Noble Midstream provides crude oil, natural gas, and water-related midstream services and owns equity interests in oil pipelines in the Denver-Julesburg Basin in Colorado and the Permian’s Delaware Basin in Texas. (Source: Shutterstock.com)

Chevron Corp. offered to buy out Noble Midstream LP on Feb. 5, months after closing its acquisition of the pipeline operator’s sponsor, Noble Energy.

“We have viewed a consolidation of the NBLX platform into CVX as the mostly likely outcome following the upstream merger and see a transaction as supporting the sustainability of the $1 million in opex reduction in 2020 into 2021 and beyond,” analysts with Tudor, Pickering, Holt & Co. (TPH) wrote in a Feb. 5 research note.

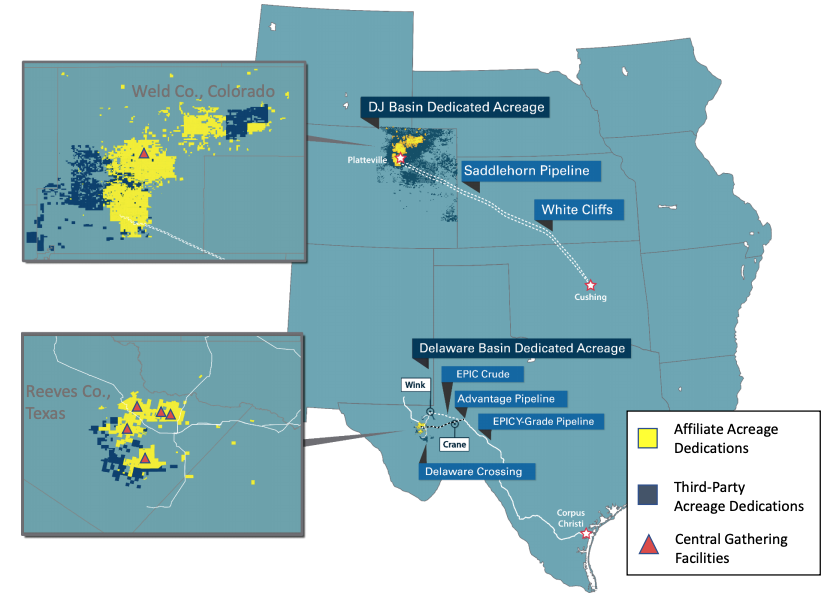

Noble Midstream is an MLP originally formed by Noble Energy and indirectly majority-owned by Chevron. The company provides crude oil, natural gas, and water-related midstream services and owns equity interests in oil pipelines in the Denver-Julesburg Basin in Colorado and the Permian’s Delaware Basin in Texas.

In a Feb. 5 company release, Chevron said it submitted a non-binding proposal to the Noble Midstream board to buy any remaining Noble Midstream interests not already owned by Chevron and its affiliates at $12.47 per common unit, which is in line with its closing price on Feb. 4. The offer values Noble Midstream at about $1.13 billion based on the company’s outstanding shares.

“With NBLX trading well above prior close in premarket, market is focused on recent precedent of LPs necessitating premium offers to get transactions across the finish line,” the TPH analysts added in their research note.

Chevron became Noble Midstream’s largest customer following its all-stock acquisition of Noble Energy last year. The U.S. oil major cited increased alignment on governance of the Noble Midstream assets as the primary strategic rationale.

“Chevron expects the proposed transaction to align long term interests by efficiently combining two highly integrated businesses while streamlining governance of the NBLX assets, which primarily serve Chevron as its largest customer,” the company said in the Feb. 5 release.

Chevron holds a roughly 62.5% stake in Noble Midstream, according to a filing from October. The proposed transaction is subject to negotiation and approval by the Noble Midstream board of directors.

Recommended Reading

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-19 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.