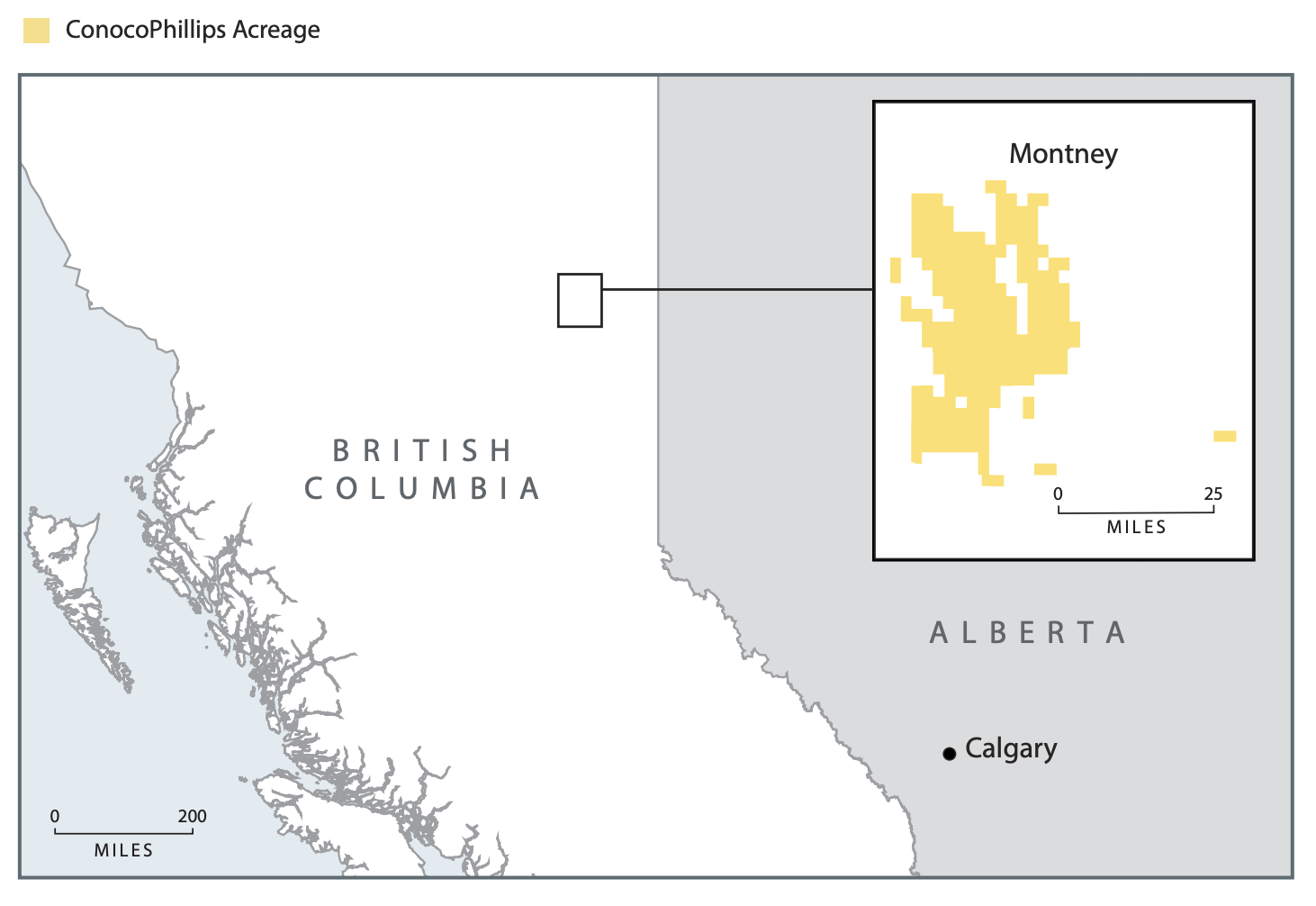

The acquisition is expected to increase ConocoPhillips’ Montney acreage position to 295,000 net acres with 100% working interest. (Source: Shutterstock.com; image of ConocoPhillips headquarters by JHVEPhoto / Shutterstock.com)

ConocoPhillips Co. on July 22 tacked on additional acreage to its position in Canada’s Montney Shale, giving the Houston-based independent “significant running room at a very attractive all-in cost,” COO Matt Fox said.

In a company release, ConocoPhillips said it agreed to pay Kelt Exploration Ltd. roughly $375 million in cash for 140,000 net acres located in the liquids-rich Inga-Fireweed asset Montney zone. ConocoPhillips will also assume about $30 million in financing obligations for associated partially owned infrastructure.

Production associated with the acquired asset, which will add over 1,000 well locations, is approximately 15,000 boe/d. ConocoPhillips estimates the acquisition adds over 1 billion boe of resource with an all-in cost of supply of mid-$30s (WTI basis), the company release said.

According to Fox, ConocoPhillips has tracked and analyzed the acreage, which is directly adjacent to ConocoPhillip’s existing Montney position, for a long time.

“[The acquired acreage] represents a high-value extension of our existing Montney position, and we’re pleased to capture this opportunity at an attractive cost of supply that meets our criteria for resource additions,” Fox said in a statement.

The acquisition is set to increase ConocoPhillips’ Montney position to 295,000 net acres with 100% working interest, nearly doubling its total acreage in the play while also giving the company full control, according to analysts with Tudor, Pickering, Holt & Co. (TPH).

The analysts estimate the transaction has an implied acreage value of about $1,250 to $1,600 per acre, assuming a 3-4x cash flow multiple at about $42/bbl WTI next year.

“Overall, the transaction is consistent with the company’s messaging regarding selective A&D for low cost-of-supply resource, with the strength of the balance sheet keeping the company positioned for future opportunities,” the TPH analysts wrote in a July 23 research note.

Separately, ConocoPhillips on July 22 announced that it initiated production from its first mutliwell pad on its Montney position in first-quarter 2020.

In his statement, Fox said ConocoPhillips is still in the process of bringing initial wells online, but noted early results are encouraging.

“We have confirmed the liquids-rich nature of the play and also confirmed that transferring the drilling and completion techniques we’re employing in the U.S. Big 3 can add significant rate and recovery potential to the play,” he said. “We view the Montney as a very attractive long-term asset and today’s announcement gives us significant running room at a very attractive all-in cost.”

The acquisition is subject to regulatory approval and is expected to close third-quarter 2020. The effective date for the transaction is July 1.

Recommended Reading

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.

Buffett: ‘No Interest’ in Occidental Takeover, Praises 'Hallelujah!' Shale

2024-02-27 - Berkshire Hathaway’s Warren Buffett added that the U.S. electric power situation is “ominous.”

The One Where EOG’s Stock Tanked

2024-02-23 - A rare earnings miss pushed the wildcatter’s stock down as much as 6%, while larger and smaller peers’ share prices were mostly unchanged. One analyst asked if EOG is like Narcissus.

Chesapeake Slashing Drilling Activity, Output Amid Low NatGas Prices

2024-02-20 - With natural gas markets still oversupplied and commodity prices low, gas producer Chesapeake Energy plans to start cutting rigs and frac crews in March.