Pro forma for the Nov. 7 deal, Colgate’s position in the Permian Basin will cover roughly 108,000 net acres with estimated current net daily production of 62,000 boe/d. (Source: Hart Energy)

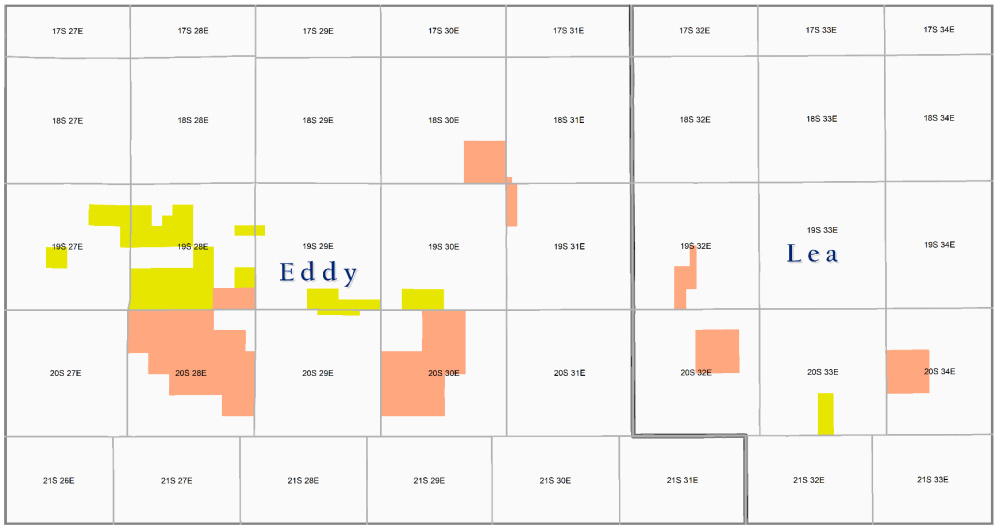

Colgate Energy Partners III LLC entered a definitive agreement with an undisclosed seller on Nov. 7 to purchase approximately 22,000 net acres directly offset Colgate’s existing position in New Mexico’s Eddy and Lea counties for $190 million.

“Given the depth of our current inventory, we have a very high bar for acquisitions and this one was just too good to pass up,” Will Hickey, co-CEO of Colgate, commented in a company release.

The deal marks the third acquisition for privately held Colgate Energy so far this year. Previously, the company completed two acquisitions in the southern Delaware Basin in West Texas—first, with its all-stock acquisition of Luxe Energy followed by a $508 million cash acquisition of acreage in Reeves and Ward counties, Texas, from Occidental Petroleum Corp.

“Building on the transformative transactions completed earlier this year in Texas, this New Mexico acquisition adds to Colgate’s position as one of the premier private operators in the Permian Basin,” James Walter, co-CEO of Colgate, said in the release.

Based in Midland, Texas, Colgate Energy was founded in 2015 by Walter and Hickey with initial equity commitments from Pearl Energy Investments and NGP. Pro forma for the Nov. 7 deal, Colgate’s position in the Permian Basin will cover roughly 108,000 net acres with estimated current net daily production of 62,000 boe/d.

In his statement, Hickey also noted that the latest acquisition directly offsets its legacy Parkway operating area in the Northern Delaware Basin where Colgate has recently drilled some of the best wells in company history.

The acquisition adds over 200 “high-quality locations,” according to the company release.

The acquired acreage has an average 8/8ths net revenue interest of over 80% and is over 95% operated with a 78% average working interest. Current estimated average net daily production from the assets is roughly 750 boe/d.

Colgate expects to finance the acquisition through a combination of cash on hand, borrowings on its revolver and/or other potential debt financing.

“Colgate’s strong balance sheet and ample liquidity allows us to execute a cash transaction of this size while continuing to target 2022 leverage of less than 1.0x,” Walter added.

The effective date of the transaction is Sept. 1, and closing is expected to occur in first-quarter 2022.

Recommended Reading

Exxon, Chevron Tapping Permian for Output Growth in ‘24

2024-02-02 - Exxon Mobil and Chevron plan to tap West Texas and New Mexico for oil and gas production growth in 2024, the U.S. majors reported in their latest earnings.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

Chevron Adds to Carbon Capture Tech Portfolio with ION Investment

2024-04-04 - Chevron New Energies led a funding round that raised $45 million in Series A financing for ION Clean Energy, according to a news release.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

SM Energy Adds Brookman to Board, Promotes Lebeck to Executive VP

2024-02-23 - Barton R. Brookman previously served as President and CEO of PDC Energy and James B. Lebeck served as senior vice president and general counsel since January 2023.