The Anadarko Basin assets operated by ConocoPhillips could fetch the company around $200 million, while the nonoperated assets in the SCOOP and STACK shale plays are likely to be valued at about $100 million, sources told Reuters. (Source: Hart Energy)

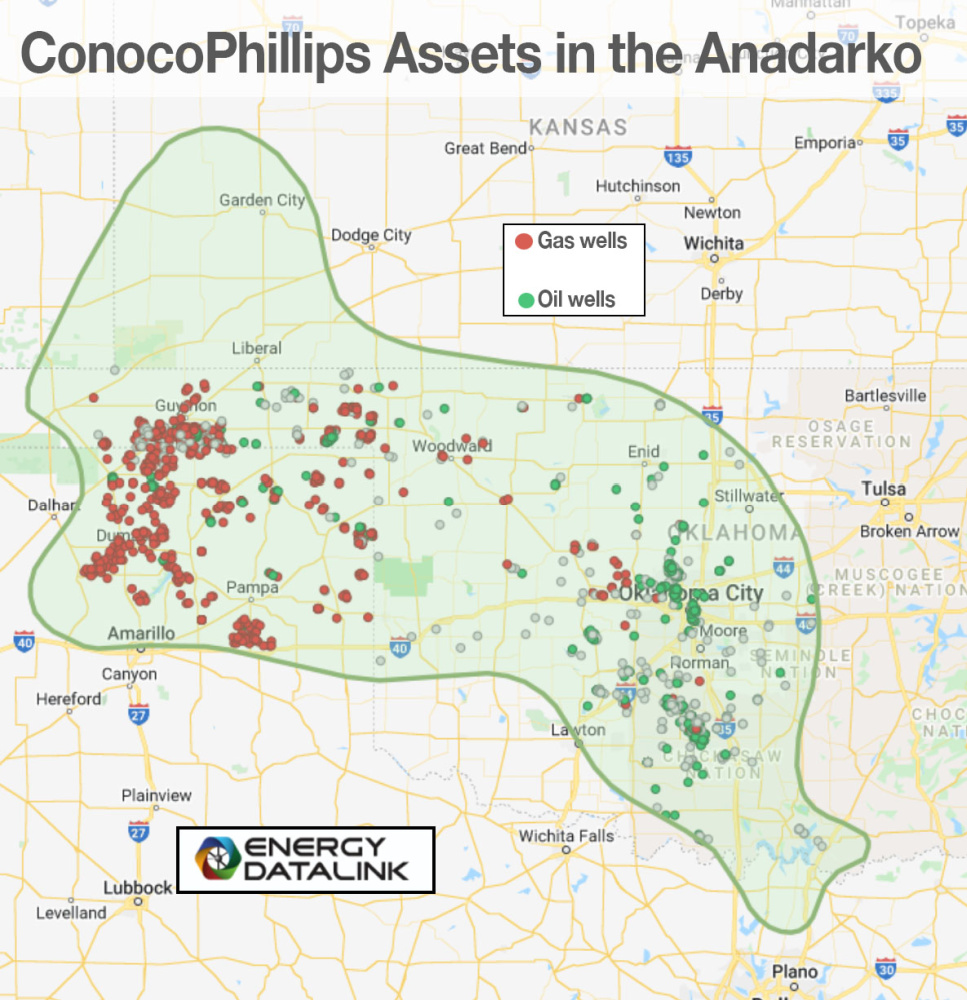

Looking to capitalize on higher commodity prices, ConocoPhillips Co. is marketing nearly 280,000 net acres, including leasehold in the western Anadarko Basin and nonoperated assets in the STACK and SCOOP plays.

Marketing materials from Wells Fargo labeled "Spring 2022" show the assets’ EBITDA, annualized by first-quarter 2021 results, is about $97.5 million.

ConocoPhillips previously announced an asset disposition target of up to $5 billion by 2023 while it works to whittle away its debt by 2026 to about $15 billion, including $800 million that matures this year. The company closed in February the sale of Indonesia assets for $1.65 billion and roughly $700 million in the Lower 48 since last year.

In a February earnings call, Chairman and CEO Ryan Lance said that in the Lower 48, ConocoPhillips “generated $0.3 billion in proceeds from the sale of noncore assets last year and [in January] … signed an agreement to sell an additional property set outside of our core areas for an additional $440 million.”

The company is deciding what it will sell based on historical cash flow, Lance said.

“Cash is cash,” he said. “We just want to take advantage of the strong markets we’re seeing today, and we recognize that we’ve made two pretty transformational transactions over the course of the last year, and it’s raised the bar in our whole company on cost of supply.”

ConocoPhillips in January 2021 closed the acquisition of Permian independent Concho Resources Inc. in an all-stock transaction valued at $13.3 billion. The company also closed last year with its purchase of Shell’s Permian Basin asset in a $9.5 billion deal completed in December.

Based on the current portfolio, Lance said “there’s things that we’re probably not going to invest in that we recognize others will invest in.”

He added that the company was continuing to high-grade its portfolio, primarily in the Permian Basin.

ConocoPhillips Midcontinent Operated and Nonoperated Opportunity Overview |

|

Western Anadarko Basin Assets |

|

| Acreage |

498,800 gross (261,200 net) acres |

| Operated PDP Avg. WI / NRI | 72% WI / 56% NRI |

| Net Production | ~8 Mboe/d (77% gas, 16% NGL, 7% oil) |

| Operated wells (Gross / Net) | 579 / 400 |

| OBO Wells (Gross / Net) | 1,331 / 241 |

| LQA EWBITDA | $67 MM |

| Total Upside Locations (Op / Nonop) | 1,627 horizontal drilling locations (229 / 1,398) |

| Avg. Upside WI (Op / Nonop) | 94.9% / 24.8 % |

SCOOP/STACK Nonoperating Holdings |

|

| Acreage | 52,600 gross (17,700 net) acres |

| Average PDP WI / NRI | 7.3% / 7.3% |

| Net Production | ~3 Mboe/d (50% gas, 29% NGL, 21% oil) |

| LQA EBITDA | $30.5 MM |

| Total Upsdie Locations | 527 horizontal drilling locations |

| Avg. Upside WI / NR | 8.2% / 7.4% |

ConocoPhillips’ marketed acreage in the Anadarko Basin includes 261,200 net acres, 100% HBP, that produces 77% gas and 23% liquids in first-quarter 2021. The assets target the Cleveland, Granite Wash and Tonkawa.

The marketing materials show a base decline of less than 6% with 66% cash flow margins as a result of high net royalty interest and royalty interests.

The nonoperated assets cover 17,700 net acres and split gas and liquids production. The primary targets for operators there are the Woodford, Springer, Meramec and Sycamore. Operators include Marathon Oil, Ovintiv and Continental Resources.

The Anadarko Basin assets operated by ConocoPhillips could fetch the company around $200 million, while the nonoperated assets are likely to be valued at about $100 million, sources told Reuters.

Wells Fargo marketing materials say management presentations are to be held in April and May. For information contact Norbie Juist, a Wells Fargo vice president, at Norbie.Juist@wellsfargo.com or 713-303-3783.

Recommended Reading

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.