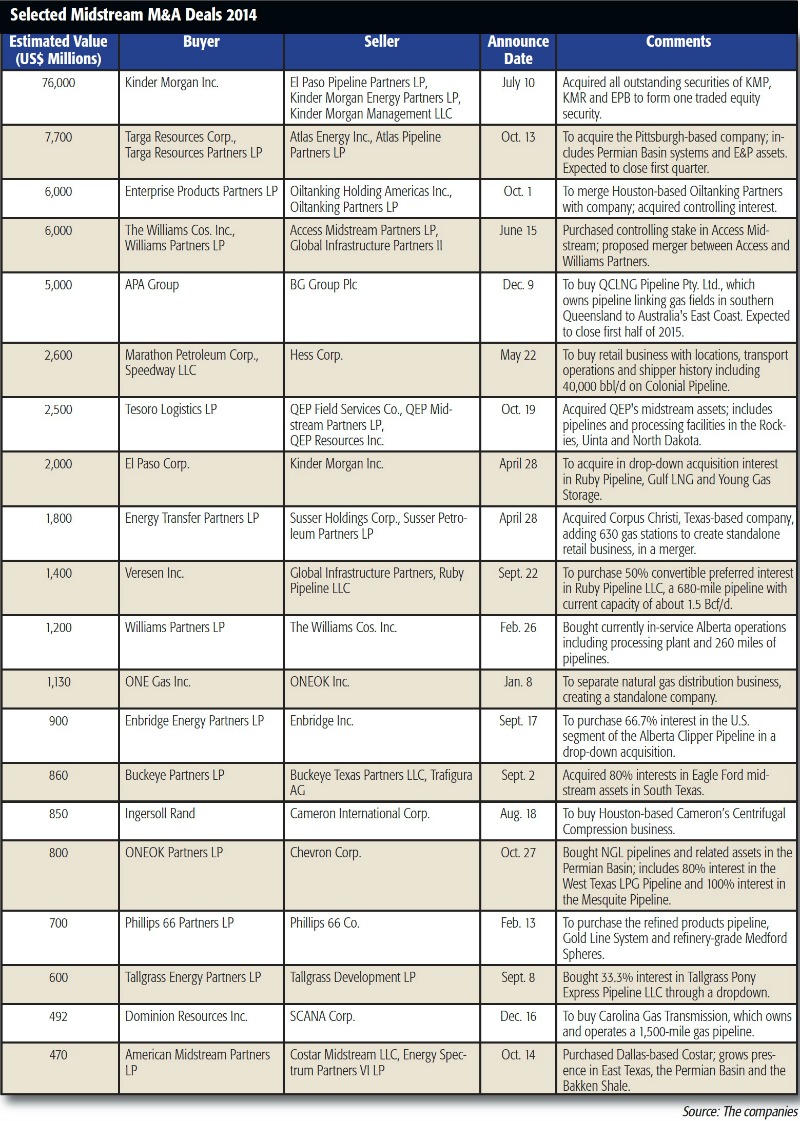

With companies like Targa Resources Corp. swallowing Atlas Energy Inc. and American Midstream Partners LP acquiring Costar Midstream LLC, at least half a dozen public MLPs announced mergers in the midstream space. Maierson said the action heated up during the latter part of 2014 because new challenges began confronting the industry.

“I think what happens when the markets get a little choppier, it becomes easier to differentiate between companies that are likely to survive and companies that are likely to struggle, so you have some separation in the market’s perception of the stronger companies and the less-strong companies. That separation creates opportunity for folks to make acquisitions in a way that’s accretive to their shareholders,” he said.

“It’s harder to get deals done in times of uncertain commodity prices than it is to get deals done when everyone agrees that commodity prices will be at a certain level, even if that level was relatively low. There may be a little bit more time for settling out and getting a feel for when we’ve hit bottom or maybe bounce back a little from the bottom, on commodity prices, and then I think deal making will pick up again,” Maierson added.

The second half

M&A activity tends to pick up in the second half of a year, Shreve said.

“In the third and fourth quarters of any given year, you tend to have more activity on the M&A front, and you could argue that it’s for different reasons,” he said, adding, “But when we had that Kinder Morgan transaction in August, you almost felt like it opened the floodgates.”

Last August, Kinder Morgan Inc. made a $76 billion announcement that it would roll up its public MLPs and El Paso Corp. into the parent company. The massive consolidation, which demonstrated M&A’s emergence in the midstream, stood out from other market activity as the biggest energy transaction of the year.

And it was subsequent to Kinder Morgan’s announcement that activity in the M&A market picked up the pace. Within a few months, Enterprise Products Partners LP had swallowed Oiltanking Partners LP; Anadarko Petroleum Corp.’s Western Gas Partners LP had gulped down Nuevo Midstream LLC; and The Williams Cos. Inc. had acquired Access Midstream Partners LP.

“These transactions didn’t get negotiated the next day. They take time,” Shreve said, adding, “There were a lot of things in the background going on, so I hate to say the Kinder Morgan deal opened the floodgates, but I think it definitely helped.”

Also part of the dynamic, Shreve said, is the tendency for business leaders to live with a January-to-December mindset.

“You’ve got the holidays at the back-end of the year and you set goals in January, and you look up, and here it is, the first half of the year flew by. I think it’s just human nature to say, ‘Oh, we’ve got to go execute some of these goals we had, and we’re running out of time at the end of the year.’

“I think you could always interject political implications, and is it an election year or not; is something going to change next year; is there tax legislation around the corner; and [a business] wants to beat the gun there and do something this year before some unknown tax law comes in next year,” he said. “I think it’s a combination of all those things.”

Dropping down

Greg Haas, director of research at Houston-based Stratas Advisors (a Hart Energy company), noted that much of 2014 was marked by a pattern in the midstream of M&A dropdowns.

“We saw dropdowns from refineries and chemical plants to form new operating MLP structures. It offers a ‘winwin’ for investors. You get more of a pure play on the equity [general partner] owner, and you’ve got a tax advantaged MLP for other types of investors who like units. That’s a positive that happened in 2014,” he told Midstream Business. “With regard to 2015, it remains to be seen how long the window will be open or shut.”

Among the MLP dropdowns, Enbridge Energy Partners LP bought a 66.7% interest in the U.S. segment of Alberta Clipper Pipeline and Tallgrass acquired a 33.3% interest in the Tallgrass Pony Express Pipeline LLC. In the biggest MLP IPO in more than a decade, Royal Dutch Shell Plc created Shell Midstream Partners LP to handle the parent company’s midstream assets.

Other companies used M&A activity to expand their services or diversify their plays, noted John England, vice chairman and U.S. oil and gas leader at Deloitte LLP. Enterprise Products Partners LP bought Oiltanking Partners to expand its oil storage capabilities and Tesoro Logistics Partners LP bought QEP Midstream Partners LP to widen its services and include gas, he told Midstream Business.

In its 2013 report, “Rise of the Midstream,” Deloitte noted that the sector was moving into a growth phase that would likely be followed by an increase in consolidations.

The LPG export facility at the Houston Ship Channel is an integral part of Enterprise’s transaction to buy Oiltanking Partners. Enterprise acquired the general partner and related incentive distribution rights. Source: Enterprise Products Partners LP

“What’s maybe surprised us a little bit is that M&A activity has picked up faster than we expected, and we’re starting to see some consolidation come into the industry now. That will probably continue into [2015],” he said.

“Some of it is just that there are some economies of scale to be gained, and people were looking to drive efficiencies and count their returns. I think that was already happening. As prices go down, we’re going to see things become more competitive, and that generally leads to some consolidation as companies look to get more scale, which hopefully drives more synergies and efficiencies in their operations,” England added.

During the first half of 2014, management teams were focused on more organic growth and cost containment. Higher commodity prices made many deals uneconomic, he said.

In a snapshot of the third quarter, PricewaterhouseCoopers LLP found that midstream activity was one of the key drivers in oil and gas M&A. During that period, there were 15 midstream deals, including three valued at more than $8 billion each for a total $74.1 billion. That equated to a 517% increase in deal value compared to the previous quarter, according to the firm’s third-quarter appraisal.

Flush with filings

The midstream continued its evolution in 2014 with a rash of MLP filings at the end of the year that demonstrated the structure’s strength and indicated that MLPs as a whole would have great access to public markets, Stratas’ Haas said.

“We saw some blockbuster MLP issuances across the circuit—everything from petrochemical MLPs to some sand MLPs—but certainly many midstream MLP IPOs as well,” he said.

And it may turn out that by the end of 2015, some of the smaller or newer public MLPs may well be swallowed up by larger ones, said Sunil Sibal, director and senior MLP analyst at Seaport Global Securities LLC in New York City.

“It’s going to be primarily people who start trading at distressed valuations in this commodity price environment. I think they’re likely to be absorbed by some of the bigger MLPs, which have healthier balance sheets, and as a result, have a better ability to weather the volatility in crude prices,” Sibal told Midstream Business.

For example, he said, even in its announcement of its enormous roll up, Kinder Morgan Inc. was quite public about wanting to make acquisitions to consolidate in the midstream space.

EnLink Midstream’s Cana processing facilities in Canadian County, Okla., include a multitrain 350 MMCf/d cryogenic processing plant and a crude oil and condensate stabilization facility. The plant was acquired as part of the merger between Crosstex Energy and certain Devon Energy assets to create EnLink Midstream in March 2014. Source: EnLink Midstream

“Being the largest name in the midstream sector, they could definitely be a major player in this whole M&A in 2015,” Sibal said.

Ultimately, like everything else in the energy sector, midstream M&A will rely heavily on commodity prices and their futures.

“A lot of these names are pretty well hedged in the near-term and have stability in cash flow, but if crude prices remain weak for a prolonged period of time, a lot of the midstream guys will lose the benefit of the hedging, post-2015, and we would start to see a lot of stress on the cash flows,” Sibal said.

Private equity involvement

Private equity is a key midstream funding mechanism, Sibal said, and likely to benefit from the drop in oil prices.

“In the history of the sector, private equity has stepped in, in some shape or form, during times like this and been able to use this market situation to its advantage in terms of taking a longer-term view,” he said. “I’m sure they’re looking at this as a good time. The midstream sector is even more attractive to the private equity guys in transactions because of more stable cash flows and hence the ability to lever up the assets. I do think they will have a role to play. Whether they end up buying existing assets with distressed value or they end up investing in some growth areas strategically remains to be seen.”

At Energy Spectrum Capital in Dallas, a private equity firm focused on the midstream sector of the North American energy industry, partner Ben Davis described M&A as evolving to include transactions that involve development projects, even greenfield work, as opposed to the simple acquisition of a fully grown business.

“We invest a lot of our capital building greenfield projects. We have learned, in a market where it was tough to make acquisitions because it was so competitive, that we could find opportunities by building things,” he told Midstream Business

.For example, Davis said, Energy Spectrum is building a crude gathering system with Concho Resources in the Bone Spring play of the Delaware Basin that spans West Texas and part of New Mexico.

“We’ve also bought midstream assets that were fully operational and had growth opportunities, and we bought a very small system that our team grew by 50 times as a development project,” he said.

Based in Midland, Texas, Concho is cutting its own 2015 capex by one-third, but company executives said in a statement they still expect production to increase at least 16% above 2014 levels.

In a private equity deal at the end of 2014, First Reserve acquired and committed $250 million to Navigator Energy Services LLC. But rather than simply buy the company, Navigator will focus the funds on continued development, construction and expansion of the Big Spring Gateway System—yet another example of private equity venturing from acquisition into business development.

To be sure, the commodity price environment can boost private equity’s presence in the midstream.

Davis said that after Lehman Brothers went bankrupt, which marked the beginning of the recession, private equity investors such as Energy Spectrum saw significant opportunity.

“Unlike during the recession, there continues to be a lot of capital out there chasing deals. At the same time, one would think that the valuation of some of these assets would be lower because prices have gone from $100 to $50 a barrel in six or seven months,” he said. “Of course, for us to buy something at a lower valuation, a seller has to be willing to sell it at a lower valuation.”

MarkWest’s Houston, Pa., gas processing complex has emerged as a midstream hub serving the Marcellus play. Source: MarkWest Energy Partners LP

Most investors live by the adage of buy low and sell high, he said, and unless the bank is breathing down their necks, companies will probably want to hold onto their assets.

“I don’t know that we’re going to see a lot of fire sales, just based on how few people really have to sell something and also, we oil and gas folks can be eternal optimists,” Davis said. “We often think oil and gas prices are going to come back up so some folks are reticent to sell in a down-price market when they don’t think it’s going to last very long. By the way, I do think prices are going to come back up.”

M&A candidates

Which companies might be targets for acquisition? Sibal said names that traded down during the end of 2014 would be likely candidates.

“Targa [Resources Partners LP] shouldn’t be a surprise to anybody. They have disclosed their [merging] discussion with Energy Transfer; and the [company] was trading at 35% to 40% discounted levels from that time,” he said. “Targa just bought [Atlas Energy Inc.] and once they are past closing in the first quarter, then [Targa] becomes a cleaner candidate. Timing may be an issue for them, but their asset footprint is very desirable, and they are likely to be on a lot of people’s radar screens.”

Another MLP that may be in the crosshairs is MarkWest Energy Partners LP, he said. MarkWest has a solid footprint in the Marcellus and Utica plays, but its units have traded down in a 52-week range—January to January—from $80.79 to $58.62.

Still, in second-half 2014, MarkWest was busy announcing expansion plans at its Keystone complex in Butler County, Pa., and closed on a $500 million public offering to pay off some debt and apply toward capex.

Sabil said that considering MarkWest’s performance as a whole, the company probably outperformed, but if its units continue to trade weak, “We could even see them as a candidate.”

Oil prices punch

As a lower-risk sector, the midstream and its transactions are more insulated from volatile commodity prices than the upstream. Fifteen- and 20-year contracts for pipeline services from credit-worthy companies can soften the blow of oil prices, which have plummeted to half what they were a year ago.

LPG vessels, such as the Derby Monrovia at the Houston Ship Channel, now owned by Enterprise Products Partners LP through its 2014 acquisition of Oiltanking Partners LP, are a key part of Enterprise’s approach to meet more midstream needs in-house. Source: Enterprise Products Partners LP

However, midstream companies are wise to watch as upstream companies cut their 2015 capex—some as much as 40%—and weigh how that will impact volumes, industry observers say. Sean Wheeler, also a partner at Latham & Watkins, told Midstream Business, “If people are shutting in wells, a lot of these smaller midstream companies aren’t going to be able to execute on their business plan the way they thought, but the other companies are going to be able to move forward and execute and still engage in M&A.”

At Deloitte, England said that the current price environment will force companies to optimize how they get their products to their markets.

“The more efficient solutions that midstream companies can provide to bring hydrocarbons to market, the better they are,” he said, adding that, “Sometimes it requires some industry consolidation to achieve that.”

It’s when new drilling doesn’t happen that the midstream may feel price pressure, England said, which may open the door to discounted deals. Downturns are typical of any cyclical industry, and it’s during these periods that some companies with high debt levels become targets of other companies that are looking for acquisition opportunities.

“Typically, when we have these cyclical downturns in our industry—and we see that across all sectors—particularly, if companies are stretched, if they have high debt levels, those tend to create opportunities for some acquisitions in the market,” he said, adding that across the industry, investors may be looking for bargains.

But upstream operators will still need to move products, even in times of a glutted market, which won’t make midstream bargains easy to find.

“The gas side of the value chain has been glutted for years now,” Stratas’ Haas said. “And just like shale gas was the precursor to shale oil development and production wave, so the gas price crash is sort of the precursor to the oil price declines we’ve seen now. Just as supply ramped very fast on the gas side, and gas prices have crashed and stayed in the $3 range for so long, we’re now starting to feel that on the oil side,” Haas said.

But the growth in production has made the U.S. significantly more energy independent, he said, adding “We’ve become the envy of the world. That’s why Saudi Arabia is trying to protect market share, and OPEC is trying to figure out how to keep prices sustainable for their needs.

Fed by the Sand Hills Pipeline, in which Phillips 66 owns a one-third interest, the Sweeny Fractionator One in Old Ocean, Texas, will supply NGL products to the petrochemical industry and heating markets. The 100,000 barrel-per-day NGL fractionator is expected to start up in the third quarter. Source: Phillips 66 Partners LP

“And meanwhile, because of the U.S. drilling and production efforts, assisted by the midstream and assisted by crude oil refining, the American driver and the American industry is definitely seeing some great benefits—far more than anybody would have predicted two to five years ago,” Haas added.

Haas explained that shale oil production came at such a fast ramp-up that some retrenching in prices almost had to occur.

“The shift has been so rapid with supply, that the prices need to equilibrate at a new, lower level, given that this shale oil output seems to be sustainable and possible,” he said. “It a new way for America to feed itself with the crude oil that it needs.”

Deon Daugherty can be reached at ddaugherty@hartenergy.com or 713-260-1065.

Oil Prices Could Undo Crude-By-Rail Growth

By Deon Daugherty, Hart Energy

While crude oil production in the rockin’ Bakken has surged 270% during the last three years, it remains remote among oil-producing basins and its North Dakota location lacks infrastructure to get all that oil to market. When existing pipelines weren’t moving hydrocarbons fast enough to and from the Cushing, Okla., trading hub, crude by rail worked to the Bakken’s benefit. And, shipping the crude by railroad was a quick fix that seemed poised to energize the railroad energy.

Crew members perform safety checks on tank cars at the Trenton, N.D., terminal of The Savage Cos. Source: Savage

But $50 per barrel (bbl) oil has brought that promise to a screeching halt, say some analysts.

“Railroads appeared to be solving the North Dakota crude transport challenge while producers waited for slower pipeline infrastructure to be built out,” wrote RBN Energy analyst Sandy Fielden in a recent report. “And for the East and West Coast markets where pipeline infrastructure seems unlikely to get built because of geography (the Rockies) or population density (East Coast), rail provided a ‘pipeline on wheels’ to get stranded crude to refineries.”

But fears that followed railroad derailments, including one in the small town of Lac-Mégantic, Quebec, that left dozens dead, slowed the Bakken’s crude-by-rail surge, RBN added. What’s more, the economics of railing Bakken crude to coastal markets were struck by narrowing price differentials between the Midcontinent crude’s West Texas Intermediate (WTI) benchmark, which is priced in Oklahoma, compared to coastal crudes priced at the Gulf Coast, and international Brent, which sets prices on the East Coast, RBN said.

“When coastal crude prices were much higher than WTI, it made sense to pay higher rail freight costs to ship crude to those markets,” Fielden said. “As the difference between WTI and coastal crudes narrowed, so did the incentive to use rail transport.”

It’s in the cost-conscious environment that appears to be shaping 2015 that higher transportation costs will weigh on rates of return, which RBN said will leave the Bakken more vulnerable than other basins closer to coastal markets.

As Stratas Advisors Director Greg Haas told Midstream Business, rail utilization from the Bakken could record a “lost year” between September 2014 and September 2015.

“One telling piece of data is that Bakken prices have been in the $30s [bbl] at the field level, so it’s quite frightening to think that Bakken oil-directed operators are facing $30 field posted prices,” Haas said, adding that in January 2014, oil prices at the field were between $73 and $80.

“So you can imagine what that may do to the crude-by-rail entities that are operating up in the Bakken region. And recall that the Bakken is the most highly leveraged play for crude by rail. That’s simply because it’s so remote from any major markets for light crude. And, they came on so fast and so strong that they never really had a reason to have a tremendous amount of high capacity crude pipelines,” he said. “I would expect utilization of many rail facilities to be at minimal levels while these prices are at such grave discounts.”

Infrastructure takes hundreds of millions—if not billions—of dollars to build and permits can take years to be approved.

“All of that will have to continue at its somewhat sluggish pace. But along the way, if you’re a crude-by-rail company looking to expand your crude-by-rail facilities in the Bakken, and if your balance sheet or income statements rely upon expansion of your crude-by-rail facilities, you might be looking for a partner to help you,” Haas said.

And that might be the case for years to come.

“We don’t foresee $100 oil for a while. Some of the higher cost plays, or even in the more marginal areas of solid oil plays that require $80 oil [to be profitable], might not see that return to production until 2017.”

For example, Haas said, if a company was looking for vibrant growth in the Tuscaloosa Marine Shale, and intended to connect some new pipelines and gathering systems out of the Tuscaloosa over to Houston or Louisiana’s Gulf Coast refining complex in Baton Rouge, those companies might have a two-year wait until production starts.

“The growth in crude by rail is probably a thing of the past,” he said.

Recommended Reading

Commentary: Are Renewable Incentives Degrading Powergen Reliability?

2024-02-01 - A Vistra Corp. chief, ERCOT’s vice chairman and a private investor talk about what’s really happening on the U.S. grid, and it’s not just a Texas thing.

Veriten’s Arjun Murti: Oil, Gas Prospectors Need to Step Up—Again

2024-02-08 - Arjun Murti, a partner in investment and advisory firm Veriten, says U.S. shale provided 90% of global supply growth—but the industry needs to reinvent itself, again.

Heard from the Field: US Needs More Gas Storage

2024-03-21 - The current gas working capacity fits a 60 Bcf/d market — but today, the market exceeds 100 Bcf/d, gas executives said at CERAWeek by S&P Global.

Exclusive: Renewables Won't Promise Affordable Security without NatGas

2024-03-25 - Greg Ebel, president and CEO of midstream company Enbridge, says renewables needs backing from natural gas to create a "nice foundation" for affordable and sustainable industrial growth, in this Hart Energy Exclusive interview.

Exclusive: Chevron Balancing Low Carbon Intensity, Global Oil, Gas Needs

2024-03-28 - Colin Parfitt, president of midstream at Chevron, discusses how the company continues to grow its traditional oil and gas business while focusing on growing its new energies production, in this Hart Energy Exclusive interview.