Chevron intends a complete exit of the southeast Gomez Field as EnergyNet called it an “unmatched basin entry or bolt-on acquisition with exposure to the prolific Delaware Basin.” (Source: Hart Energy art library)

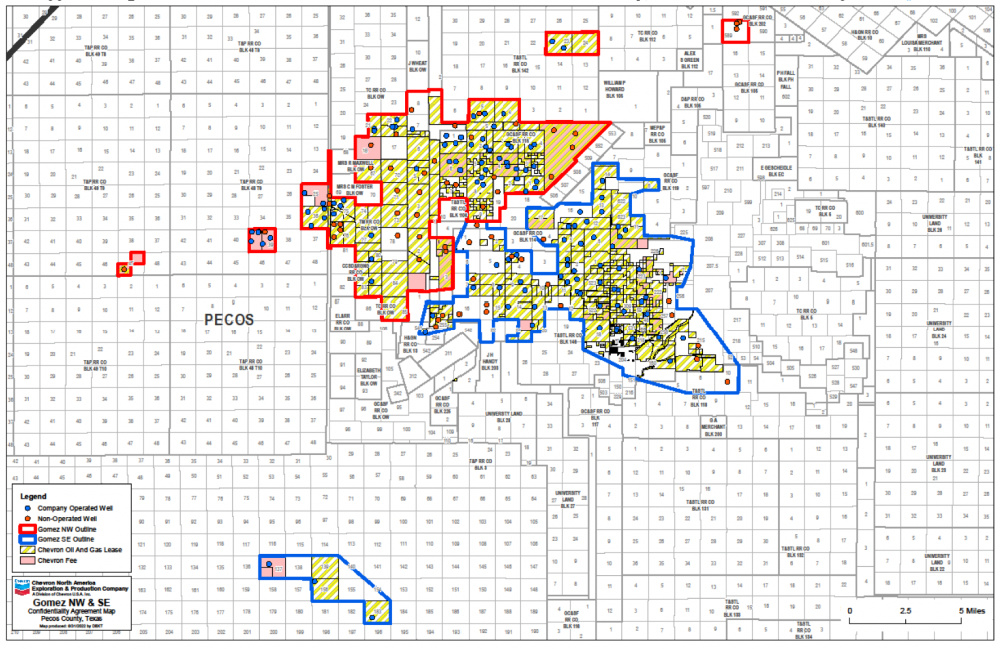

Chevron Corp. has put up for sale all of its southeast Gomez Field acreage in the Delaware Basin—a 22,124 contiguous net-acre position that could fetch between $100 million and $500 million, according to Enverus estimates.

EnergyNet Indigo, which is handling the sale as financial adviser to Chevron USA and its affiliates, said Sept. 29 that the company will shortly launch a process for Chevron’s northwest Gomez Field, which would effectively double the acreage footprint for the Pecos County, Texas, opportunity.

The asset’s estimated January 2023 PDP average daily production is about 1,280 boe, EnergyNet said. The asset includes gas infrastructure with takeaway capacity for a full development plan. Next 12-month PDP cash flow is expected to be $7.6 million, the firm said.

Andrew Dittmar, director at Enverus Intelligence Research, a subsidiary of Enverus, said bid-ask spreads remain “just brutal” but that, like any seller, Chevron “just needs that one buyer that likes it.”

“It is hard to get paid for inventory right now, even good inventory,” Dittmar said, noting that inventory-heavy Permian assets are now in competition between largely PDP assets found in other basins such as the Williston or the Eagle Ford Shale.

“It’s hard to say” what buyers will be willing to pay for the asset.

Offset operators include Diamondback Energy Inc., which has largely been quiet on the upstream A&D front in 2022, as well as private operator Gordy Oil Co.

EnergyNet noted in its sales listing that Chevron holds operational control of 99% of production operated with a working interest of 90% in its operated PDP wells. The firm also highlighted:

- Future development utilizes contiguous acreage position for 529-ft 10,000-ft laterals

- Gross Wolfcamp thickness of about 400 ft with high TOC and porosity across the acreage position

- Low-decline, predictable production profile from conventional deep Ellenburger wells

- No MVCs or drilling commitments

Chevron intends a complete exit of the southeast Gomez Field as EnergyNet called it an “unmatched basin entry or bolt-on acquisition with exposure to the prolific Delaware Basin.”

Additionally, EnergyNet said the acreage offers “delineated, premium inventory potential across several zones” including:

- 529 gross (about 264 net) repeatable drilling locations including across the position in Pecos County

- 131 locations in the 2nd Bone Spring at 1,320-ft spacing

- 199 locations in the Wolfcamp A at 880-ft spacing

- 199 locations in the Wolfcamp B at 880-ft spacing

- Further potential upside of 262 locations at 1,320-ft spacing in the following reservoirs:

- 131 locations in the 3rd Bone Spring

- 131 locations in the Wolfcamp C

A virtual data room for the asset is open. Bids are due Nov. 9. The transaction would have a Jan. 1, effective date, according to EnergyNet.

For complete due diligence information visit energynet.com or email Cody Felton, managing director, at Cody.Felton@energynet.com, or Denna Arias, executive director of acquisitions and divestments, at Denna.Arias@energynet.com, or Keith Ries, managing director of engineering, at Keith.Ries@energynet.com.

Recommended Reading

HighPeak Energy Authorizes First Share Buyback Since Founding

2024-02-06 - Along with a $75 million share repurchase program, Midland Basin operator HighPeak Energy’s board also increased its quarterly dividend.

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.

CorEnergy Infrastructure to Reorganize in Pre-packaged Bankruptcy

2024-02-26 - CorEnergy, coming off a January sale of its MoGas and Omega pipeline and gathering systems, filed for bankruptcy protect after reaching an agreement with most of its debtors.

Tellurian, Institution Investor Agree to New Loan Repayment Terms

2024-02-22 - Tellurian reached an agreement with an unnamed institutional investor to pledge its interest in the Driftwood project as collateral.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.