Chevron Corp. (NYSE: CVX) is exiting several operating areas as it pursues its divestment target of $5 billion to $10 billion by year-end 2017.

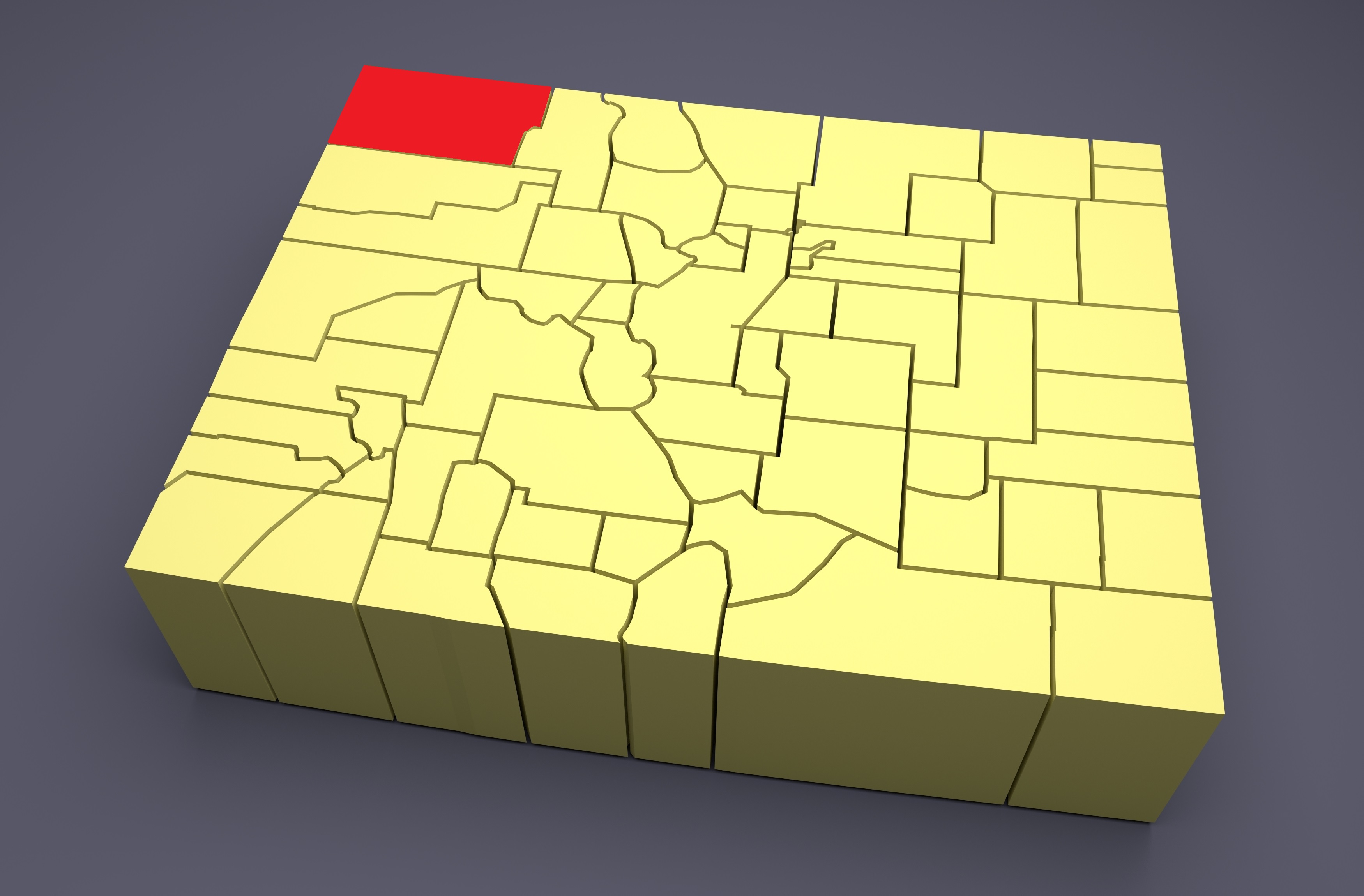

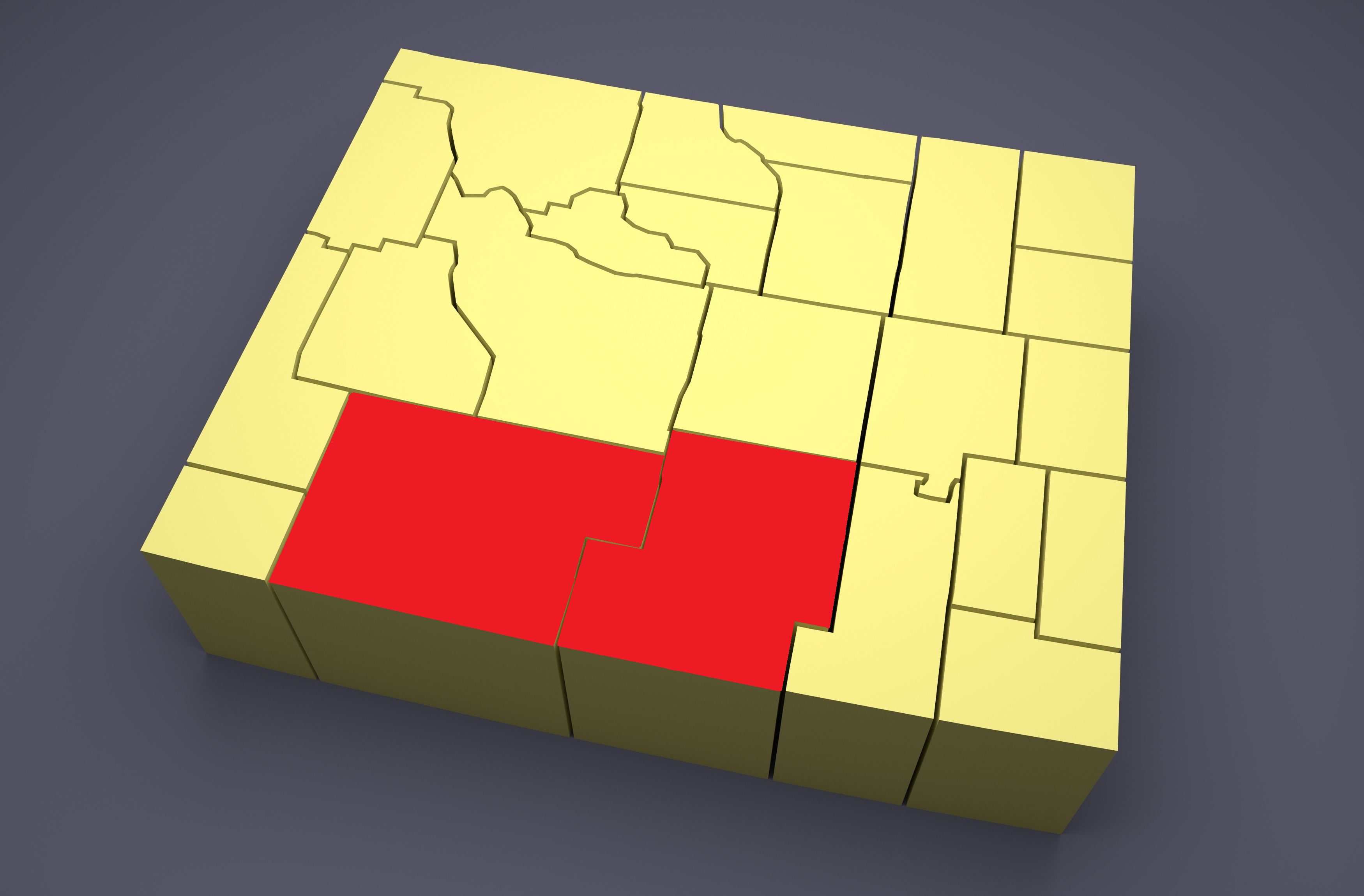

The San Ramon, Calif.-based company is selling producing wet gas assets and about 100,000 net acres across Wyoming in a move to exit the state. The company also has plans to exit the Texas Panhandle.

So far in 2016, Chevron has received proceeds of $1.4 billion from asset sales including: New Zealand marketing, Canadian gas storage assets, California pipeline assets and Gulf of Mexico upstream assets. The company also has “a number of potential transactions presently being worked,” Pat Yarrington, Chevron’s CFO, said during its second-quarter earnings call on July 29.

“We believe our sales program is executable and that we can secure good value,” Yarrington said.

Chevron is committed to paying dividends, despite generating insufficient cash flows to do so in second-quarter 2016.

“CVX should begin to achieve cash flow neutrality by 2017 especially if the targeted $5 billion to $10 billion in asset sales comes to fruition,” said Roger Read, senior analyst at Wells Fargo Securities.

The Wyoming assets, which are being offered in six separate packages through EnergyNet, consist of interests in more than 500 operated wells and more than 1,000 nonoperated wells. The offer also includes interest in northwest Colorado.

Areas include the Green River Basin, Moxa Arch area, Wind River Basin, Wyoming Overthrust Belt and Powder River Basin. Net production is about 56 million cubic feet equivalent per day (80% gas, 15% NGL and 5% condensate) with annual decline rates of 7%-12%.

Combined, the packages’ 12-month cash flow averages $838,854 per month net to the interest offered. Ownership to Chevron averages 70% working interest with 59% net revenue interest.

Sealed-bid offers for the Wyoming packages are due at 4 p.m. CT Sept. 29. For information visit energynet.com or contact Chris Atherton, EnergyNet’s president, at 832-654-6612.

Green River Basin—Moffat County, Colo.

Chevron U.S.A. Inc. is offering 100% interest in about 5,730 net acres of property in Hiawatha and Hiawatha West fields located in northwestern Colorado in Moffat County.

Highlights:

- 16,050 gross (5,730 net) acres with 95% average working interest;

- All acreage is HBP and 100% federal acreage;

- 46 total wells;

- 45 producing and one disposal;

- Aggregate six-month average 8/8ths production is 5,828 thousand cubic feet per day (Mcf/d) and 9 barrels per day (bbl/d) of oil;

- Net daily production is 10 bbl/d of oil, 4,300 Mcf/d and 100 bbl/d of NGL; and

- 12-month average monthly net income is $44,339.

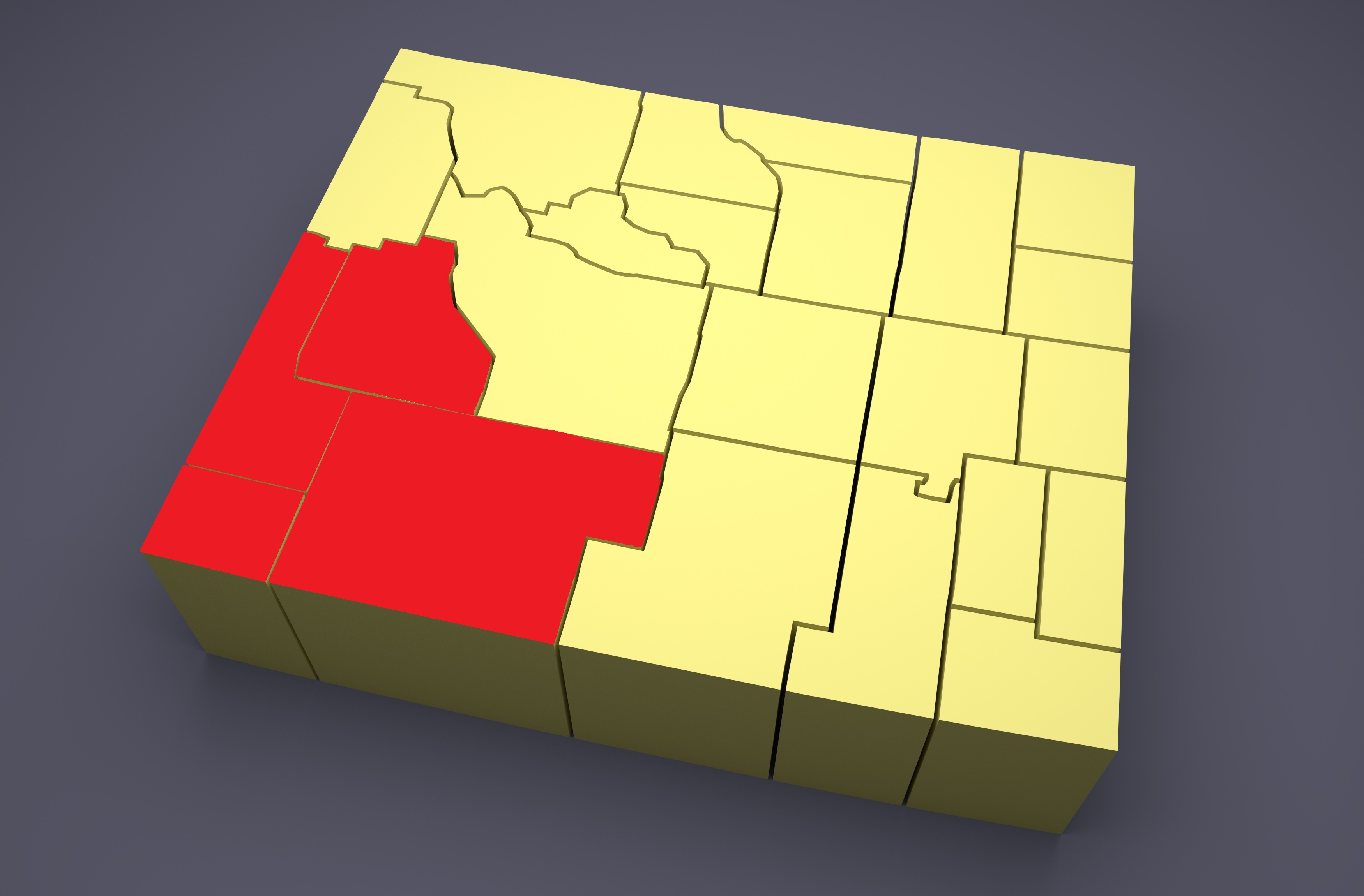

Green River Basin/Moxa Arch—Multiple Counties, Wyo.

Chevron U.S.A. Inc. and Chevron Midcontinent LP are offering 100% interest in about 58,000 net acres of property in operated, nonoperated and royalty assets across the Moxa Arch area in southwestern Wyoming.

The assets are located in Lincoln, Sublette, Sweetwater and Uinta counties, Wyo.

Highlights:

- Moxa Arch area;

- 92,128 gross (58,250 net) acres;

- Operated and nonop positions;

- All acreage is HBP and about 76,368 acres (83%) is federal;

- More than 360 operated wells and more than 880 nonop wells across 17 fields;

- Aggregate six-month average 8/8ths production is 98,449 Mcf/d and 913 bbl/d of oil;

- Operated assets are producing about 2,830 net barrels of oil equivalent per day (boe/d);

- Nonop assets are producing about 1,820 net boe/d; and

- Aggregate 12-month average monthly net income is $634,772.

Operated Portfolio:

- Located in Southwest Wyoming within the Green River Basin;

- 10 operated fields;

- Majority of production from gas-bearing formations;

- Oil formations include the Almy and Mesaverde;

- 363 total wells;

- 324 producing, five disposals and 34 shut-in; and

- Net daily production is 170 bbl/d of oil, 13,250 Mcf/d and 450 bbl/d of NGL.

Nonop Portfolio:

- Majority of assets located near the operated fields;

- 13 nonop fields;

- More than 892 total wells;

- 832 producing, three injectors, 55 shut-in and three temporarily abandoned; and

- Net daily production is 165 bbl/d of oil, 8,400 Mcf/d and 255 bbl/d of NGL.

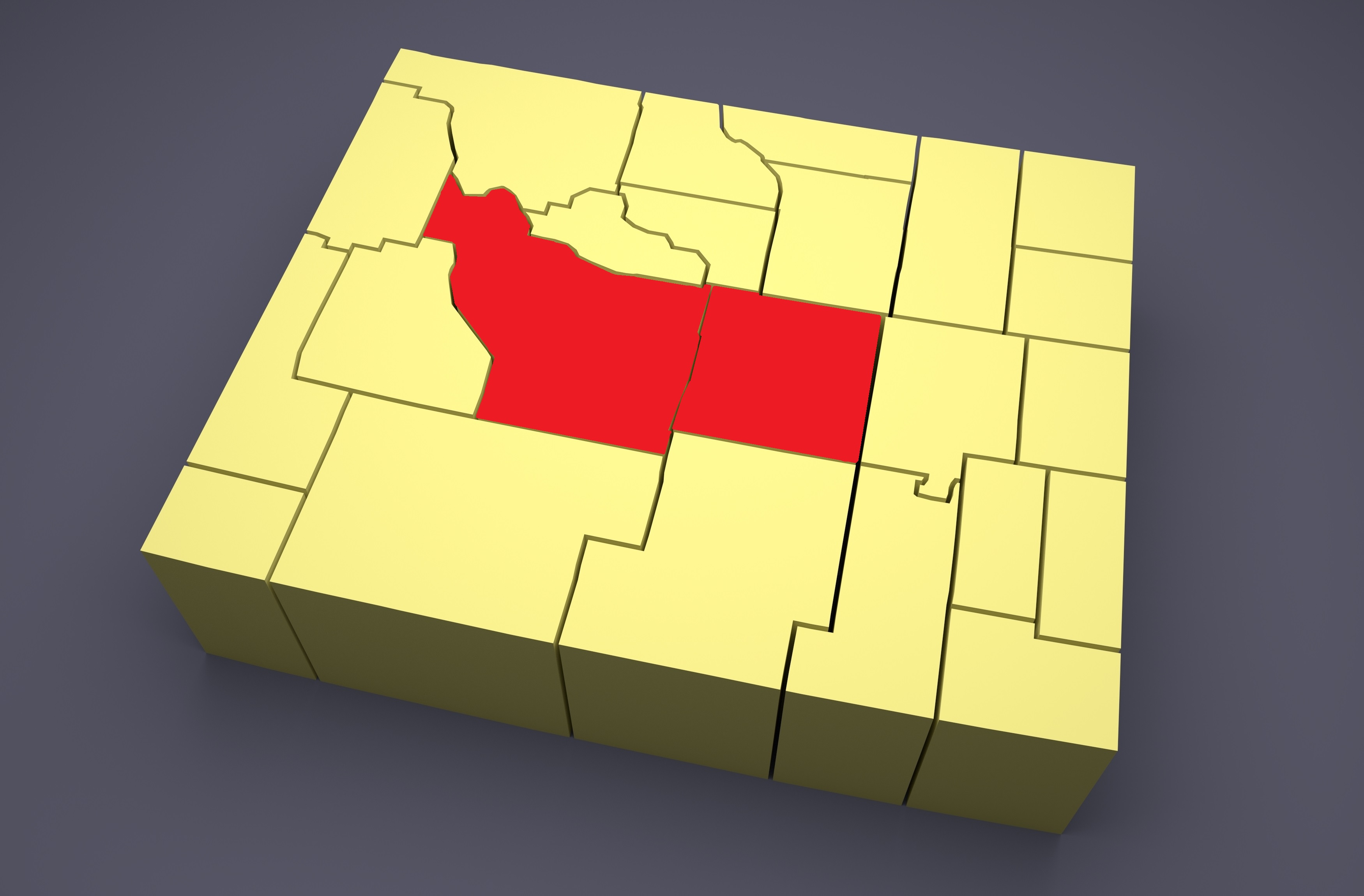

Wind River Basin—Fremont & Natrona Counties, Wyo.

Chevron U.S.A. Inc. is offering 100% interest in about 17,000 net acres of property in the operated Waltman Field and nonoperated Madden and Long Butte fields plus associated royalty properties in central Wyoming.

The assets are located in Fremont and Natrona counties, Wyo.

Highlights:

- 79,183 gross (17,195 net) acres;

- Operated and nonop positions plus associated royalty properties;

- All acreage is HBP and 88%, about 69,726 acres, is federal;

- 363 total wells across four fields;

- Multiple producing formations including Fort Union, Lance, Mesaverde, Cody, Shannon, Frontier and Madison;

- Aggregate six-month average 8/8ths production is 248,858 Mcf/d and 91 bbl/d of oil;

- Aggregate net daily production is 48 bbl/d of oil, 12,568 Mcf/d and 215 bbl/d of NGL;

- Aggregate 12-month average monthly net income is $36,181; and

- Nonop position with seasoned operator at Madden Field, according to EnergyNet.

Operated Portfolio:

- 63 total wells;

- 57 producing, three idle wellbores, two disposals and one royalty income well; and

- Net daily production is 42 bbl/d of oil, 6,480 Mcf/d and 215 bbl/d of NGL.

Nonop Portfolio:

- 300 total wells;

- 171 producing, 125 idle wellbores and four disposals; and

- Net daily production is 6 bbl/d of oil and 6,088 Mcf/d.

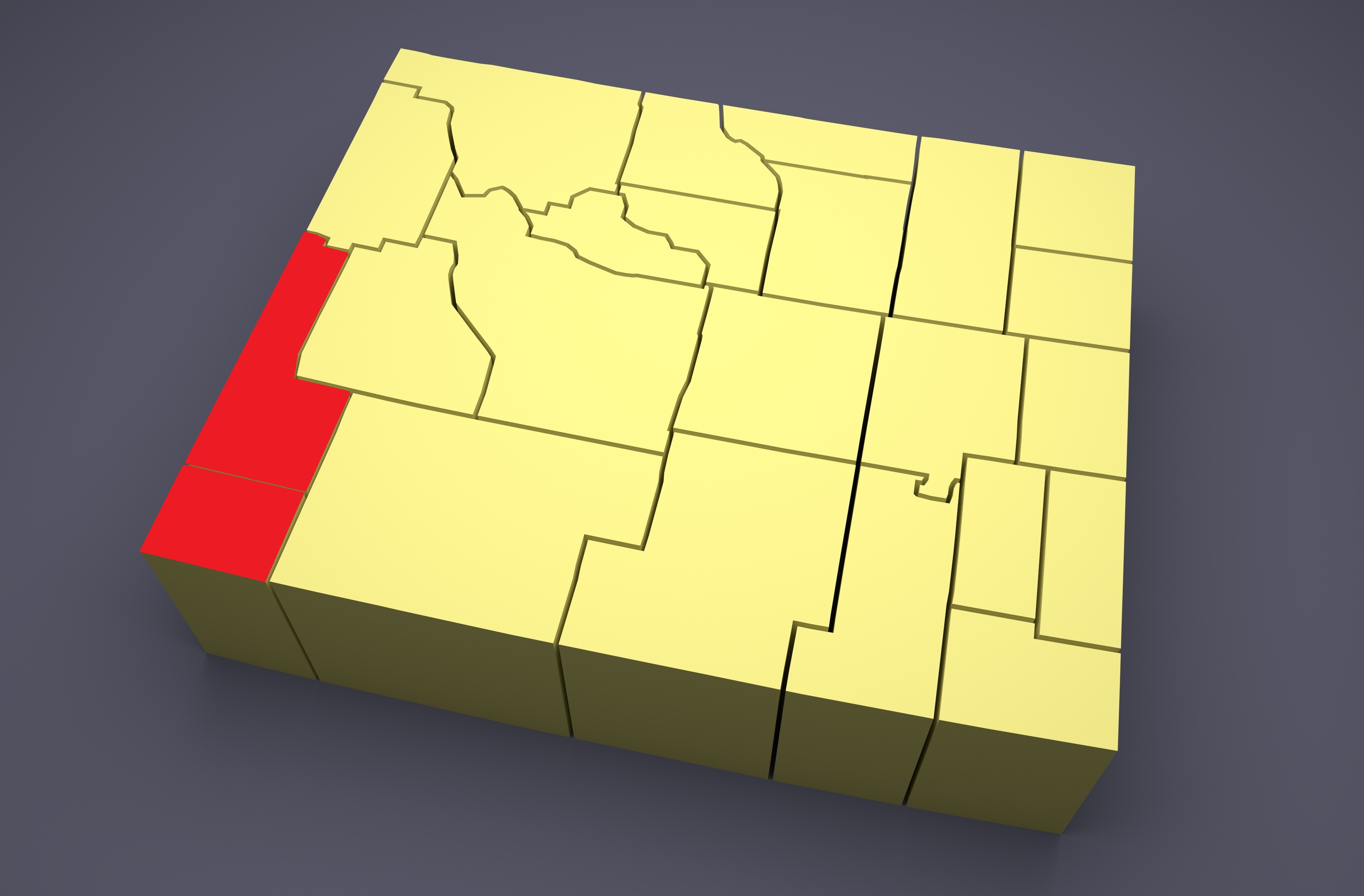

Wyoming Overthrust Belt—Lincoln & Uinta

Chevron U.S.A. Inc. is offering 100% of its interest in about 25,000 net acres of property in Whitney Canyon and Carter Creek fields in southwestern Wyoming.

The assets are located in Lincoln and Uinta counties, Wyo., and include 100% working interest in the Carter Creek Gas Plant.

Highlights:

- Revenue from sulfur production and local market demand;

- Contiguous land position along the Wyoming Overthrust Belt

- 25,000 net acres of largely federal leases in Lincoln and Uinta counties;

- 100% HBP;

- No depth right restrictions;

- High working interest ownership;

- 95%-100% working interest in 33 operated wells;

- Except for one well at 50% working interest;

- 31%-50% working interest in nine nonoperated wells;

- 95%-100% working interest in 33 operated wells;

- Aggregate six-month average 8/8ths production is 28,774 Mcf/d and 41 bbl/d; and

- 12-month average monthly net income is $123,562.

Whitney Canyon & Carter Creek Fields:

- 33 operated wells (COOP);

- Nine active nonoperated (NOJV) wells;

- Operated by Merit Energy Co.;

- Seven injection wells, two COOP Department of Environmental Quality (DEQ) Class 1 and two NOJV DEQ Class 1;

- Net daily production is 150 bbl of condensate, 14,000 Mcf and 375 bbl of NGL; and

- Sulfur yield averages 6.2 long tons per million standard cubic feet.

Carter Creek Gas Plant:

- Legacy Chevron sour gas plant in operation since 1982; and

- Critical for sour gas operations along the Overthrust.

Green River Basin—Carbon & Sweetwater

Chevron U.S.A. Inc. and Chevron Midcontinent LP are offering 100% interest in about 16,710 net acres of property in the operated Table Rock Field and associated nonoperated assets in southwestern Wyoming.

The assets are located in Carbon and Sweetwater counties, Wyo.

Highlights:

- 20,958 gross (16,710 net) acres with 85% average working interest;

- All acreage HBP and 68%, or 14,246 acres, is federal;

- 92 total wells across three operated and three nonoperated fields;

- Production from multiple horizons;

- Aggregate six-month average 8/8ths production is 8,453 Mcf/d and 103 bbl/d of oil;

- Net daily production is 107 bbl/d of oil, 6,627 Mcf/d and 306 bbl/d of NGL; and

- Upside potential through compression, recompletions and artificial lift optimization, EnergyNet said.

Operated Portfolio:

- 85 total wells;

- 63 producing, 21 idle wellbores and one disposal; and

- Net daily production is 107 bbl/d of oil, 6,492 Mcf/d and 340 bbl/d of NGL.

Nonop Portfolio:

- Seven total wells;

- Five producing and two idle wellbores; and

- Net daily production is 135 Mcf/d.

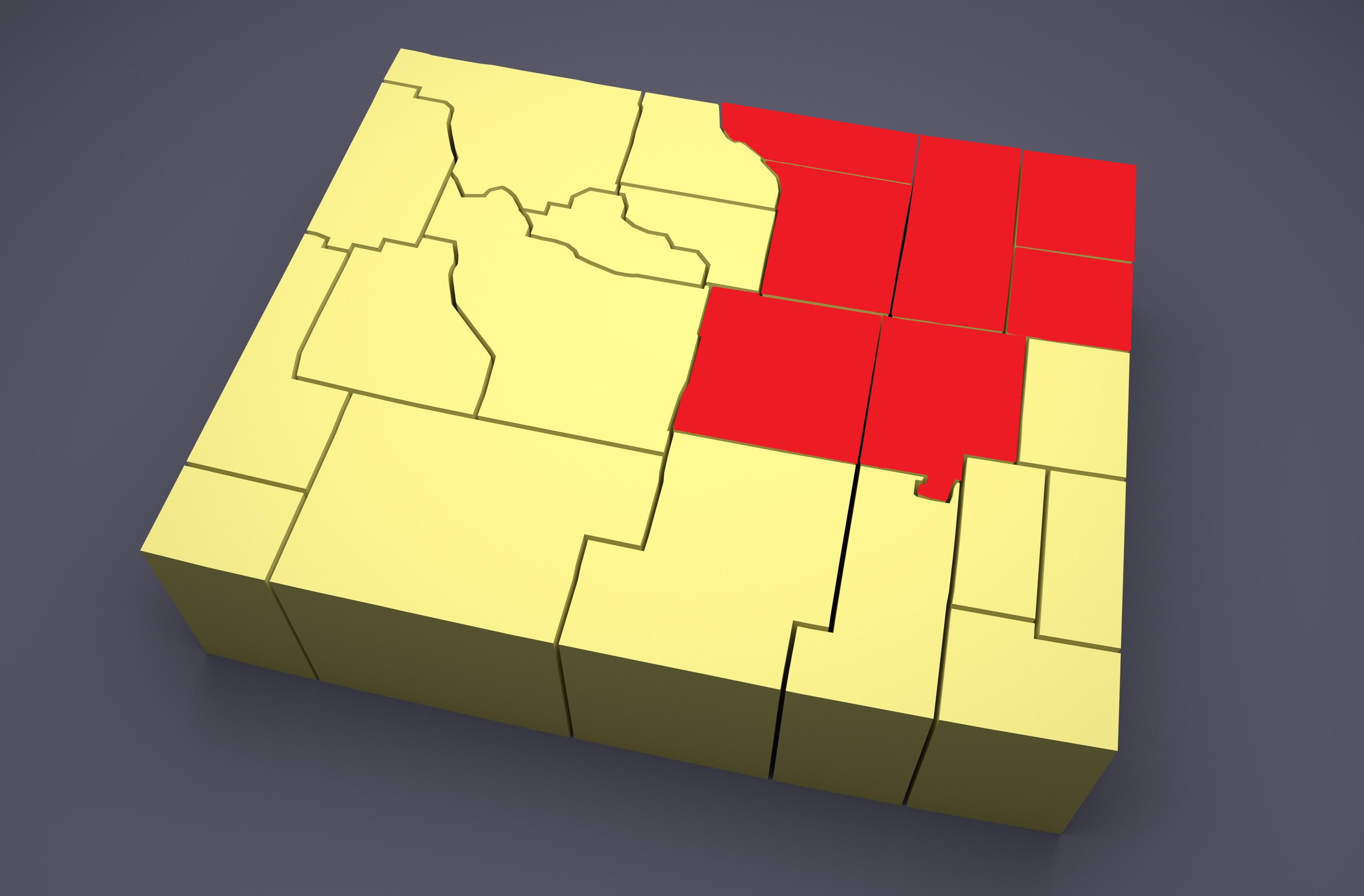

Powder River Basin—Multiple Counties, Wyo.

Chevron U.S.A. Inc. and Chevron Midcontinent LP are offering 100% interest in about 2,869 net acres in the Powder River Basin.

The assets are located in Campbell, Converse, Crook, Johnson, Natrona, Sheridan and Weston counties, Wyo.

Highlights:

- 13,152 gross (2,869 net) acres and 74%, or 9,676 acres, is federal;

- 1,455 net acres with no depth severances;

- 520 net acres with all depths less Muddy Formation;

- 290 net acres with all depths less Newcastle Formation;

- Average gross working interest in leasehold is 22%;

- Acreage position has direct access to interstate pipelines and processing and treating plant capacity, EnergyNet said;

- Five producing wells;

- One nonop and four royalty interest only;

- Aggregate six-month average 8/8ths production is 469 bbl/d of oil and 1,060 Mcf/d; and

- Aggregate 12-month average monthly net income is $361.

Emily Moser can be reached at emoser@hartenergy.com.

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.