ConocoPhillips projects its liquids-rich Eagle Ford assets will bring in about $12 billion in free cash flow between 2020 and 2029. (Source: ConocoPhillips)

U.S. independent ConocoPhillips Co. aims to generate about $19 billion in free cash flow between 2020 and 2029 from its Lower 48 assets with the Permian Basin, Bakken and Eagle Ford Shale—the so-called Big 3—leading the way.

“We now have 6.5 billion barrels at less than $40 cost of supply in the Lower 48. Six billion barrels of that is in the Big 3 and that’s grown by about 1 billion barrels since our last Analysts Day in 2017,” Dominic Macklon, president of the company’s Lower 48 region, told analysts Nov. 19. “No greater than 97% of those increases have been organic, driven primarily by successful results in additional benches in the Delaware and improved well performance in the southwest area of Eagle Ford.”

The goal is part of the company’s 10-year plan that targets about $50 billion in free cash flow, limiting spending to less than $7 billion over the next decade as it grows annual production by more than 3% on average.

The news was shared as the oil and gas industry faces continued pressure from investors to improve earnings, return cash to shareholders and keep spending in check. It also comes amid lower oil prices, industrywide layoffs and a growing list of bankruptcies.

ConocoPhillips—which also has a presence in Alaska, Canada, Asia-Pacific, Middle East, Norway and Libya—has fared better than its peers. The company has managed to be free cash flow positive for the last three years. It’s something company executives attribute in part to its relentless focus on returns on and of capital, low cost of supply portfolio and optimized capital investments.

“COP remains a top pick and should be a core holding in our view,” analysts with Tudor, Pickering, Holt and Co. said in a note Nov. 20.

The Lower 48 is expected to be the fastest-growing region for ConocoPhillips.

“We plan to employ about 50% of the capital, which will increase our production from approximately 500,000 barrels a day [bbl/d] to around 800,000 barrels a day by the end of the decade,” Macklon said. “And with very strong cash margins around $25 a barrel at $50 WTI, ... we are not driven by production targets. Rather, we are driven by capital efficiency, returns and free cash flow.”

Eagle Ford

ConocoPhillips projects its liquids-rich Eagle Ford Shale assets will bring in about $12 billion in free cash flow between 2020 and 2029. The optimal plateau rate will be about 300,000 bbl/d with eight rigs, Macklon said, noting that’s up from today’s approximately 215,000 bbl/d with seven rigs. The eighth rig will be added early next year.

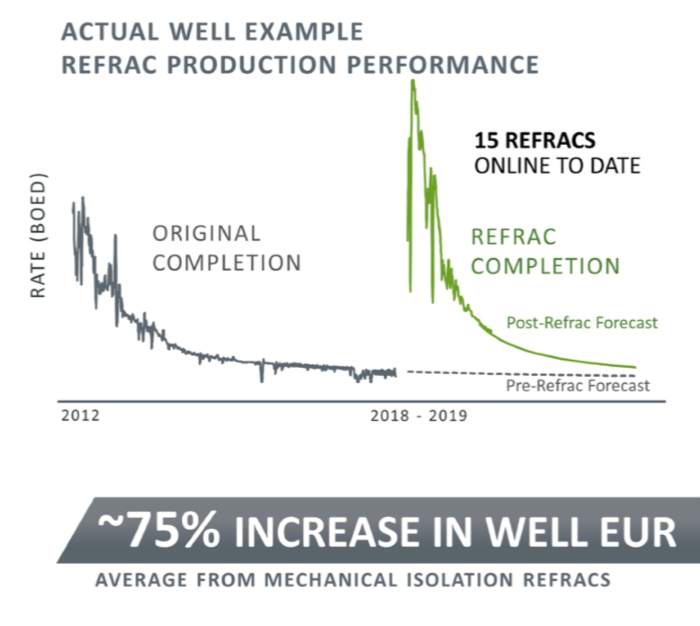

“We still have only drilled 25% of our identified inventory. After successful results from our refrac program, we have added 300 refracs to our base plan,” he added. “On top of this we have recovery enhancement pilots underway that provide further upside potential not yet built into our resource base.”

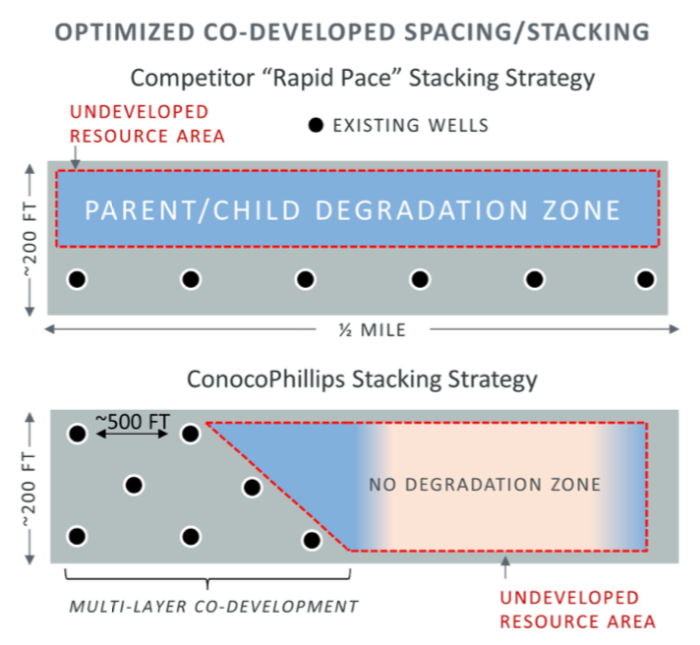

The company said it has about 3,800 locations remaining in the Eagle Ford, where it has worked to successfully minimize parent and child well interaction issues that have plagued other companies in some shale plays. ConocoPhillips said most of its inventory has minimal degradation.

ConocoPhillips sees further upside in mitigating child well degradation with its refracs and Vintage 5 completions, which aim to improve proppant placement and increase tessellation of the frac pattern.

The company said it has already made progress with mechanical isolation refracs this year.

“We are installing a casing liner within the original lateral; we’re cementing and re-completing, and this is key to their success,” Macklon said. “We now have 15 refracs online with an average 75% increase in forecast well EUR. Our base plan includes 300 refracs with a cost of supply less than $30 per barrel with further upside beyond our plan.”

He also noted that 80% of these are on parent wells that will be simultaneously stimulated with neighboring child wells—a move he said will “significantly reduce degradation by achieving a much more symmetrical frac pattern in the child wells.”

Bakken

The Bakken, described as the most mature of ConocoPhillips’ unconventional assets, is expected to bring in $3 billion in free cash flow over the next decade. The Bakken has been outperforming expectations, partly driven by an improved completion design and execution efficiency, he said.

The plateau rate outlook is now between 90,000 bbl/d and 100,000 bbl/d, up from the 70,000 bbl/d or so expected in 2017.

Just like in the Eagle Ford, refracs brighten the outlook. ConocoPhillips is gearing up to bring on its first three refrac pilots in the Bakken this quarter, Macklon said. About 300 refrac candidates have been identified.

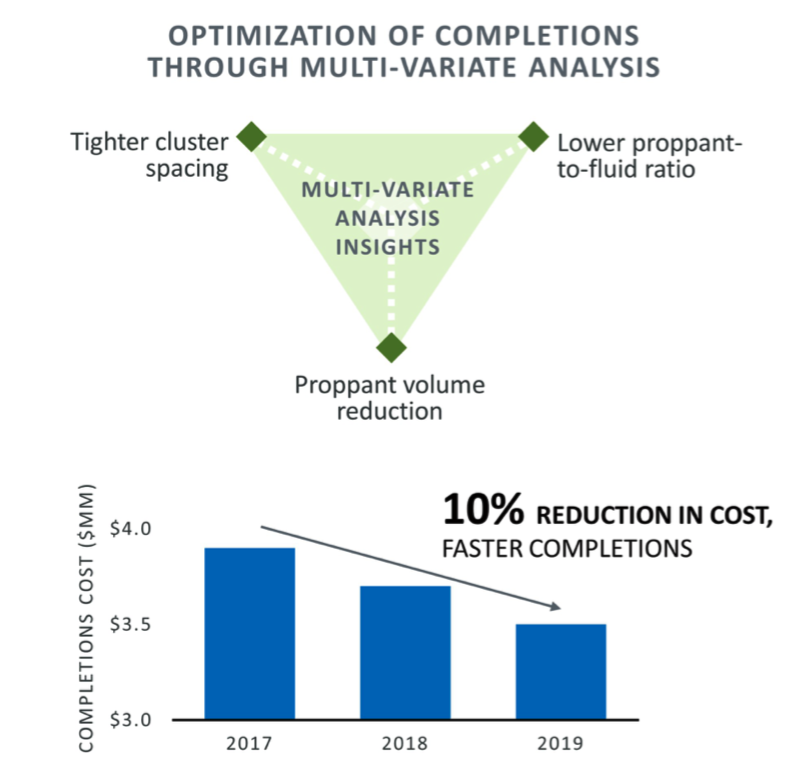

The company also plans to build on knowledge gained in recent years from studying industry well completion data.

“We found three drivers that really mattered—tighter cluster spacing, lower proppant and lower proppant to fluid ratio—suggesting an opportunity to improve recovery factors near the wellbore,” Macklon explained. “We’ve baked these insights into our design and the results really have been tremendous. With less proppant, our completion time and cost have fallen and yet our well productivity has increased, all resulting in a $2 per barrel cost of supply improvement.”

The Bakken serves as a role model for ConocoPhillips’ approach to unconventionals: “get to optimal plateau, generate strong returns and free cash flow, keep learning, find upside and increase value.” It’s what the company aims to accomplish in the Permian Basin, where it has acreage in the Delaware, Midland and Northwest Shelf.

Permian Basin

By 2029, the Permian Basin will grow to become the largest of ConocoPhilips’ Big 3 assets. The company anticipates it will generate about $4 billion in free cash flow in the Permian with 10 rigs total in Delaware and Midland/Northwest Shelf post-2025. Production plateau is pegged at about 400,000 barrels of oil equivalent per day.

“We are still very much on the steep part of the learning curve, particularly around well spacing and stacking,” Macklon said, later acknowledging analysts’ focus on optimal development strategies.”

In the Delaware Basin, the company has tested 11 benches on its acreage and projects 90% of its production will be from primary zones—Wolfcamp A and Wolfcamp C at China Draw and Bone Springs Second Sand at Zia Hills. It believes optimal spacing is 12 to 16 wells per section.

ConocoPhillips is also turning to technology to evaluate benches as it forms development plans. These include time-lapse geochemistry and microseismic. With the former, by taking hydrocarbon samples and analyzing geochemical fingerprints the company can allocate produced fluids to specific zones using reference data from rock core or cuttings, he explained. Microseismic can use used to help determine stimulated rock volume.

“We are integrating all of these aspects of applied science with actual well performance data to ensure we optimize development planning as we prepare to ramp towards manufacturing mode in the Permian,” Macklon said.

Recommended Reading

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-19 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.