Commodities trader Trafigura smashed its previous profit records to make around $3.5 billion in the first quarter of its current financial year, four sources with knowledge of the matter told Reuters, benefiting from volatile energy prices.

The Geneva-based company does not publish quarterly figures but provides half-year and full-year reports. A spokesperson for Trafigura declined to comment.

The exceptional returns were driven by global energy shortages, stemming in part from sweeping western sanctions on Russia for its invasion of Ukraine, plus underlying tightness in global energy markets due to under-investment in new developments and infrastructure.

Extreme market dislocations and soaring prices, particularly in natural gas and liquefied natural gas (LNG), have proved a boon for major commodity trading houses.

The company's result in the first quarter that started on Oct. 1 is already half of its net profit of $7 billion during its previous full financial year and is 30% more than in the first half of its fiscal 2022.

Trafigura, the second-biggest independent oil trader after Vitol, moved 6.6 million barrels per day (bpd) of crude and refined products last year and 13 million tonnes of LNG.

The sources said the net profit figure took into account an impairment on a major nickel deal last year. Trafigura suspected a quality issue with its cargoes in October last year and said it found that at least 156 containers out of the more than 1,000 it financed did not contain the metal.

Trafigura said on Feb. 9 it had booked a $577 million charge relating to what it alleges is "systematic fraud" by a group of companies connected to and controlled by Indian businessman Prateek Gupta.

Gupta's team were preparing "a robust response" to the allegations, a spokesperson has said.

Recommended Reading

Exclusive: Sabine CEO says 'Anything's Possible' on Haynesville M&A

2024-04-09 - Sabine Oil & Gas CEO Carl Isaac said it will be interesting to see what transpires with Chevron’s 72,000-net-acre Haynesville property that the company may sell.

Exclusive: Liberty CEO Says World Needs to Get 'Energy Sober'

2024-04-02 - More money for the energy transition isn’t meaningfully moving how energy is being produced and fossile fuels will continue to dominate, Liberty Energy Chairman and CEO Christ Wright said.

Chesapeake, Awaiting FTC's OK, Plots Southwestern Integration

2024-04-01 - While the Federal Trade Commission reviews Chesapeake Energy's $7.4 billion deal for Southwestern Energy, the two companies are already aligning organizational design, work practices and processes and data infrastructure while waiting for federal approvals, COO Josh Viets told Hart Energy.

Exclusive: Tenaris’ Zanotti: Pipes are a ‘Matter of National Security’

2024-04-12 - COVID-19 showed the world that long supply chains are not reliable, and that if oil is a matter of U.S. national security, then in turn, so is pipe, said Luca Zanotti, U.S. president for steel pipe manufacturer Tenaris at CERAWeek by S&P Global.

Exclusive: As AI Evolves, Energy Evolving With It

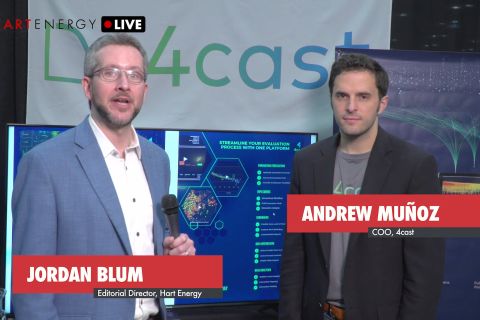

2024-02-22 - In this Hart Energy LIVE Exclusive interview, Hart Energy's Jordan Blum asks 4cast's COO Andrew Muñoz about how AI is changing the energy industry—especially in the oilfield.