Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Cimarex Energy Co. agreed to sell producing properties in western and southern Oklahoma and the Texas Panhandle, a group led by industry veteran Tom Ward said in a recent release.

In the release, BCE-Mach III LLC said it recently signed a purchase and sale agreement to acquire the Oklahoma and Texas properties from Cimarex for an undisclosed amount. The transaction, expected to close in June, also included two gas gathering and processing assets located in southern Oklahoma.

BCE-Mach III is the third portfolio company formed by a joint venture between Ward’s Mach Resources LLC and Houston-based private equity firm Bayou City Energy Management LLC (BCE). In total, the group have made eight separate acquisitions across Oklahoma, Kansas and the Texas Panhandle since linking up in 2018.

“We continue to have success adding to our holdings in the Midcontinent region,” said Ward, who serves as CEO, in a statement on May 17.

Ward, well-known for co-founding shale pioneer Chesapeake Energy Corp., formed his latest venture, Mach Resources, in 2017 to pursue “high-return, low-cost” projects. Through its partnership with BCE, the company has assembled an expansive upstream portfolio of Anadarko Basin assets.

The partnership’s latest acquisition vehicle, BCE-Mach III, was formed in early 2020 and in April 2020 acquired the upstream assets of Alta Mesa Holdings, primarily located in the heart of the STACK shale play in Oklahoma’s Kingfisher County. The deal, which was completed as part of Alta Mesa’s bankruptcy and associated 363 sale process, also included the midstream assets of Kingfisher Midstream LLC.

In total, BCE-Mach owns interest in over 7,200 producing wells and more than 700,000 net acres (96% HBP) across 46 counties in Oklahoma, Kansas and the Texas Panhandle. The group’s net production is roughly 48,000 boe/d (50% liquids), according to the release.

In his statement, Ward added he expects the group to continue adding to their Midcontinent position due to the “team’s expertise in the region and strong financial standing.”

“As a result of our scale in the area across our platforms, we are able to bolt on an acquisition of this size with minimal incremental overhead costs,” he said.

Will McMullen, BCE’s managing partner, also added that the BCE-Mach partnership will also start to consider making acquisitions outside of the Midcontinent.

“With this formidable financial strength,” McMullen said in reference to the group anticipated combined net debt to EBITDA multiple of a less than 0.25x, “we will add to the Midcontinent producing holdings and prudently develop the assets when appropriate. We will also evaluate applying this strategy to other basins where assets are either non-strategic to a seller or owned by unnatural holders.”

Mach is headquartered in Oklahoma City, with 80 corporate team members and 220 field team members across seven field offices. In addition to its upstream assets, BCE-Mach owns and operates an extensive infrastructure portfolio including two fully integrated water transfer and disposal systems, three gas gathering and processing systems, a roughly 85,000 HP compression fleet and a crude gathering system.

“Generating free cash flow from our platform assets will continue as our overriding strategy,” McMullen said.

For 2021, McMullen projects free cash flow from the BCE-Mach partnership to exceed $200 million after accounting for all capex, G&A and debt interest expenditures. This will help achieve a combined net debt to EBITDA multiple of a less than 0.25x, he added.

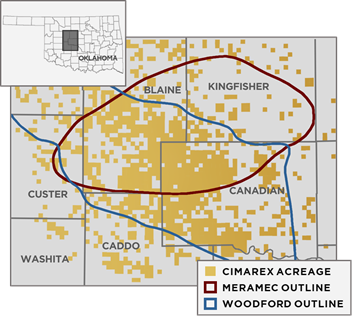

Based in Denver, Cimarex has operations in the Permian Basin and Midcontinent regions across Texas, New Mexico and Oklahoma. Most of the company’s wells are drilled in the Wolfcamp Shale and Bone Spring Sands in the Permian Basin and in the Woodford and Meramec Shales in western Oklahoma, according to its website.

The Midcontinent accounted for 32% of Cimarex’s year-end 2020 proved reserves and 27% of total production.

Recommended Reading

Second Light Oil Discovery in Mopane-1X Well

2024-01-26 - Galp Energia's Avo-2 target in the Mopane-1X well offshore Namibia delivers second significant column of light oil.

CNOOC Makes 100 MMton Oilfield Discovery in Bohai Sea

2024-03-18 - CNOOC said the Qinhuangdao 27-3 oilfield has been tested to produce approximately 742 bbl/d of oil from a single well.

CNOOC Finds Light Crude at Kaiping South Field

2024-03-07 - The deepwater Kaiping South Field in the South China Sea holds at least 100 MMtons of oil equivalent.

Eni Finds 2nd Largest Discovery Offshore Côte d’Ivoire

2024-03-08 - Deepwater Calao Field’s potential resources are estimated at between 1 Bboe and 1.5 Bboe.