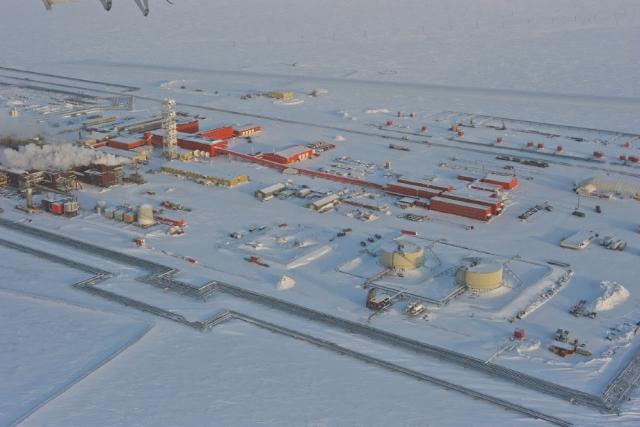

ConocoPhillips’ Kuparek unit on Alaska’s North Slope is shown on a cold winter day. It is located about 40 miles west of Prudhoe Bay. (Source: ConocoPhillips)

With about 75% of its Alaskan portfolio undrilled, ConocoPhillips Co. is gearing up for its “largest ever” winter program to date, a company executive told analysts Oct. 29.

“We’ll drill wells at Willow, at Narwhal and at Harpoon,” Michael Hatfield, president of ConocoPhillips’ operations in Alaska, Canada and Europe, said on the company’s earnings call.

First-half 2019 work in Alaska included drilling seven appraisal wells, a series of horizontal production wells, injectivity and interference tests. Third-quarter 2019 results included completed turnarounds at Prudhoe, West and North Slope and Kuparuk.

Details on the upcoming winter program are expected when ConocoPhillips presents its 10-year capital and financial plan during its annual analyst and investor meeting in November.

“We also continue to progress appraisal of our Willow and Narwhal discoveries,” added Matthew Fox, executive vice president and COO. “Earlier this month we spud another horizontal well from an existing Alpine drill site into the Narwhal trend. The well is designed to provide offset injection to the horizontal producer we drilled earlier in the year to help us optimize future development planning.”

The work comes as the company continues efforts to add value for shareholders, focusing on returns and strong delivery while coping with volatile market conditions.

Like some of its peers, ConocoPhillips has been divesting assets—including the $2.68 billion sale of its U.K. North Sea assets—to boost its profit. But the company also has been making strategic acquisitions to further strengthen its portfolio, including in Alaska where the company recently closed its Nuna discovered resource acquisition from Caelus Energy LLC.

RELATED: ConocoPhillips Tacks On Alaska Acreage To Growing North Slope Position

Alaska, where ConocoPhillips is the largest producer, continues to maintain its strong position in the company’s portfolio.

So far, between 500 million barrels of oil equivalent (boe) and 1.1 billion boe of resources have been discovered in Alaska. But potential could exist for more. ConocoPhillips’ 2019 program is focused on existing discoveries including appraisal at Greater Willow and Narwhal.

BP’s decision to sell its Alaskan business to Hilcorp Energy Co. means ConocoPhllips will have a new partner in Prudhoe Bay if the $5.6 billion sale closes as planned in 2020.

RELATED: Hilcorp To Buy BP’s Alaska Business For $5.6 Billion

“Hilcorp does have a track record in Alaska of rejuvenating mature fields. They’ve reduced lifting costs,” Hatfield said. “They’ve increased development activity and increased production in these other fields. So, we expect to see a reduction in operating costs and renewed focus on investment.”

He noted, however, that any capital plans for Prudhoe Bay requires approval from Hilcorp, Exxon Mobil Corp. and ConocoPhillips, which have an interest in the unit.

“While we work very closely today with BP as the operator, we’ll continue to work closely with Hilcorp as they come in and Exxon to maximize the value of this legacy asset,” Hatfield added. “We’re excited for this transaction. We see opportunity to unlock more value at Prudhoe Bay.”

Alaska was among the areas contributing to ConocoPhillips’ third-quarter production increase, which jumped by 98,000 boe to about 1.3 million barrels of oil equivalent per day (boe/d), excluding Libya.

Most of that growth came from the Lower 48 Big 3 segment comprising the Eagle Ford, Bakken and Delaware Basin where production increased 21% to 379,000 boe/d. Fourth-quarter Big 3 production is expected to be flat compared to third quarter, according to Dominic Macklon, president of Lower 48 for ConocoPhillips. He cautioned that the Bakken may experience weather impacts in December, but the Delaware could see a “little bit” of growth.

“Overall our guidance is relatively flat in Q4 in the Big 3 vs. Q3,” Macklon said. “We will see continued growth in 2020 in the Big 3.”

In all, ConocoPhillips beat analysts’ expectations, reporting third-quarter 2019 earnings of $3.1 billion, up from $1.9 billion a year earlier, driven primarily by gains from its U.K. divestment.

RELATED: ConocoPhillips’ Profit Beats Estimates On Higher Production

Analysts at Tudor, Pickering, Holt & Co. (TPH) called the results “positive on an EPS (earnings per share) beat” and mentioned in a note “shareholder returns totaled 41% of CFO (cash from operations) in Q3’19 [vs. target of >30%]” and “a peer-leading total return of about 7.8% FY’20.”

However, due to lower average realized oil and gas prices, ConocoPhillips reported a drop in year-over-year profit. Oil prices, for example, fell to $47.07/bbl in the third quarter from $57.71 a year earlier.

ConocoPhillips’ adjusted earnings fell to $914 million from about $1.6 billion a year earlier.

Alaska generated about $312 million in adjusted earnings for the quarter, down from $427 million, while the Asia-Pacific and Middle East region generated $449 million, down from $577 million. Adjusted earnings in the Lower 48 dropped to $136 million from $550 million.

“At next month’s event, we’ll be looking for asset-level data to validate capability of continuing to deliver robust FCF [free cash flow] generation and priorities for its uses,” TPH said in a note.

ConocoPhillips generated free cash flow of $1 billion during the third quarter and ended the quarter with $8.4 billion in cash and short-term investments.

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.