Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

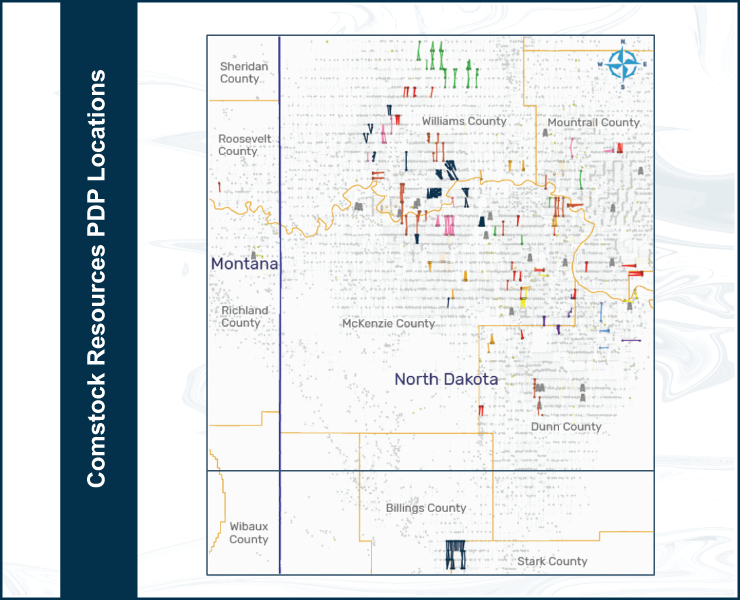

Dallas Cowboys owner Jerry Jones’ Comstock Resources oil company is offering to sell properties in North Dakota’s Bakken oil field, a marketing document seen by Reuters shows, as rising energy prices lift buying and selling in the sector.

Editor’s note: For information on Comstock’s package of Bakken assets being offered through EnergyNet Indigo visit our A&D Transactions database.

Crude oil prices are up about 38% year-to-date as economies bounce back and fuel demand recovers from travel restrictions to curb the pandemic. U.S. shale oil companies also are seeking larger scale to drive returns and operational efficiency.

A representative for Comstock did not immediately respond to a request for comment.

The properties on offer include a nonoperated working interest in 436 wellbores. The holdings are valued at about $200 million based on futures pricing, according to the document.

The 427 actively producing wells in the portfolio most recently had a six-month average net production of 6,400 boe/d, the teaser said.

The value of second-quarter deals this year hit $33 billion for more than 40 deals—the highest quarterly value since the second quarter of 2019, consultancy Enverus found.

Comstock’s decision to offload its Bakken assets comes as deal activity is rising in the Haynesville shale in Louisiana, where it produces most of its energy. Louisiana rivals Southwestern Energy recently bought Indigo Natural Resources and Chesapeake Energy’s acquired Vine Energy.

“High oil prices and a resurgence in Bakken M&A activity may have led to the company’s decision to market its non-operated interests to help fund participation in Haynesville consolidation,” said Andrew Dittmar, a senior M&A analyst with data provider Enverus.

Recommended Reading

Mexico Pacific Appoints New CEO Bairstow

2024-04-15 - Sarah Bairstow joined Mexico Pacific Ltd. in 2019 and is assuming the CEO role following Ivan Van der Walt’s resignation.

Global Partners Declares Cash Distribution for Series B Preferred Units

2024-04-15 - Global Partners LP announced a quarterly cash dividend on its 9.5% fixed-rate Series B preferred units

W&T Offshore Adds John D. Buchanan to Board

2024-04-12 - W&T Offshore’s appointment of John D. Buchanan brings the number of company directors to six.

73-year Wildcatter Herbert Hunt, 95, Passes Away

2024-04-12 - Industry leader Herbert Hunt was instrumental in dual-lateral development, opening the North Sea to oil and gas development and discovering Libya’s Sarir Field.

Riley Permian Announces Quarterly Dividend

2024-04-11 - Riley Exploration Permian’s dividend is payable May 9 to stockholders of record by April 25.