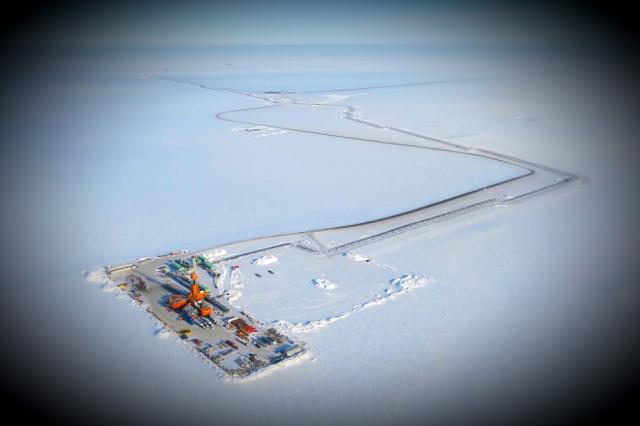

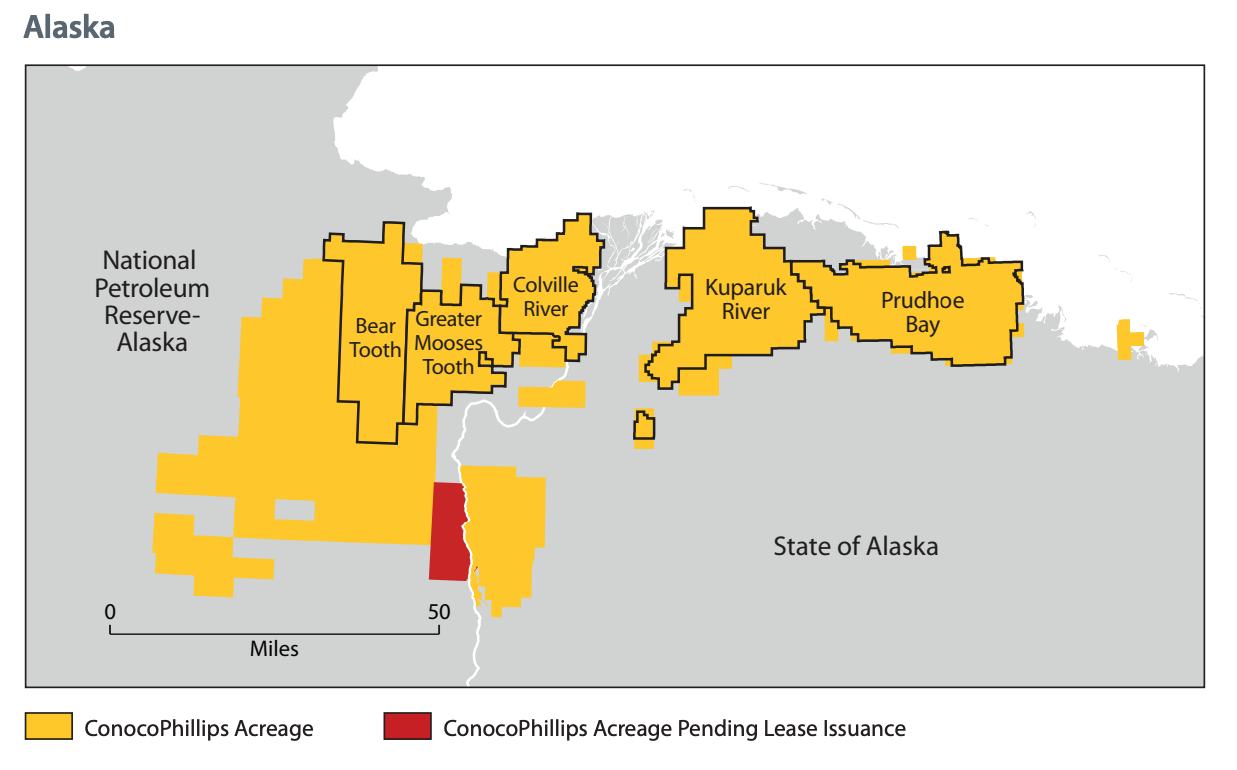

Pro forma for its recent acquisition from private-held Caelus Energy, ConocoPhillips portfolio in Alaska covers nearly 1.3 million net undeveloped acres. Pictured is a ConocoPhillips drillsite at the Alpine Field in Western North Slope. (Source: ConocoPhillips Co.)

ConocoPhillips Co. recently landed a deal with a private E&P for North Slope assets that further expands the Houston-based company’s Alaskan footprint, which already totals more than 1 million acres.

Last year, ConocoPhillips grew its position in the region with a deal for nonoperated interests in the western North Slope from fellow independent oil and gas company Anadarko Petroleum Corp. The $400 million bolt-on acquisition gave ConocoPhillips 100% control over 200 million barrels of gross reserves and about 900 million barrels of risked gross reserves.

In a deal on June 17, ConocoPhillips said it signed an agreement to acquire the Nuna Discovery located east of the Colville River and southwest of the Oooguruk Field. Although the terms of the transaction weren’t disclosed, ConocoPhillips said the purchase included 11 tracts covering 21,000 acres.

The seller, Caelus Energy LLC, is a privately held company headquartered in Dallas. The E&P is led by its founder and CEO Jim Musselman, who had previously co-founded Kosmos Energy Ltd.

__________________________________________________________________________________________________

RELATED:

ConocoPhillips To Buy Alaska Interests For A Cool $400 Million

Caelus Energy Makes ‘World-Class Discovery’ On North Slope

__________________________________________________________________________________________________

In October 2016, Caelus unveiled a light oil discovery on the Alaska North Slope expected to hold at least an estimated 6 billion barrels of oil in place. The find, located on the company’s Smith Bay state leases, was one of the biggest oil discoveries the North Slope had seen in several decades.

At the time, Musselman said the Smith Bay discovery has the “size and scale to play a meaningful role in sustaining the Alaskan oil business over the next three or four decades,” but “fiscal stability going forward is critical for a project of this magnitude.”

Musselman experienced similar exploration success at Kosmos. He led the Dallas-based company in the discovery of the Jubilee Field offshore Ghana in 2007 while serving as chairman and CEO. He later retired from Kosmos to focus on “entrepreneurial ventures and startup opportunities,” Kosmos said in a January 2011 release announcing his departure.

As for ConocoPhillips, the company and its predecessors have been exploring for oil in Alaska for more than 50 years, according to its website.

The company ranks as Alaska’s largest oil producer and one of the largest owners of state and federal exploration leases. Pro forma for the recent acquisition, ConocoPhillips’ Alaska portfolio included nearly 1.3 million net undeveloped acres at year-end 2018.

The acquisition from Caelus comprises 100% interest of the Nuna discovery. The transaction has an effective date of June 14. Completion of the deal remains subject to state regulatory approval.

The Nuna prospect was announced as a discovery in 2012. ConocoPhillips said the plans are for its Alaskan affiliate, ConocoPhillips Alaska, to appraise Nuna over the next several years with a goal toward making a final investment decision thereafter.

In a statement, Joe Marushack, president of ConocoPhillips Alaska, said: “This transaction represents an attractive addition to our expanding North Slope position and will allow ConocoPhillips to cost-effectively develop Nuna utilizing Kuparuk River Unit infrastructure.”

Vinson & Elkins represented Caelus affiliate, Caelus Natural Resources Alaska LLC, in the transaction. The law firm’s team was led by Danielle Patterson and Danny Nappier.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.