Before New Mexico’s Delaware Basin dominated oil and gas interest, the Northwest Shelf’s Yeso abided. (Source: Hart Energy)

[Editor's note: A version of this story appears in the October 2019 edition of Oil and Gas Investor. Subscribe to the magazine here.]

In the what-have-you-done-for-me-lately world of Permian Basin oil and gas, New Mexico’s Northwest Shelf has, until now, escaped public notice. It is not the Delaware or Midland basins. Nor is it part of the Spraberry-Bone Spring-Wolfcamp triumvirate of 21st century, headline-producing geology.

But, welcome anyway to the Northwest Shelf’s Yeso, the slope margin dolomitic and time-coterminous equivalent of the Delaware Basin’s Bone Spring to the south. The Yeso occupies that netherworld between conventional and unconventional geologic characteristics that have garnered economic notice with the application of modern horizontal drilling and multistage fracturing.

At less than 5,000 feet, Yeso reservoirs are shallow, which means current breakevens below $30 oil on $4 million horizontal wells. Production finds a ready outlet to the Artesia, N. M., refining complex.

Oil and gas interest in Yeso-related reservoirs (primarily Blinebry) and Paddock formations of Leonardian age) dates to the 1960s. Privately held regional companies such as Yates Petroleum Corp. and Chase Energy Corp. were among the most active Yeso participants early on. Interest was rekindled after 2011 when ConocoPhillips Co. drilled 70 vertical Yeso wells near Maljamar, N.M., for evaluation. Historically, vertical Yeso wells were located along the narrow east/west Abo Reef trend between Carlsbad and Artesia, N.M., targeting the slope down from the Northwest Shelf into the Delaware Basin. Current horizontal drilling has moved activity back north of the reef margin edge.

Before New Mexico’s Delaware Basin dominated oil and gas interest, the Yeso abided. E&Ps drilled more than 3,600 Yeso wells. By volume, Concho Resources Inc. accounted for more than half of Yeso wells followed by Apache Corp., with a little more than one-third.

In fact, Concho Resources traces its corporate history to the Yeso. In 2006, the Midland-based E&P combined with Artesia-based Chase Oil Corp. to establish a Yeso position on the Northwest Shelf. This predated Concho’s Henry Petroleum LP acquisition in 2008 that set the company on course to become a dominant player in the Texas portion of the Permian Basin. In 2010, Concho expanded its Yeso holdings after acquiring Artesia–based Marbob Energy Corp. for $1.4 billion.

Other regional Yeso acquisitions include EOG Resources Inc., which picked up its own slice of the Yeso pie as part of the Yates Petroleum $2.34 billion acquisition in 2016. The Northwest Shelf Yeso neighborhood also includes Apache, Occidental Petroleum Corp. and ConocoPhillips.

The modern Yeso narrative developed traction when Houston-based Percussion Petroleum LLC picked up 6,000 net acres in Eddy County in 2016. Eventually, Percussion became the largest player on the western portion of the Northwest Shelf with 22,000 net acres, while Concho remained the main player on the eastern half. Concho initiated horizontal drilling in 2016 and Percussion followed, applying modern slickwater horizontal techniques to what was formerly a shallow vertical play.

Enter Houston-based Spur Energy Partners LLC. The privately held start-up is led by Jay Graham with financial backing from New York-based KKR & Co. Graham is formerly the CEO of WildHorse Resource Development Corp., which established its technical street cred by developing the geologically complex conventional Red River Play in northern Louisiana. That acreage subsequently sold to Range Resources Corp. for $4.4 billion in 2016. The next corporate iteration of WildHorse focused on the underdeveloped northeast Eagle Ford and legacy Austin Chalk. WildHorse went public at the end of 2016 and was subsequently merged into Chesapeake Energy Corp. in a $3.98 billion deal in late 2018.

After acquiring Percussion’s Yeso holdings in May 2019, Spur added 70,000 net acres and 2,500 operated Yeso wells from Concho—roughly one-third of Concho’s well inventory—for $925 million in cash in September 2019.

Graham’s companies are known for exceptional technical prowess in addressing overlooked, geologically challenging oil and gas plays. That history may make the difference in the Yeso. One intriguing question is whether the upper Yeso and Glorieta formations in New Mexico exhibit similar residual oil zone characteristics to those found in the horizontal San Andres play underway on the Central Basin Platform and the Texas extension of the Northwest Shelf.

Such linkage suggests that production will be longer-lived, even in a low commodity price environment.

In that case, long live New Mexico’s Yeso.

Recommended Reading

Despite LNG Permitting Risks, Cheniere Expansions Continue

2024-02-28 - U.S.-based Cheniere Energy expects the U.S. market, which exported 86 million tonnes per annum (mtpa) of LNG in 2023, will be the first to surpass the 200 mtpa mark—even taking into account a recent pause on approvals related to new U.S. LNG projects.

Venture Global Gets FERC Nod to Process Gas for LNG

2024-04-23 - Venture Global’s massive export terminal will change natural gas flows across the Gulf of Mexico but its Plaquemines LNG export terminal may still be years away from delivering LNG to long-term customers.

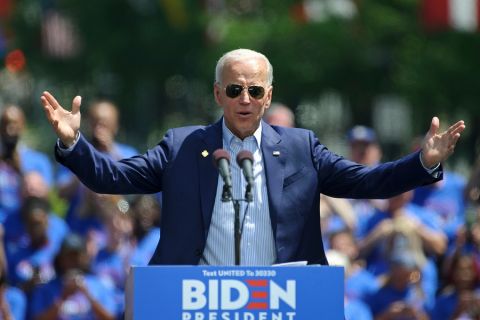

Pitts: Producers Ponder Ramifications of Biden’s LNG Strategy

2024-03-13 - While existing offtake agreements have been spared by the Biden administration's LNG permitting pause, the ramifications fall on supplying the Asian market post-2030, many analysts argue.

EQT’s Toby Rice: US NatGas is a Global ‘Decarbonizing Force’

2024-03-21 - The shale revolution has unlocked an amazing resource but it is far from reaching full potential as a lot more opportunities exist, EQT Corp. President and CEO Toby Rice said in a plenary session during CERAWeek by S&P Global.

Venture Global Seeks FERC Actions on LNG Projects with Sense of Urgency

2024-02-21 - Venture Global files requests with the Federal Energy Regulatory Commission for Calcasieu Pass 1 and 2 before a potential vacancy on the commission brings approvals to a standstill.