Clearfork said it plans to invest additional capital following the acquisition to optimize the efficiency of Azure Midstream’s systems in support of existing customers in the Haynesville Shale. (Source: Hart Energy)

Clearfork Midstream LLC agreed to acquire Azure Midstream Energy LLC following a $400 million initial capital commitment from EnCap Flatrock Midstream, Clearfork said in a Jan. 18 company release.

Based in Fort Worth, Texas, Clearfork is a growth-oriented midstream company that was formed in 2020 to provide comprehensive midstream solutions for oil and gas producers in basins across North America.

“Over the past few years, we have developed strong relationships with key members of the EFM team,” Clearfork CEO Kipper Overstreet commented in a company release.

Overstreet, who previously served in roles of increasing responsibility at Azure Midstream, leads the Clearfork team comprised of industry veterans including COO George Grau Jr., Chief Commercial Officer Corey Lothamer and Executive Vice President Kevin Venturini. Together, they have more than 75 years of collective experience in the energy industry, according to the company release.

“[EnCap Flatrock Midstream] aligned with us on the acquisition of Azure Midstream and Azure’s growth potential,” Overstreet added. “We are very pleased to be part of the EFM family of companies.”

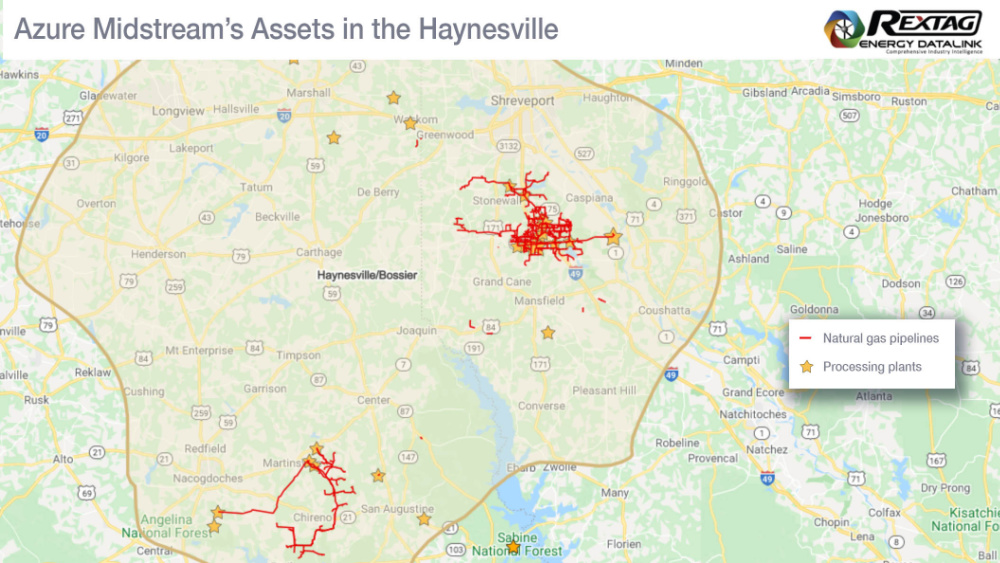

Azure Midstream’s natural gas gathering and treating platform spans the core areas of the Haynesville Shale formation and includes more than 500 miles of pipeline and 1.2 Bcf/d of treating capacity across systems in North Louisiana and East Texas. Azure also has nine downstream interconnects offering access to major market hubs, including Henry Hub, Houston Ship Channel/Katy, Carthage, Columbia Gulf Mainline, Perryville and Agua Dulce (via TETCO and NGPL).

In a statement commenting on the announcement, EFM Managing Director Zach Kayem said: “We have known members of management for better than half of a decade and are excited to pursue this significant midstream opportunity in East Texas and North Louisiana.”

Kayem also serves as a member of the Clearfork board of directors.

Terms of the Azure Midstream transaction weren’t disclosed. The transaction is subject to standard regulatory approvals and is expected to close during first-quarter 2022.

Clearfork plans to invest additional capital following the acquisition to optimize the efficiency of Azure Midstream’s systems in support of existing customers and to pursue additional acreage dedications, throughput volumes and regional infrastructure, the company release said.

Upon closing the transaction, most of the Azure Midstream team will move on to new ventures with the launch of Laser3, a midstream development and acquisition company with a “battle hardened and wizened management team eager to take on new challenges,” l.J. “Chip” Berthelot II said in a statement on the company website.

Azure Midstream was formed in 2013 with investment by members of our management team and our primary sponsors, Energy Spectrum Partners and Tenaska Capital Management.

Latham & Watkins LLP was legal adviser to EnCap Flatrock Midstream on the equity commitment with Partner James M. Garrett in the lead role. Vinson & Elkins LLP served as legal adviser to Clearfork on both the equity commitment and the acquisition of Azure Midstream. Partner Matthew Falcone led the firm’s legal team.

Donovan Ventures served as financial adviser to Clearfork regarding the Azure acquisition. Jefferies was financial adviser and Porter Hedges LLP was legal adviser to Azure.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers.

Novo II Reloads, Aims for Delaware Deals After $1.5B Exit Last Year

2024-04-24 - After Novo I sold its Delaware Basin position for $1.5 billion last year, Novo Oil & Gas II is reloading with EnCap backing and aiming for more Delaware deals.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.