Chevron intends a complete exit of the southeast Gomez Field as EnergyNet called it an “unmatched basin entry or bolt-on acquisition with exposure to the prolific Delaware Basin.” (Source: Hart Energy art library)

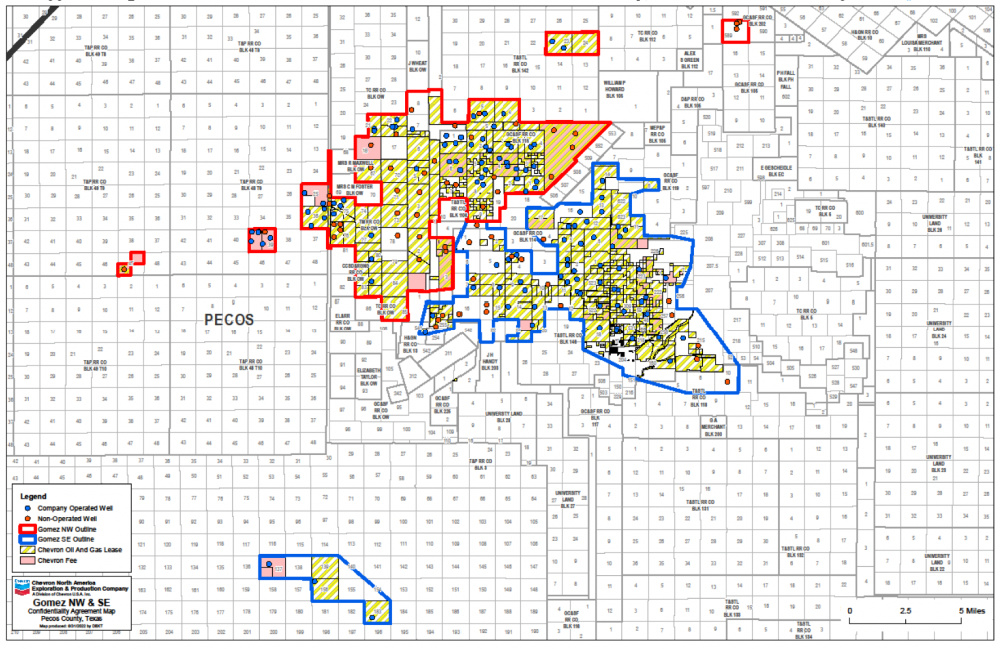

Chevron Corp. has put up for sale all of its southeast Gomez Field acreage in the Delaware Basin—a 22,124 contiguous net-acre position that could fetch between $100 million and $500 million, according to Enverus estimates.

EnergyNet Indigo, which is handling the sale as financial adviser to Chevron USA and its affiliates, said Sept. 29 that the company will shortly launch a process for Chevron’s northwest Gomez Field, which would effectively double the acreage footprint for the Pecos County, Texas, opportunity.

The asset’s estimated January 2023 PDP average daily production is about 1,280 boe, EnergyNet said. The asset includes gas infrastructure with takeaway capacity for a full development plan. Next 12-month PDP cash flow is expected to be $7.6 million, the firm said.

Andrew Dittmar, director at Enverus Intelligence Research, a subsidiary of Enverus, said bid-ask spreads remain “just brutal” but that, like any seller, Chevron “just needs that one buyer that likes it.”

“It is hard to get paid for inventory right now, even good inventory,” Dittmar said, noting that inventory-heavy Permian assets are now in competition between largely PDP assets found in other basins such as the Williston or the Eagle Ford Shale.

“It’s hard to say” what buyers will be willing to pay for the asset.

Offset operators include Diamondback Energy Inc., which has largely been quiet on the upstream A&D front in 2022, as well as private operator Gordy Oil Co.

EnergyNet noted in its sales listing that Chevron holds operational control of 99% of production operated with a working interest of 90% in its operated PDP wells. The firm also highlighted:

- Future development utilizes contiguous acreage position for 529-ft 10,000-ft laterals

- Gross Wolfcamp thickness of about 400 ft with high TOC and porosity across the acreage position

- Low-decline, predictable production profile from conventional deep Ellenburger wells

- No MVCs or drilling commitments

Chevron intends a complete exit of the southeast Gomez Field as EnergyNet called it an “unmatched basin entry or bolt-on acquisition with exposure to the prolific Delaware Basin.”

Additionally, EnergyNet said the acreage offers “delineated, premium inventory potential across several zones” including:

- 529 gross (about 264 net) repeatable drilling locations including across the position in Pecos County

- 131 locations in the 2nd Bone Spring at 1,320-ft spacing

- 199 locations in the Wolfcamp A at 880-ft spacing

- 199 locations in the Wolfcamp B at 880-ft spacing

- Further potential upside of 262 locations at 1,320-ft spacing in the following reservoirs:

- 131 locations in the 3rd Bone Spring

- 131 locations in the Wolfcamp C

A virtual data room for the asset is open. Bids are due Nov. 9. The transaction would have a Jan. 1, effective date, according to EnergyNet.

For complete due diligence information visit energynet.com or email Cody Felton, managing director, at Cody.Felton@energynet.com, or Denna Arias, executive director of acquisitions and divestments, at Denna.Arias@energynet.com, or Keith Ries, managing director of engineering, at Keith.Ries@energynet.com.

Recommended Reading

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.

EIG’s MidOcean Closes Purchase of 20% Stake in Peru LNG

2024-04-23 - MidOcean Energy’s deal for SK Earthon’s Peru LNG follows a March deal to purchase Tokyo Gas’ LNG interests in Australia.

Marketed: Stone Hill Minerals Holdings 95 Well Package in Colorado

2024-02-28 - Stone Hill Minerals Holdings has retained EnergyNet for the sale of a D-J Basin 95 well package in Weld County, Colorado.