(Source: ConocoPhillips Co.)

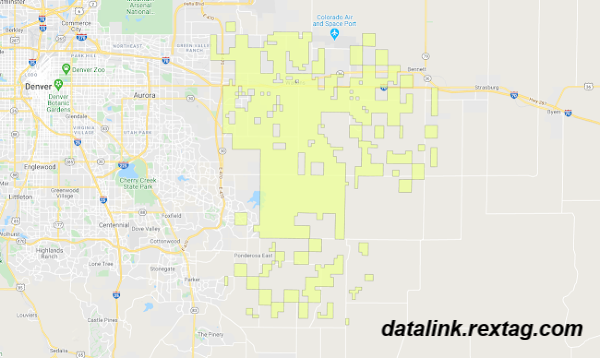

ConocoPhillips Co. closed on a multimillion-dollar sale of Niobrara assets located in the southern Denver-Julesburg (D-J) Basin, marking its exit from Colorado where operators have faced regulatory uncertainty in recent years.

The Houston-based company held about 98,000 net acres in the Niobrara, located in northeastern Colorado, according to recent filings. Production from the divested assets was about 11,000 barrels of oil equivalent per day (boe/d) in 2019.

ConocoPhillips said an undisclosed company purchased the Niobrara asset for $380 million, plus customary adjustments, and overriding royalty interests in certain future wells.

Click here for more data on ConocoPhillips’ operations.

On March 5, the company also said it had completed the sale of its Waddell Ranch property, a conventional asset located in the Permian Basin. Full-year 2019 production associated with the Waddell Ranch asset was 4,000 boe/d.

The buyer and terms of the Waddell Ranch transaction weren’t disclosed.

Crestone Peak Resources LLC is believed to be the buyer of ConocoPhillips’ Colorado asset, according to reports by multiple media outlets.

Formed in 2016 with backing from The Canada Pension Plan Investment Board and The Broe Group, Crestone’s acreage is in the Greater Wattenberg Field of Colorado’s D-J Basin.

The effective date of the Niobrara transaction is June 1, 2019. The Wadell Ranch transaction had an effective date of Nov. 1.

Recommended Reading

Report: Crescent Midstream Exploring $1.3B Sale

2024-04-23 - Sources say another company is considering $1.3B acquisition for Crescent Midstream’s facilities and pipelines focused on Louisiana and the Gulf of Mexico.

Targa Resources Forecasts Rising Profits on 2024 Exports

2024-02-20 - Midstream company Targa Resources reports a record fourth quarter in volumes and NGL fractionation.

Midstream Operators See Strong NGL Performance in Q4

2024-02-20 - Export demand drives a record fourth quarter as companies including Enterprise Products Partners, MPLX and Williams look to expand in the NGL market.

Summit Midstream Launches Double E Pipeline Open Season

2024-04-02 - The Double E pipeline is set to deliver gas to the Waha Hub before the Matterhorn Express pipeline provides sorely needed takeaway capacity, an analyst said.

Kinder Morgan Sees Need for Another Permian NatGas Pipeline

2024-04-18 - Negative prices, tight capacity and upcoming demand are driving natural gas leaders at Kinder Morgan to think about more takeaway capacity.