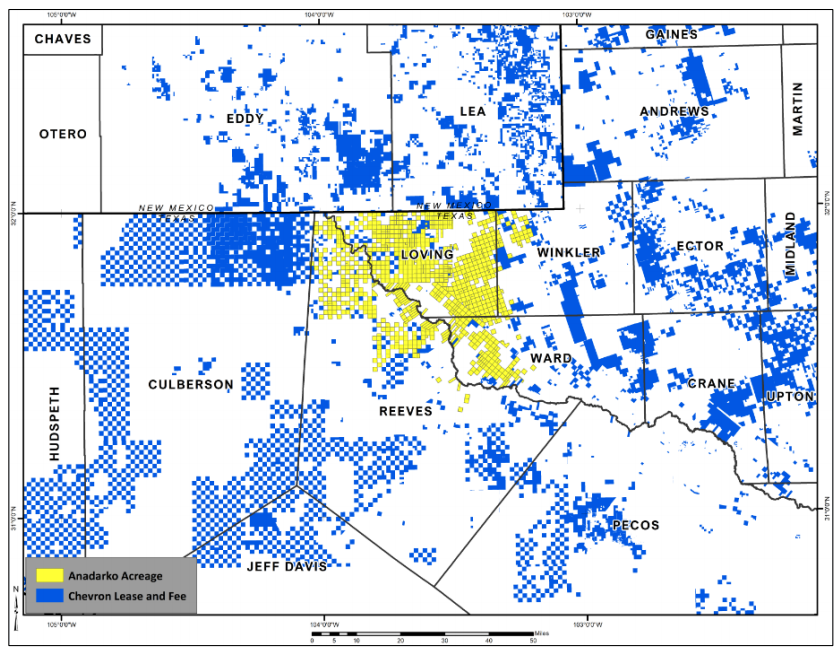

Anadarko Petroleum’s Delaware Basin position in the Permian is nearly 600,000 gross acres and holds 8,500 feet of stacked oil potential. (Source: Anadarko Petroleum Corp.)

[Editor’s note: This story was updated at 10:53 a.m. CST April 12. Check back for more updates on this developing story throughout the day.]

The landscape of the oil and gas industry shifted on April 12 following Chevron Corp.’s merger agreement to acquire Anadarko Petroleum Inc., one of the world’s largest independent E&P companies based in The Woodlands, Texas.

The $33 billion megadeal will also include the assumption of $15 billion net debt. The terms of the transaction are comprised of 75% stock and 25% cash, which translates to Chevron paying about 200 million shares and $8 billion cash.

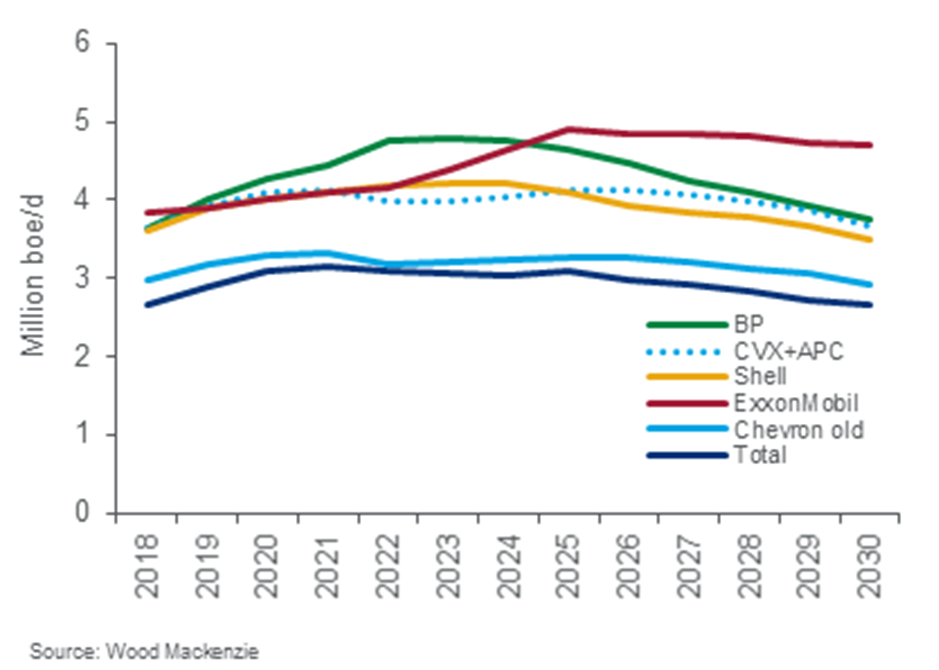

The transaction—the largest upstream deal since Royal Dutch Shell Plc’s acquisition of BG Group in 2015—is set to make Chevron the second-largest producing major, according to analysts with consulting firm Wood Mackenzie.

“Chevron now joins the ranks of the ultra-majors—and the big three becomes the big four,” Roy Martin, senior analyst of corporate analysis for WoodMac, said in a statement.

Chevron had ranked fourth in size below other oil majors Exxon Mobil Corp., Shell and BP Plc.

“The acquisition makes the majors’ peer group much more polarized,” Martin added. “Exxon Mobil, Chevron, Shell and BP are now in a league of their own.”

Anadarko Petroleum casts a wide exploration footprint to diversify its value—from short-cycle U.S. onshore unconventional assets to deepwater projects offshore Africa and in the U.S. Gulf of Mexico. The company, which came in fourth in Oil and Gas Investor’s 2019 ranking of top 50 public E&Ps, also owns midstream assets through its affiliate Western Midstream Partners LP.

Chevron was reportedly not the only company that considered Anadarko an attractive acquisition target though.

CNBC reported April 12, citing sources, that Occidental Petroleum Corp. had also submitted a cash-and-stock bid worth $70 per share to acquire Anadarko Petroleum.

Anadarko, however, went with the Chevron offer for $65 a share despite Occidental’s bid containing more cash, the unnamed sources said.

Occidental is now considering its options, per the CNBC report.

Martin notes the major drivers of the combination for Chevron includes Anadarko Petroleum’s tight oil assets in the Permian and Denver-Julesburg (D-J) basins plus its Mozambique LNG project.

“By buying Anadarko, they take on a highly contiguous Delaware basin position in the Permian,” he said. “Chevron ought to be able to do more with the acreage than Anadarko, which lagged behind in terms of well productivity. Chevron’s deepwater Gulf of Mexico position is also strengthened.”

Shale Overdrive

On a conference call following announcement of the deal, Mike Wirth, chairman and CEO of Chevron, said getting more out of the Permian sooner is an important value driver for the oil major.

“If you liked Chevron’s Permian position before, you’ll like it even more now,” Wirth said.

(Source: Chevron Corp. Presentation April 2019)

With Anadarko, Chevron’s position in the Delaware Basin becomes stronger, creating what Wirth described as an “unmatched position in the core of the core.”

The California-based company is in the midst of a drive to boost its Permian shale production to 900,000 barrels per day (bbl/d) by year-end 2023. The company’s production in the Permian jumped 84% to about 377,000 bbl/d in fourth-quarter 2018, compared to a year earlier.

Anadarko, which has a nearly 600,000 gross acre position in the Delaware Basin, puts its estimated recoverable resources at more than 3 billion barrels of oil equivalent in the Wolfcamp Shale alone.

Combine Anadarko’s Permian position with Chevron’s 1.7 million net acres in the basin and the result is a “75-mile wide highly contiguous corridor,” Wirth said.

But “it’s not about getting bigger in the Permian,” he later added. “It’s about getting better in the Permian.”

Plans are for the company to accelerate development of Anadarko’s acreage, incorporating Chevron’s basis of design and digital technologies. Chevron, which has acreage bordering Anadarko’s, aims to increase the rig count and pursue long laterals and pad drilling, which Anadarko has already started, in the basin.

"We have always considered Anadarko as having the best-positioned acreage in the sweetest spot of the Permian Delaware Basin,” Per Magnus Nysveen, founding partner and head of research for Rystad Energy, said in a statement. “Combining these shale assets with Chevron’s strong legacy position in the same area, we will now see Chevron emerging as the clear leader among all Permian players, both in terms of production growth and as a cost leader.”

The deal is expected to generate roughly $2 billion of synergies annually, $1 billion of which within the first year.

Chevron intends to be cash-flow positive next year.

“On the surface, [Chevron] synergies from the deal suggest the deal could be accretive on a [free cash flow] yield basis,” Jason Gabelman, equity research analyst with Cowen & Co., said in an April 12 research note. “But, there is regulatory uncertainty around [Anadarko’s] largest asset in the D-J.”

Wirth called Anadarko’s shale and tight assets in the D-J basin “another attractive position,” singling out how the company has driven down costs, increased lateral lengths and pushed up EURs in the liquids-rich basin.

“We really like what they’ve done here and believe we can leverage our factory model and proprietary technologies to maintain and perhaps improve performance,” he said.

Among the headwinds blowing through Colorado is legislation that tightens regulation on the oil and gas industry and hands control of oil and gas permits over to local governments rather than the state.

Wirth said he recognized the “political and regulatory dynamic that has been underway” in Colorado and said the company would engage at the appropriate time with the appropriate parties to ensure that “we understand their expectations that we operate responsibly, which is what Anadarko has done and we plan to continue to do.”

Offshore, International Benefits

Offshore, the deal gives birth to an even stronger powerhouse in the U.S. GoM, where Anadarko is a known leader in subsea tieback developments. The acquisition will bring the third and fourth largest producers in the GoM together, nearly tripling the combined company’s operated platform count to 16, Wirth said.

“This extensive infrastructure combined with advances in subsea technology is expected to further enable even more capital efficient payback opportunities, driving strong cash margins and higher project returns,” Wirth said. “With greater scale and improving technology, we believe we get more out of the combined assets in the Gulf of Mexico.”

Anadarko has 10 operated facilities in the GoM.

The deal also deepens Chevron’s international portfolio, including in Mozambique where Anadarko has a massive LNG project underway with a large resource upside. Anadarko and its partners have discovered about 75 trillion cubic feet of estimated recoverable gas resources in Offshore Area 1 of the deepwater Rovuma Basin offshore Mozambique.

“With 9 ½ million tonnes per year of contracted LNG, this project is fast approaching FID—a timeline we fully support,” Wirth said. “Mozambique LNG is expected to lead to stable and long-lived cash flows and the timing of its first production fits nicely in Chevron’s production outlook.”

Anadarko’s resource base of more than 10 billion barrels is also positioned in Ghana, Algeria and South Africa.

But some assets will be on the chopping block as portfolio high-grading continues.

Sales already in the public domain as part of Chevron’s 2018-2019 divestment program include assets in the U.K. Central North Sea, Azerbaijan, Rosebank, Denmark and Frade.

There’s more to come. “We’re establishing a new target of an additional $15 [billion] to $20 billion of asset sales between 2020 and 2022,” Wirth said.

The transaction represents a 39% premium to Anadarko Petroleum’s closing price on April 12, according to Gabelman.

Upon closing, the company will continue to be led by Wirth as chairman and CEO. Chevron will remain headquartered in San Ramon, Calif.

The transaction has been approved by the boards of directors of both companies. The acquisition remains subject to Anadarko shareholder approval, regulatory approvals and other customary closing conditions.

Credit Suisse Securities (USA) LLC is financial adviser to Chevron for the merger transaction and Paul, Weiss, Rifkind, Wharton & Garrison LLP is acting as the company’s legal adviser. Evercore and Goldman Sachs & Co. LLC are Anadarko’s financial advisers. Wachtell, Lipton, Rosen & Katz and Vinson & Elkins LLP are legal advisers to Anadarko.

Emily Patsy can be reached at epatsy@hartenergy.com, and Velda Addison can be reached at vaddison@hartenergy.com

.Recommended Reading

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

Technip Energies Wins Marsa LNG Contract

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.