Wells Fargo describes the leasehold as a “proven Eagle Ford development opportunity” with Austin Chalk potential. (Source: Hart Energy, Shutterstock.com & ConocoPhillips Co.)

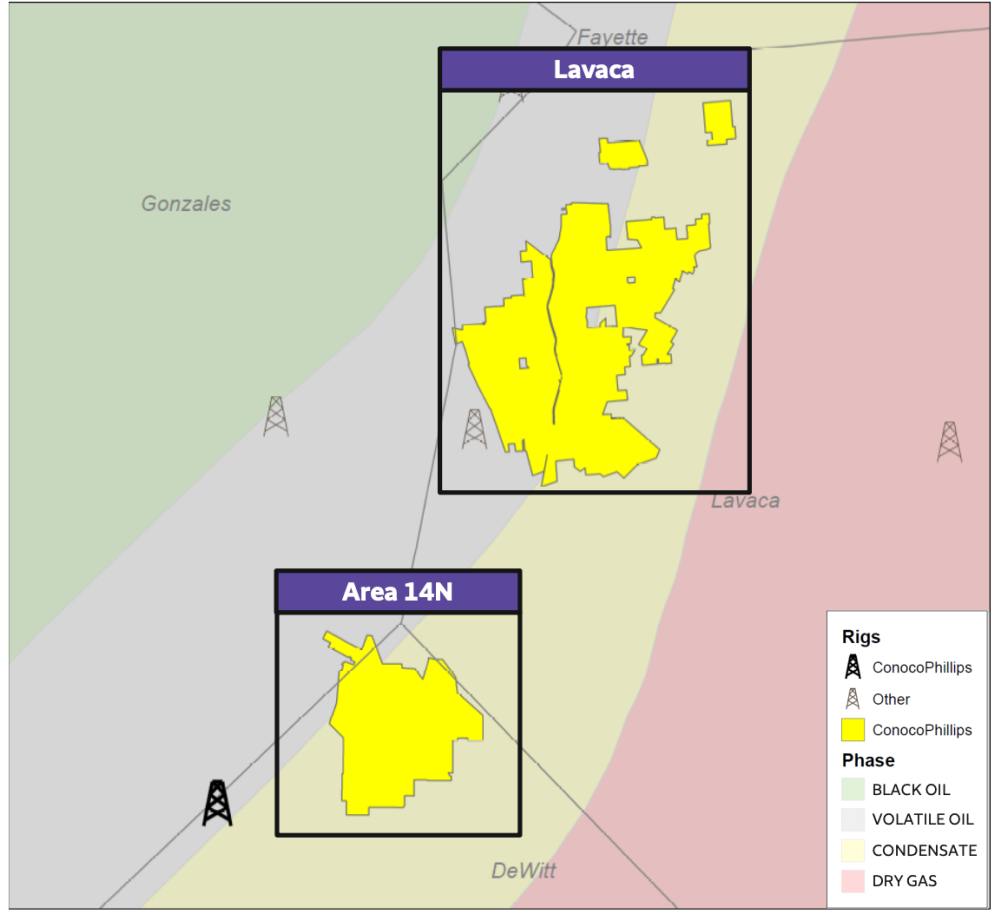

After a period of relative M&A quiet in the Eagle Ford Shale, ConocoPhillips Co. is offering for sale a mix of operated, nonoperated and overriding royalty interests in DeWitt and Lavaca counties, Texas, including locations in the Basal Austin Chalk.

So far in 2022, the sole announced E&P deal in the Eagle Ford was January’s acquisition by Lime Rock Resources LP. The company said it had purchased Eagle Ford and Austin Chalk assets from a private seller for $271.3 million.

ConocoPhillips is also engaged in marketing nearly 280,000 net acres comprising leasehold in the western Anadarko Basin and nonoperated assets in the STACK and SCOOP plays as the company looks to high-grade its portfolio.

The ConocoPhillips Eagle Ford position includes 7,497 net acres (34,719 gross) in the Eagle Ford oil fairway with fourth-quarter 2021 annualized field-level operating cash flow of $32 million. The leasehold position yielded 2,304 boe/d of production (53% oil) from 175 horizontal producers, as of fourth-quarter 2021, according to Wells Fargo, which is handling the sale process.

Wells Fargo describes the leasehold as a “proven Eagle Ford development opportunity” with Austin Chalk potential.

The asset includes:

- 231 gross Eagle Ford locations at ~330 ft - 550 ft spacing;

- Average lateral length of about 6,600 ft; and

- EURs ranging from 60 - 90 boe per ft with IRRs at more than 150% at current strip prices.

ConocoPhillips is also touting more than 40 Austin Chalk locations and noted that its Langhoff well produced more than 280,000 boe in its first 12 months—about 30% higher than regional expectations, according to Wells Fargo.

Offset and nonop partners include SilverBow Resources and Ranger Oil Corp, which have completed more than 25 on-lease wells since 2020, according to Wells Fargo. The two companies have a combined 16 active permits and/or DUCs that will drive near-term production and cash flow.

In January, Enverus estimated that about 17% of the $25 billion in available asset deals were located in the Eagle Ford.

However, the more mature Eagle Ford has trailed the Permian’s Midland Basin and Appalachia’s Marcellus Shale in deal activity and largely has seen prices priced at PDP value alone, often at discounts greater than PV-10, Enverus said in the January report.

Notably, SilverBow and Ranger Oil have been among the more active acquirers in the play. In 2021, SilverBow announced two deals totaling more than $100 million. Ranger Oil also completed two deals last year for a combined price of nearly $410 million.

Enverus has predicted that more mature regions like the Eagle Ford and Williston Basin are likely to see substantial high-production assets placed on the market, possibly at prices that will draw a mix of public and private buyers.

A return to higher asset-level deal flow would smooth the boom-or-bust cycle of M&A that has characterized the two years since the emergence of COVID, Enverus said.

ConocoPhillips’ Eagle Ford leasehold is 100% HBP and requires no continuous drilling obligations.

Management presentations for ConocoPhillips’ assets will be held in late April through early May. Confidentiality agreements can be obtained from Norbie Juist, Wells Fargo vice president of energy investment banking.

Recommended Reading

E&P Highlights: March 15, 2024

2024-03-15 - Here’s a roundup of the latest E&P headlines, including a new discovery and offshore contract awards.

Rystad: More Deepwater Wells to be Drilled in 2024

2024-02-29 - Upstream majors dive into deeper and frontier waters while exploration budgets for 2024 remain flat.

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.

E&P Highlights: March 4, 2024

2024-03-04 - Here’s a roundup of the latest E&P headlines, including a reserves update and new contract awards.

Stena Evolution Upgrade Planned for Sparta Ops

2024-03-27 - The seventh-gen drillship will be upgraded with a 20,000-psi equipment package starting in 2026.