Worries that crude oil bottlenecks in the Permian Basin would shift south to the Gulf Coast have not materialized, analysts concluded as the year began, because infrastructure projects completed in 2019 in the Corpus Christi, Texas, area are enabling record levels of waterborne exports.

Market intelligence provider Genscape said the addition of almost 2 million barrels per day (MMbbl/d) of inbound pipeline capacity and 5 MMbbl of storage capacity has allowed the region to absorb the increased output from the prolific Permian. That contributed to the record average of 3.72 MMbbl/d of U.S. crude exports during the last week of 2019, the U.S. Energy Information Administration reported in a release of data.

The trend remained strong going into the new year.

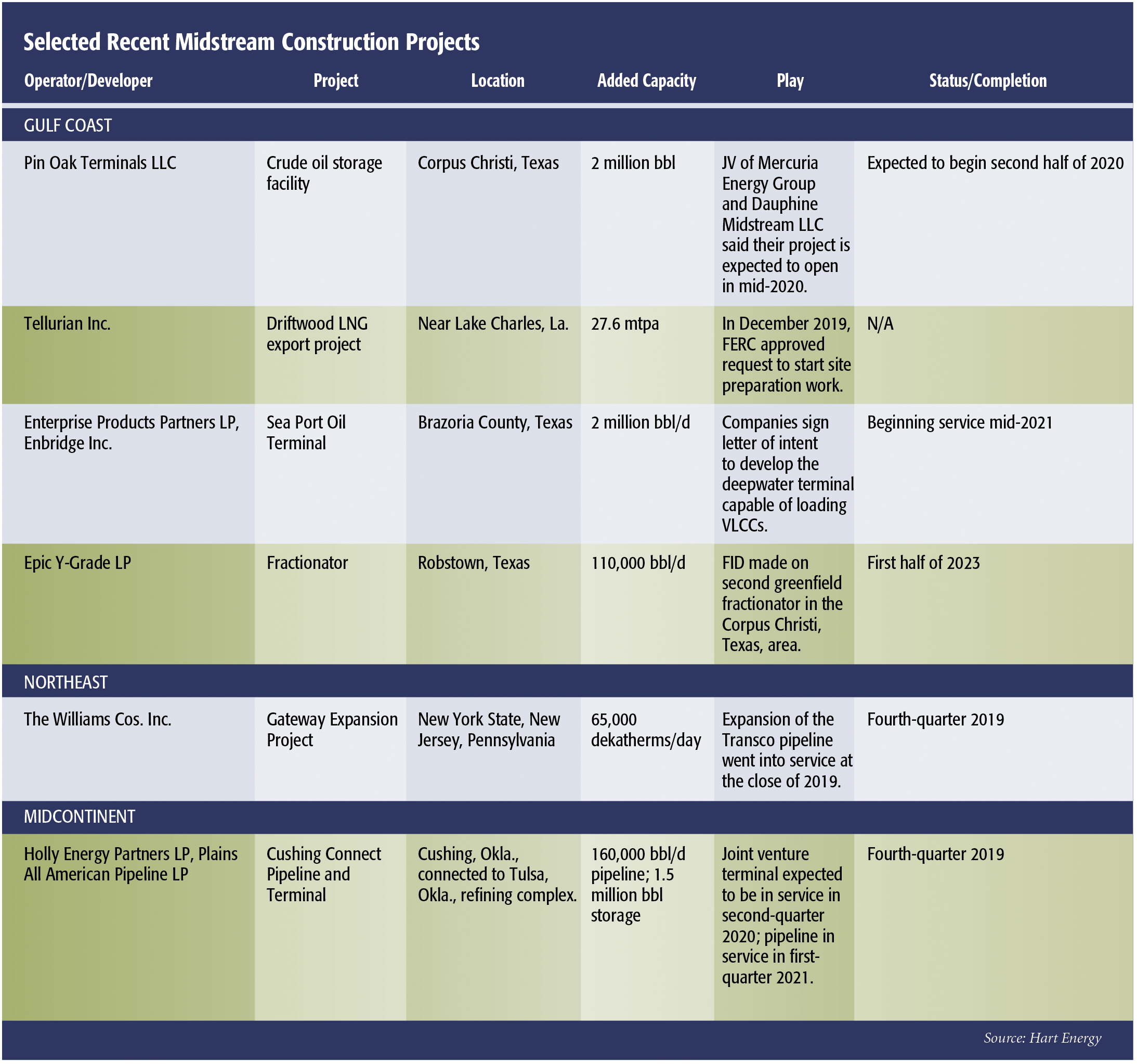

In a twist, the Gulf Coast—not the Permian Basin—led the way in the adjoining table of selected midstream infrastructure projects, including plans to build another major storage facility and another fractionator in the Corpus Christi area.

Things remain active in the basin, of course. Enterprise Products Partners LP started-up its new Mentone natural gas processing plant in Loving County, Texas, early in 2020. The cryogenic facility can process 300 million cubic feet per day, extracting more than 40,000 barrels per day (bbl/d) of NGL. Supported by a long-term acreage dedication agreement, the new plant facilitates continued growth of the Delaware Basin, the company noted in an announcement.

Mentone is the seventh gas plant operated by Enterprise in the Delaware.

Gulf Coast

Joint venture partners Mercuria Energy Group and Dauphine Midstream LLC envision their Pin Oak Terminal storage facility, scheduled to open midyear in the Corpus Christi area, as a trading hub for the volumes of shale oil shipped to the coast.

Mercuria, a Swiss commodities trader, wants the 2 million barrel (MMbbl) facility to become the main crude oil price assessment location for oil flowing through Corpus Christi. Pin Oak will have the ability to export 320,000 bbl/d when it opens, though that capacity could double in 2021 when the planned Phillips 66 Red Oak pipeline is expected to go into service and bring crude to the Corpus Christi port from West Texas, North Dakota, Colorado and the big Cushing, Okla., pipeline trading hub and storage facility.

Also in the Corpus Christi area, EPIC Y-Grade LP announced its final investment decision (FID) for a second greenfield fractionator at its complex in the Corpus suburb of Robstown, Texas. The decision signals the continued ability of EPIC to lock in gathering and processing companies in the Permian Basin to fixed-fee multiyear supply contracts for their NGL.

In conjunction with making the FID, the company upsized its existing Term Loan B by $150 million to finance the project. This upsize brings the total borrowing base of the company to $950 million.

The project involved upsizing the company’s existing Term Loan B by $150 million. That brought the total borrowing base of the company to $950 million.

“Our customers value EPIC as a strategic alternative to Mont Belvieu, and we are committed to providing them the highest level of service,” said Phillip Mezey, CEO of EPIC.

Deepwater project

Up the coast, Enterprise Products Partners and Canadian pipeline giant Enbridge Inc. announced a letter of intent in December to jointly develop a deepwater crude oil terminal capable of fully loading very large crude carriers (VLCCs).

VLCCs, which carry most crude shipments in the world, can handle from 1.9- to 2.2 MMbbl of West Texas Intermediate (WTI) oil. Enterprise’s Sea Port Oil Terminal (SPOT), an onshore/offshore facility in Brazoria County, Texas, will be capable of loading 85,000 bbl/ hour or 2 MMbbl/d.

Assuming the project succeeds in obtaining a deepwater port license from the U.S. Maritime Administration, Enbridge could purchase an interest in SPOT Terminal Services LLC, which owns SPOT.

Even farther up the coast in Louisiana, Tellurian Inc.’s Driftwood LNG export project gained approval from the U.S. Federal Energy Regulatory Commission (FERC) as 2019 ended to start site preparation work, including vegetation clearing and grading, demolition and removal of existing buildings, and dredging of marine berths.

Tellurian plans to begin construction of the $27.5 billion plant sometime in 2020, with first production of LNG expected in 2023. The company said it had completed 27% of the required engineering work and ordered equipment in advance of construction.

Driftwood is designed to produce about 3.6 billion cubic feet per day (Bcf/d) of natural gas. Project partners include units of Total SA, Vitol, Petronet LNG Ltd., General Electric Co. and Bechtel Corp., which has a contract to build the liquefaction facility.

Northeast

As a raucous crowd welcomed the New Year in Times Square, The Williams Cos. Inc. welcomed the Gateway Expansion Project into full service, boosting the level of natural gas coming into the region and beating the target date by 11 months.

Gateway, an expansion of the existing Transco pipeline system, provides 65,000 dekatherms per day of incremental firm transportation capacity for the New Jersey tri-state area. Construction began in early 2019, with an original in-service projection of November 2020.

However, the company attributed the early in-service to close coordination with customers, which allowed expedited project execution and construction.

Midcontinent

Holly Energy Partners LP and Plains All American Pipeline LP announced in early October they will invest a total of $130 million in a 50:50 joint venture, Cushing Connect Pipeline & Terminal LLC. Cushing Connect will build a 160,000 bbl/d common carrier crude oil pipeline that will connect the Cushing crude oil hub to the Tulsa, Okla., refining complex some 60 miles away, owned by a subsidiary of HollyFrontier Corp. Also included is ownership and operation of 1.5 MMbbl crude oil storage in Cushing.

The terminal is expected to be in service in the second quarter, and the target in-service date for the pipeline is first-quarter 2021. The project is backed by long-term commercial agreements.

Eagle Ford

Goodnight Midstream LLC announced an expansion of its Eagle Ford Shale operations in late November, including the start of construction of a saltwater injection facility in DeWitt County, Texas. The company also rebranded Wyatt Water Solutions LLC, which is now under the Goodnight corporate umbrella.

In October, Goodnight received a commitment of more than $500 million in growth capital from Tailwater Capital LLC to support the expansion.

The saltwater disposal facility, named Rooster, will be located south of Yorktown, Texas, and will serve both piped and trucked volumes. Rooster is expected to expand Goodnight’s Eagle Ford operations to include three saltwater disposal facilities and 40 miles of pipeline in DeWitt and Atascosa counties.

Bakken

Dakota Access LLC will nearly double the flow of its oil pipeline through North Dakota if the North Dakota Public Service Commission approves the project. The Standing Rock Sioux Tribe opposes the plan, contending that spills could foul their drinking water and a sacred lake.

Dakota Access, controlled by Energy Transfer LP, wants to build a pump station as part of an upgrade to boost capacity of the 1,172-mile underground pipeline from 570,000 bbl/d to 1.1 MMbbl/d. The extra capacity is seen as critical to handling expanding crude output from the Bakken Shale.

Construction would take eight to 10 months, starting this spring, Energy Transfer’s vice president of engineering, Chuck Frey, told the state commission.

Canada

Rangeland Midstream Canada Ltd., a wholly owned subsidiary of Rangeland Energy III LLC, said it commenced the construction of its Marten Hills Pipeline System in October 2019. The system consists of new crude oil and condensate pipelines located in the Marten Hills region of north-central Alberta.

The Marten Hills Pipeline System will extend about 53 miles to an interconnect with Plains Midstream Canada’s Rainbow Pipeline System, which serves the Edmonton, Alberta, hub and refining market. The Marten Hills system is expected to come into service in second-quarter 2020.

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.