Chevron Corp. is offering to sell about 73,000 acres (29,540 hectares) of oil and gas properties in New Mexico, according to documents viewed by Reuters, as oil firms accelerate divestitures in a rebounding oil market.

Sales in the Permian Basin of West Texas and New Mexico have jumped as shale producers and private-equity firms seize on a sizzling recovery in oil prices to buy companies or secure new drilling prospects.

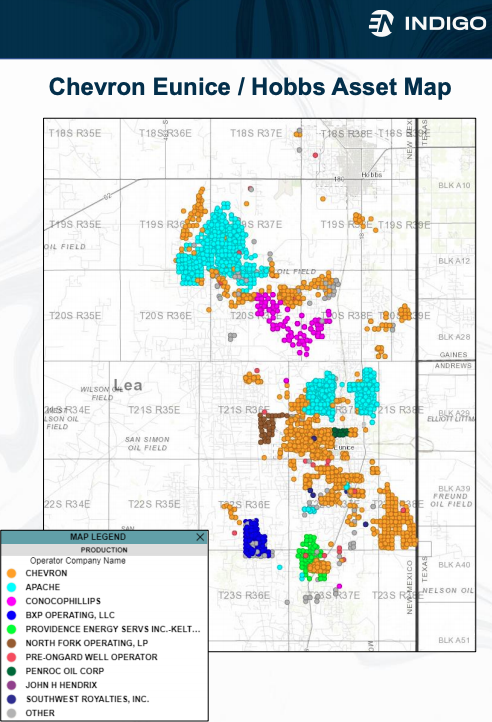

Chevron set a May 20 deadline for bids on acres holding more than 1,000 producing wells with $1.1 million in combined monthly revenue, according to a sales document. Some of the properties are operated by ConocoPhillips Co., BXP Operating LLC and Providence Energy Services Inc., the document showed.

“Chevron has an ongoing and methodical program to evaluate and prioritize its assets,” spokeswoman Veronica Flores-Paniagua said, confirming the New Mexico’s Lea County offer. She declined to say what the company hopes to get for the assets.

The properties could fetch about $100 million, according to one analyst who reviewed the parcels but declined to be named because he was not authorized to speak on the matter. The wells are in conventional fields in the Permian’s Central Basin, not in the more desirable Midland and Delaware areas, the person said.

“Current valuations are favorable for buyers and we expect private equity to be strategic players largely via consolidation and growth of existing portfolio companies,” said Brian Lidsky, managing director at energy investment bank Entoro Capital LLC.

U.S. oil is trading in the mid-$60s/bbl this year, helping trigger a revival in deals. Commodities trader Vitol last week bought 44,000 acres (17,800 hectares) in the Permian from Hunt Oil Co. for about $1 billion.

Pioneer Natural Resources Co. recently acquired Permian producers DoublePoint Energy and Parsley Energy for a combined $10.9 billion, and ConocoPhillips Co. paid $9.7 billion for Concho Resources.

Recommended Reading

Scathing Court Ruling Hits Energy Transfer’s Louisiana Legal Disputes

2024-04-17 - A recent Energy Transfer filing with FERC may signal a change in strategy, an analyst says.

Balticconnector Gas Pipeline Will be in Commercial Use Again April 22, Gasgrid Says

2024-04-17 - The Balticconnector subsea gas link between Estonia and Finland was damaged in October along with three telecoms cables.

Targa Resources Ups Quarterly Dividend by 50% YoY

2024-04-12 - Targa Resource’s board of directors increased the first-quarter 2024 dividend by 50% compared to the same quarter a year ago.

Canada’s First FLNG Project Gets Underway

2024-04-12 - Black & Veatch and Samsung Heavy Industries have been given notice to proceed with a floating LNG facility near Kitimat, British Columbia, Canada.

Biden Administration Argues Against Enbridge Pipeline Shutdown Order

2024-04-11 - The U.S. argues that shutting down the pipeline could interrupt service and violate a 1977 treaty between the U.S. and Canada to keep oil flowing.