In mid-April, a Montana judge ruled that the U.S. Army Corps of Engineers violated federal law in the way that it approved a permit for the Keystone XL pipeline to cross bodies of water. (Source: Hart Energy)

[Editor's note: This story appears in the June 2020 edition of Midstream Business. Subscribe to the magazine here. It was originally published June 1, 2020.]

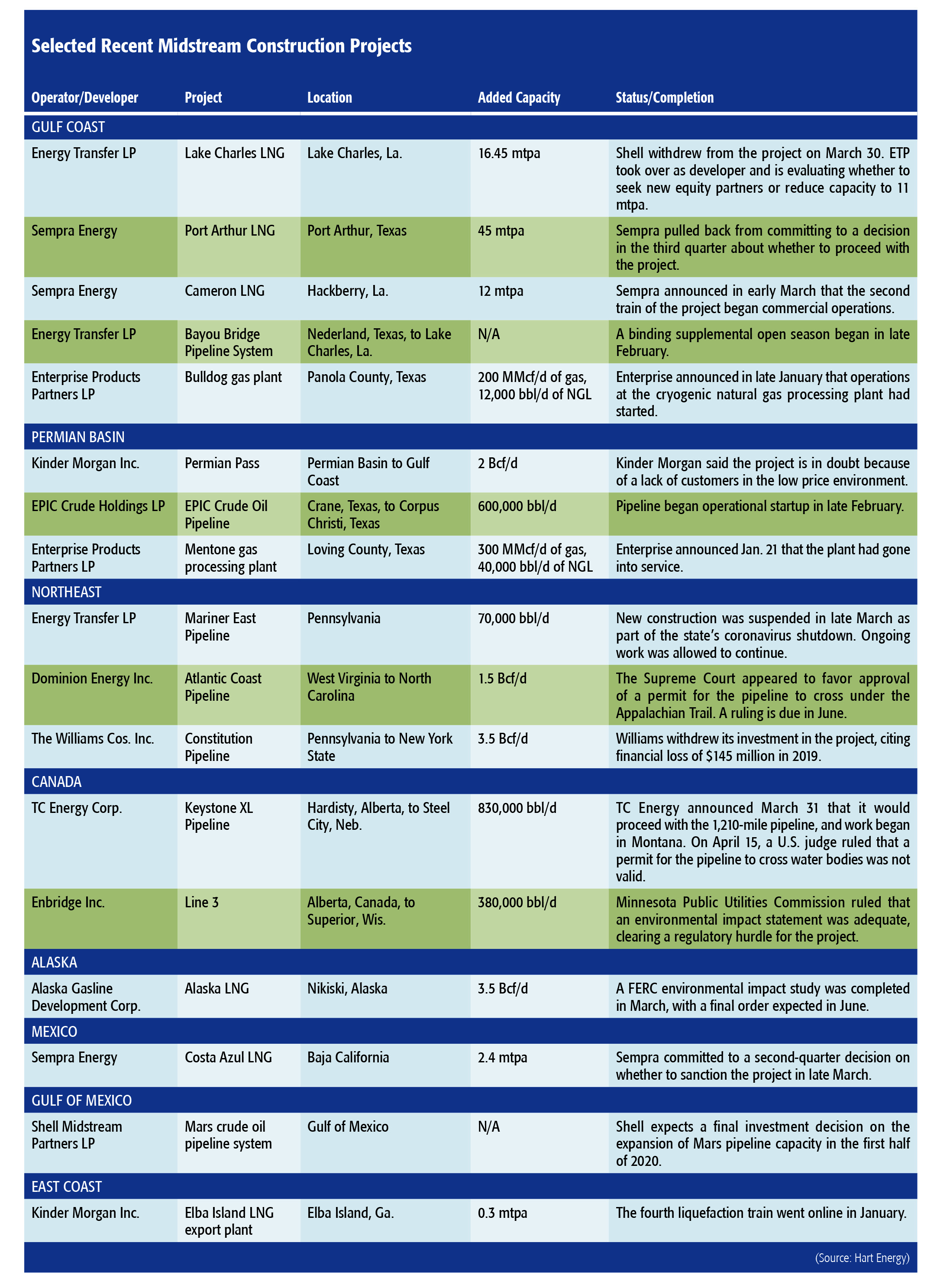

The paradox of projects in the time of COVID- 19 is that as virtually the entire industry pulled back, plans for TC Energy Corp.’s long, long, long-awaited Keystone XL Pipeline (KXL) leapt forward. Stranger still, while one of the downcycle’s root causes was the lightning-fast collapse of global oil prices, the market price of the Canadian crude that KXL will carry has been in worse shape than most, closing at an anemic $7.52/bbl on April 1 (no joke), though it quickly bounced back.

The sunny KXL outlook clouded in mid-April, though, when a Montana judge ruled that the U.S. Army Corps of Engineers violated federal law in the way that it approved a permit for the pipeline to cross bodies of water.

Many but not all of the project the first two months of the quarter. KXL’s short-lived triumph, for example, was announced on March 31. The near term, however, is uncertain. Prior to the crash, a slew of plants were under construction, and the Gulf Coast was awaiting another 1.4 MMbbl/d of fractionation capacity to come online.

“There are midstream projects that were put in place well before the coronavirus happened, and many of these projects are still progressing,” Peter Fasullo, co-founder and principal of En*Vantage Inc., told Midstream Business.

“Everything that’s under construction now was based on the expectation that the big supply push would continue,” he said. “We were in a supply-push story up until just recently, and we were in a major export mode because of the supply push.”

Hit the brakes

The momentum of the industry, Fasullo said, was akin to that of a supertanker: difficult to put on the brakes quickly.

“There are things that were put in place well before [the downcycle] happened, and they’re still going on,” Fasullo said. “It’s kind of like having a big leak in your house and you can’t find the main water line to shut if off yet.”

That same type of momentum applies to the construction of LNG export facilities. Not all of the news on the table is positive, but a fair number of the projects are moving forward.

“When it comes to planned LNG terminals, some of them may not realize, given lower prices and a lower demand environment,” Anna Mikulska and Steven Miles, nonresident fellows in the Baker Institute’s Center for Energy Studies at Rice University, told Midstream Business in an email. “That being said, the investment is made for the future and not current conditions.”

Gulf Coast

As the first quarter ended, Energy Transfer LP’s announcement that it will take over development of the Lake Charles, La., LNG export project couldn’t hide the $7 billion elephant in the room—Shell’s market-based decision to pull out of its 50% equity investment in the $12 billion to $16 billion project.

“We continue to believe that Lake Charles is the most competitive and credible LNG project on the Gulf Coast,” Tom Mason, executive vice president and president of LNG for Energy Transfer, said in the announcement. “Having the ability to capitalize on our existing regasification infrastructure at Lake Charles provides a cost advantage over other proposed LNG projects on the Gulf Coast.”

If the company cannot find another equity partner, it may reduce the project from three trains to two, cutting capacity from 16.45 million tonnes per annum (mtpa) to 11 mtpa.

Just one week before the commodity market crash, on March 2, Sempra LNG, a subsidiary of Sempra Energy, announced that the second train of its Cameron LNG export facility had launched commercial operations.

The company said that Train 3 was on track to start initial LNG production in the second quarter, with commercial operations to follow in the third quarter. The facility’s first liquefaction train started commercial operations in August 2019. The three trains will boast a capacity of 12 mtpa of LNG, or about 1.7 Bcf/d.

Early in the year, Enterprise Products Partners LP began operations at its new Bulldog cryogenic natural gas processing plant in Panola County, Texas. Previously known as Panola 3, Bulldog adds 200 MMcf/d of gas processing and 12,000 bbl/d of NGL capacity to the Panola cryogenic facility, resulting in a total of 320 MMcf/d and 18,000 bbl/d for the plant, which handles gas from Cotton Valley and the Haynesville. NGL produced at the plant will move on the Panola Pipeline to the big Mont Belvieu, Texas, NGL hub for fractionation.

Permian Basin

The EPIC Crude Oil Pipeline began operational startup in the first quarter, transporting crude from Crane, Texas, to Corpus Christi, Texas. The 30-inch pipeline has an initial capacity of about 600,000 bbl/d and will eventually add 200,000 bbl/d to the Permian’s takeaway capacity. EPIC had been offering interim crude service on its converted Y-grade NGL pipeline, which was halted when the new line began operations.

Analysts at Tudor, Pickering, Holt & Co. noted that the incremental capacity supports Midland Basin pricing.

Enterprise’s Mentone cryogenic natural gas processing plant in Loving County, Texas, joined EPIC in launching operations in the first quarter. The plant’s capacity is 300 MMcf/d of natural gas and 40,000 bbl/d of NGL. Mentone is located in the Delaware Basin and is supported by a long-term acreage dedication agreement, the company said.

“Mentone is our seventh natural gas processing plant in the Delaware Basin and increases our total capacity in the Permian Basin to more than 1.6 MMcf/d of natural gas processing and more than 250,000 bbl/d of NGL extraction,” Brent Secrest, executive vice president and chief commercial officer of Enterprise’s general partner, said in a statement.

Mentone is linked to Enterprise’s NGL and Texas Intrastate pipeline networks by 66 miles of new large-diameter gathering and residue pipelines and expanded compression capabilities.

Kinder Morgan Inc., however, expressed less confidence in its proposed Permian Pass natural gas pipeline, intended to connect 2 Bcf/d of associated gas from the Permian to East Texas pipelines and LNG terminals in Louisiana. The problem, the company said, was that low prices for natural gas discouraged customers.

“We don’t have anybody signed up yet,” Kinder Morgan Chief Strategy Officer Dax Sanders told analysts. “If it comes together, it does. If it doesn’t, it doesn’t.”

Permian Pass will be needed around 2023, Sanders said, based on market projections. But given the difficulty in pursuing a pipeline project, it’s unlikely that the company will commit funds to it now.

Northeast

Northeast projects have experienced better quarters, but some promising news popped up in the first quarter regarding construction of Dominion Energy Inc.’s Atlantic Coast Pipeline.

Based on questions the justices asked, observers believe the U.S. Supreme Court will favor the federal government’s argument that it had the authority to approve the pipeline’s path under the Appalachian Trail in Virginia. The Fourth U.S. Court of Appeals in Richmond, Va., had ruled that the U.S. Forest Service did not have the authority to allow the pipeline to cross the trail on federal forest land. The suit was brought by environmental groups including the Sierra Club and Southern Environmental Law Center.

Though the court will not issue a ruling until June, the chances for continued construction look promising. The proposed $7.5 billion pipeline would be 600 ft below a section of the 2,200-mile trail, which stretches from Maine to Georgia. Dominion leads a consortium of companies.

New construction on the Mariner East pipeline project, however, was temporarily halted when Pennsylvania Gov. Tom Wolf instituted a statewide shutdown in March in response to the COVID-19 pandemic. Ongoing work on the pipeline system and facilities continued, having been defined as a “life-saving” activity.

Mariner East was not alone. Royal Dutch Shell Plc also temporarily suspended construction on its multibillion-dollar ethane cracker along the Ohio River in Beaver County, Pa. Local officials called for construction to stop, concerned about the spread of the coronavirus among the large number of workers on the project.

Temporary was not the term connected with the Constitution Pipeline project, a 125-mile line proposed to move natural gas from the Marcellus Shale in Pennsylvania to New York State. The Williams Cos. Inc. pulled its investment in the project in late February. Constitution did not make financial sense for the Tulsa, Okla.-based giant.

Williams’ 41% stake in the pipeline accounted for $145 million of the company’s $354 million loss in 2019.

“Our existing pipeline network and expansions offer much better risk-adjusted returns than greenfield opportunities, which can be impacted by an ambiguous and vulnerable regulatory framework,” Williams said in a statement.

Projects

Joseph Markman can be reached at jmarkman@hartenergy.com or 713-260-5208.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.