(Source: G B Hart / Shutterstock.com)

The unwritten rule of M&A is that after most mergers, divestitures ensue. Chord Energy, no exception, has a hefty package of noncore acreage to sell, with the largest chunk in the Permian Basin.

Chord Energy was created after a July 1 combination valued at $6 billion between Whiting Petroleum Corp. and Oasis Petroleum Inc. The resulting company is the largest net acreage holder and second-largest producer in the Williston Basin — with an estimated 10% of the basin’s production.

Roughly two weeks after the merger closed, the company completed the divestiture of its interests in various assets, including producing wells and an equity interest in a pipeline in Rio Blanco County, Colo., for an aggregate sales price of $8 million, according to November federal regulatory filings.

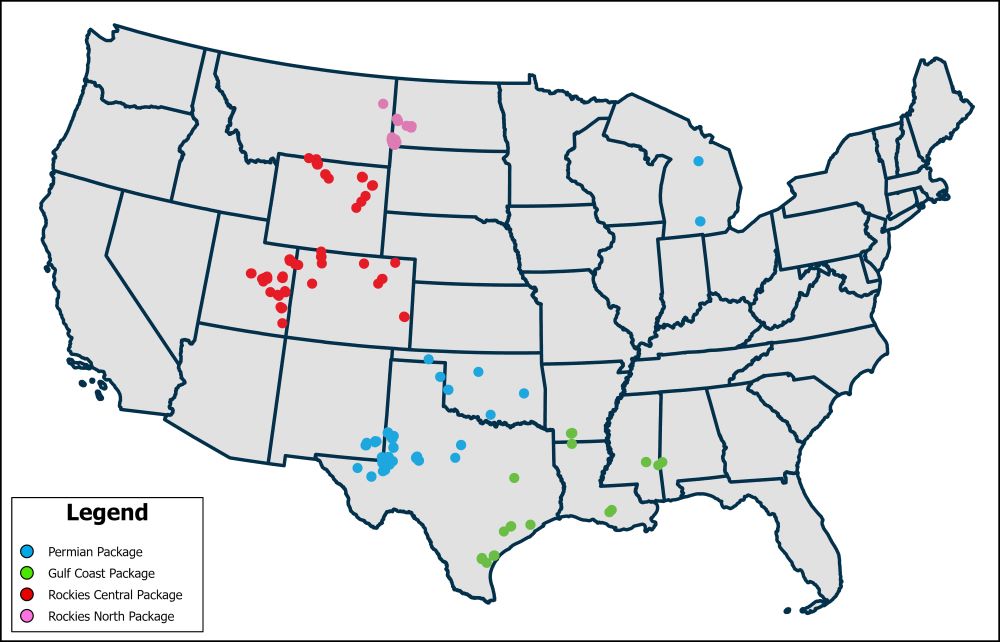

But the company remains ready to jettison a sizeable chunk of non-core asset across the U.S., including the Permian Basin, Central and Northern Rockies and Gulf Coast.

EnergyNet Indigo has now marketed some of those assets — totaling 46,077 net acres and interests in 1,664 wells — for Chord. A large portion of the production and proved reserves are located in the Permian.

Chord said its preference is a sole buyer for the assets, but will consider offers on a regional basis, as well.

The combined assets average about 2,200 boe/d, 80% of which is oil that have produced $3.2 million in average operating income over a six-month period from March 2022 to August 2022, according to EnergyNet Indigo. Production is primarily from conventional reservoirs and established waterfloods with predictable production profiles.

The properties “have not been core assets of Chord (and formerly Whiting) for several years,” according to EnergyNet Indigo marketing materials. “Whiting USA Trust II held a 90% net profits interest in the properties, which terminated and reverted to Whiting Oil and Gas Corp.” on Dec. 31, 2021.

Chord’s Permian position spans the Midland and Delaware basins and the Central Basin Platform. EnergyNet Indigo described the assets as “stable operations from conventional and waterflood assets with horizontal development potential.”

The Permian package’s highlights include:

- Net production of 1,300 boe/d, including 73% oil;

- Average months operating income of $1.7 million;

- Estimated average base declines of 14% from January 2023 to January 2024;

- 23,936 net acres, 96% HBP;

- A total of 656 wells, 485 active and 171 inactive; and

- Of those wells, 305 are operated and 322 are non-operated.

EnergyNet.com said the sale is a sealed bid property, Lot# 97444.

Bids are due at 4 p.m. CST Feb.16, 2023. Complete due diligence information on is available online or by emailing Lindsay Ballard, managing director, at Lindsay.Ballard@energynet.com or Reilly Bilton, director of engineering at EnergyNet Indigo, at Reilly.Bilton@energynet.com.

Disclaimer: The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Recommended Reading

Exclusive: Dan Romito Urges Methane Mitigation Game Plan

2024-04-08 - Dan Romito, the consulting partner at Pickering Energy Partners, says evading mitigation responsibility is "naive" as methane detection technology and regulation are focusing on oil and gas companies, in this Hart Energy Exclusive interview.

Wanted: National Gas Strategy for Utilities, LNG

2024-02-07 - Chesapeake CEO Nick Dell’Osso and Mercator Energy President John Harpole, speaking at NAPE, said some government decision-makers have yet to catch on to changes spreading across the natural gas market.

Venture Global Seeks FERC Actions on LNG Projects with Sense of Urgency

2024-02-21 - Venture Global files requests with the Federal Energy Regulatory Commission for Calcasieu Pass 1 and 2 before a potential vacancy on the commission brings approvals to a standstill.

From Satellites to Regulators, Everyone is Snooping on Oil, Gas

2024-04-10 - From methane taxes to an environmental group’s satellite trained on oil and gas emissions, producers face intense scrutiny, even if the watchers aren’t necessarily interested in solving the problem.

The Jones Act: An Old Law on a Voyage to Nowhere

2024-04-12 - Keeping up with the Jones Act is a burden for the energy industry, but efforts to repeal the 104-year-old law may be dead in the water.