[Editor's note: A version of this story appears in the April 2020 edition of Oil and Gas Investor. Subscribe to the magazine here.]

By now you’ve read way too much about the effects of the first oil price war of the new decade—it’s not going to be the last. Now that the yellow caution lights are flashing, just hit the reset button. I don’t mean to be naive, but it does no good to run around with your hair on fire during an oil price shock with an unknown duration. Certainly, this price rout should force every company to reset its 2020 plans, even if the price rebounds by the time you’re reading this.

For 2020, stick to your core business but adjust your strategy. Keep running the numbers and analyzing the data. Continue to tweak everything to cut expenses. Hunker down and slow down.

In years past, we’ve seen that unexpected, disruptive price shocks do not last. The price and rig count always come back, although the timing is never clear.

This year, 2020, was never going to be that good anyway. Oil and gas prices were already wobbly; U.S. production growth was slowing down. If a $30 oil scenario holds, Lower 48 oil production will end the year more or less flat from where it started, according to Rystad Energy modeling. At press time, some producers already announced that they will lay down rigs.

Concurrently, Saudi Arabia was flooding global markets with additional oil we do not need and, what’s more, offering customers much lower prices, in a bid to recoup lost market share. But the International Monetary Fund said Saudi Arabia needs $83 a barrel to balance its budget—not $30 or $40.

About a week before the OPEC-Russia battle erupted, EOG Resources Inc. CEO Bill Thomas spoke on his fourth-quarter 2019 conference call. He reiterated the company’s strict standards, which should serve as a business model for all E&Ps. “Our premium well strategy dictates that a well isn’t a well unless it earns at least 30% return at an oil price of $40. Requiring our hurdle rate of 30% for direct capital ensures that once full cost is applied, we earn a healthy double-digit all-in return.”

The base decline rate on EOG’s existing production is 32%, but it has 13 years of premium drilling inventory to offset that; the median rate of return on those locations is 58% at $40 oil, the company said.

Or if these metrics simply aren’t possible, do what one guru said recently, “Don’t hesitate; consolidate.” “There is only one good number [to pay attention to], and that’s the oil price,” declared Paul Sankey, Mizuho Securities managing director, addressing Hart Energy’s Energy Capital Conference in Dallas—just two days before OPEC+ met in Vienna and all hell broke loose.

“We are at 3 MMbbl/d of oversupply in the market, so this year will be another unfortunate year, regardless of what OPEC does, and all the OPEC members are cheating,” he said.

He did offer one ray of hope, however. “The next 10 years is still assuredly the decade of oil. It takes about 16 years to turn over the U.S. fleet, so if you buy only EVs now, it will take 16 years. The stock market will stabilize—where else can you put your money if you pull out: China? No. Japan? No.”

In a research note on March 9, Sankey wrote, “With no price elasticity of oil demand right now because of coronavirus, price elasticity of supply is the only question. U.S. E&P is the fastest-cycle, most price-sensitive production globally, so that will be the pain point.

“It is imperative that private oil companies cut capex to retrench to the point where debt is not rising. On average to balance the market, we need 2 MMbbl/d to 3 MMbbl/d less U.S. oil supply, which implies at least 20% capex cuts.”

Reuters calculated that $18.2 billion in corporate debt in the oil and gas sector is due to mature in the next three months, and most of the issuers were on credit watch for a downgrade.

A Wood Mackenzie analyst told Reuters, “… it will take at least six months for U.S. shale production to ease off even if capital spending is cut now. That means supply will remain elevated and the oil price could stay around $35.” Yikes.

All of this should serve as an important reminder of two basic facts, wrote Sarah Ladislaw, senior vice president and director, and senior fellow of the Energy Security and Climate Change Program, at the Center for Strategic and International Studies in Washington, D.C.

“First, oil markets remain interconnected, and what happens in oil-producing countries around the world still impacts the United States. So much for energy independence.

“Second, there may be an energy transition underway for which many oil-producing countries are trying to create a long-term strategy for future competitiveness. But today, oil still matters a great deal to their life and livelihood, and in the current energy arena at least two major producers have decided it’s time to do battle.”

Recommended Reading

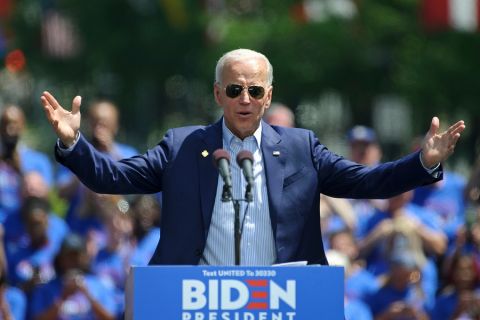

Belcher: Election Year LNG ‘Pause’ Will Have Huge Negative Impacts

2024-03-01 - The Biden administration’s decision to pause permitting of LNG projects has damaged the U.S.’ reputation in ways impossible to calculate.

Belcher: Our Leaders Should Embrace, Not Vilify, Certified Natural Gas

2024-03-18 - Recognition gained through gas certification verified by third-party auditors has led natural gas producers and midstream companies to voluntarily comply and often exceed compliance with regulatory requirements, including the EPA methane rule.

Exclusive: The Politics, Realities and Benefits of Natural Gas

2024-04-19 - Replacing just 5% of coal-fired power plants with U.S. LNG — even at average methane and greenhouse-gas emissions intensity — could reduce energy sector emissions by 30% globally, says Chris Treanor, PAGE Coalition executive director.

Vietnam Seeks Delicate Balance Among US, China, Russia

2024-02-08 - Ongoing U.S. tensions with China and Russia offer Vietnam an opportunity to boost economic ties with the former if American investors can steer past geopolitical smokescreens and destine funds for infrastructure, power and LNG projects all somewhat tied to Vietnam’s manufacturing sector.

Pitts: Producers Ponder Ramifications of Biden’s LNG Strategy

2024-03-13 - While existing offtake agreements have been spared by the Biden administration's LNG permitting pause, the ramifications fall on supplying the Asian market post-2030, many analysts argue.