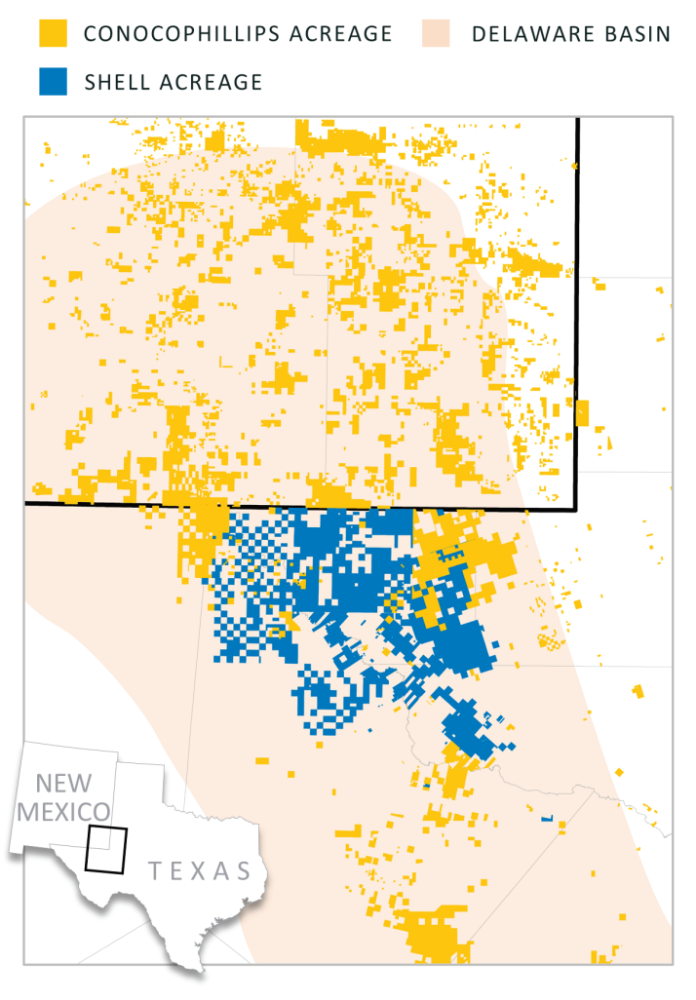

ConocoPhillips has made a major commitment to shale within the past year. In addition to the Shell deal, ConocoPhillips completed in January 2021 its all-stock acquisition of Concho Resources, which was one of the largest unconventional shale producers in the Permian Basin. (Source: ConocoPhillips Co.)

ConocoPhillips Co. wrapped up an “exceptional year” with the completion of its $9.5 billion all-cash acquisition of Royal Dutch Shell Plc’s Permian Basin asset, CEO Ryan Lance said in a Dec. 1 release.

“The completion of this acquisition caps off an exceptional year and significantly strengthens our company as we head into 2022,” commented Lance.

Houston-based ConocoPhillips entered into its agreement in September to acquire the Shell Permian assets, located entirely within the Delaware Basin in West Texas. The assets include roughly 225,000 net acres and producing properties plus over 600 miles of operated crude, gas and water pipelines and infrastructure. Estimated 2022 production from these assets is expected to be approximately 200, 000 boe/d, roughly half of which is operated.

In addition to further bolstering its profitability with projections to generate $10 billion in free cash flow over the next 10 years as a result of the acquisition, ConocoPhillips expects the addition of Shell’s Permian asset to its portfolio to improve its greenhouse-gas (GHG) intensity reduction target for 2030 by 5%.

“This deal was justified on three key merits: it meets our rigorous cost of supply framework, we see a way to drive efficiencies from the assets, and the transaction makes our 10-year plan better,” Lance added in the release. “We believe the addition of these high-quality assets improves our underlying business drivers, expands our cash from operations, enhances our ability to deliver higher returns on and of capital, and lowers our average GHG intensity.”

The transaction was said to be funded from available cash with ConocoPhillips still retaining a significant level of cash on the balance sheet for general purposes. After customary closing adjustments, cash paid for the acquisition is approximately $8.6 billion, with an effective date of July 1, according to the Dec. 1 release announcing completion of the transaction.

Shell plans to use cash proceeds from the transaction, which marked the European supermajor’s exit from the Permian Basin, to fund $7 billion in additional shareholder distributions. Commencement of the first tranche in the form of share buybacks of up to $1.5 billion began on Dec. 2. The form and timing for distributing the remaining $5.5 billion will be announced in early 2022.

Morgan Stanley & Co. LLC and Tudor, Pickering, Holt & Co. served as Shell’s financial advisers and Norton Rose Fulbright was legal adviser to Shell for the divestment.

Goldman Sachs & Co. LLC was ConocoPhillips’ exclusive financial adviser and Baker Botts LLP served as legal adviser to the company for the acquisition.

Recommended Reading

Element3 Extracts Lithium from Permian’s Double Eagle Wastewater

2024-01-30 - The field test was conducted with wastewater from a subsidiary of Double Eagle Energy Holdings’ produced water recycling facility.

Occidental’s Lithium Technology ‘Ready for Prime Time’

2024-03-20 - Occidental is leaning towards a ‘build, own and operate’ approach to growing its direct lithium extraction business.

Energy Transition in Motion (Week of Feb. 9, 2024)

2024-02-09 - Here is a look at some of this week’s renewable energy news, including the latest on a direct lithium extraction technology test involving one of the world’s biggest lithium producers and the company behind the technology.

Exclusive: Building Battery Value Chain is "Vital" to Energy Transition

2024-04-18 - Srini Godavarthy, the CEO of Li-Metal, breaks down the importance of scaling up battery production in North America and the traditional process of producing lithium anodes, in this Hart Energy Exclusive interview.

Elephant in the North: E3 Lithium CEO on Finding Opportunity ‘Hunters’

2024-02-28 - E3 Lithium is working toward commercial lithium production for its Clearwater project in South-Central Alberta’s Bashaw District, while developing its own DLE technology.