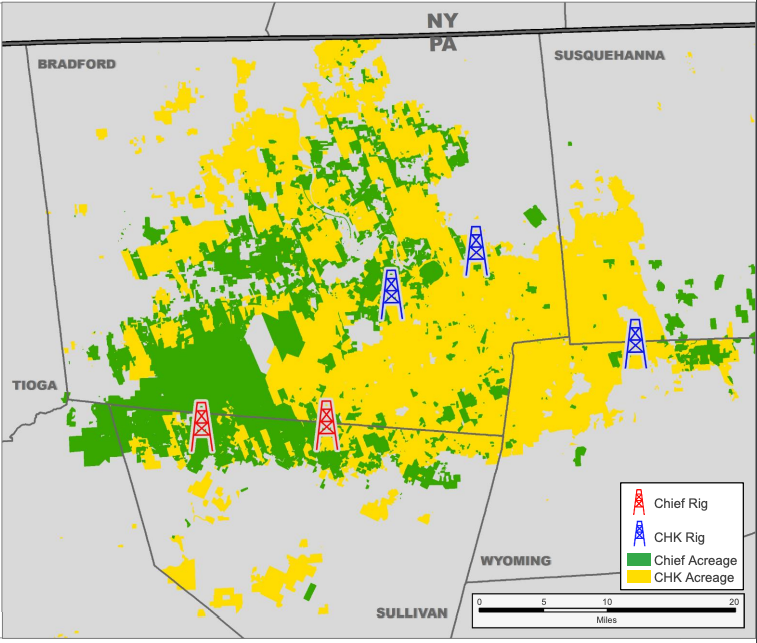

Chesapeake Energy plans to operate two rigs on the acquired Marcellus properties during 2022, resulting in a total of nine to 11 gas-focused rigs and two to three oil-focused rigs. (Source: Hart Energy)

U.S. shale pioneer Chesapeake Energy Corp. refocused its portfolio on shale gas on Jan. 25 with a flurry of A&D activity totaling over $3 billion that included the previously rumored acquisition of Chief Oil & Gas and an exit from the Powder River Basin.

“In less than a year, we have achieved our goal of refocusing and high-grading our portfolio around our core assets, positioning us to generate meaningful returns for shareholders today while embracing lower carbon energy production for tomorrow,” President and CEO Nick Dell’Osso commented in a company release.

According to the release, Chesapeake signed definitive agreements to acquire privately held Chief E&D Holdings LP and associated nonoperated interests held by affiliates of Tug Hill Inc. for $2 billion in cash and approximately 9.44 million common shares. Analysts with Tudor, Pickering, Holt & Co. (TPH) estimate the cash-and-stock deal structure implies a roughly $2.6 billion total price tag for the Marcellus Shale assets.

“We’ll still need to go through our own modeling of the transaction,” the TPH analyst wrote in a research note, “but per Chesapeake management [the] deal is expected to increase cumulative free cash flow over the next five years to $9 billion from previous guidance of $6 billion (offered during third-quarter 2021 earnings) with synergies of $50 million to $70 milllion annually.”

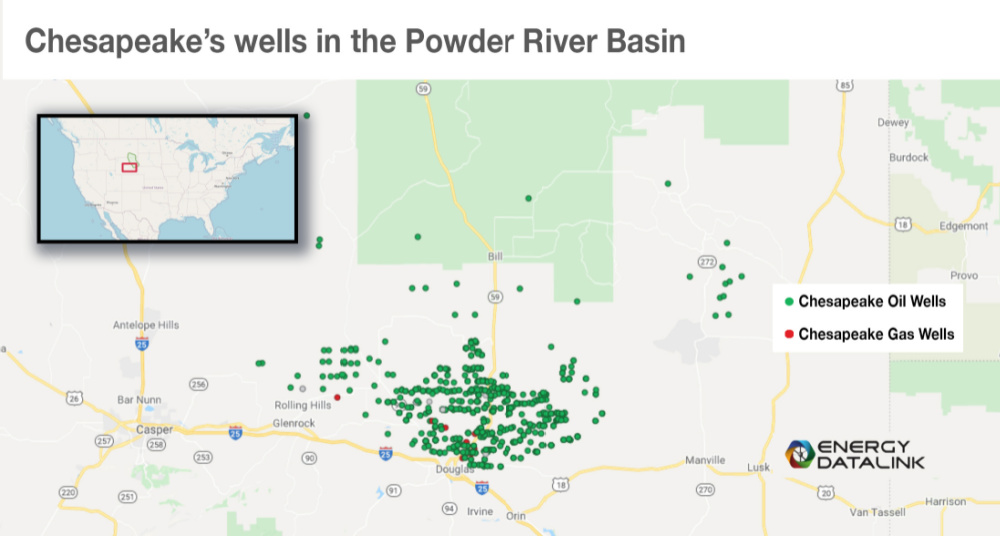

Additionally, Chesapeake also announced an agreement to sell its Powder River Basin assets in Wyoming to Continental Resources Inc. for $450 million in cash. The transaction marks Continental’s latest significant acquisition in the Powder River Basin, where Continental CEO William Berry unveiled in an exclusive interview with Oil and Gas Investor the company had completed a “follow up” deal that closed in November for about 85,000 net acres in the Powder River Basin.

Chesapeake’s Powder River Basin position includes approximately 172,000 net acres and 350 operated wells in southeastern Wyoming averaging about 19,000 boe/d of production in the fourth quarter. Production is approximately 58% crude oil and NGL.

Proceeds from the Powder River Basin sale will go toward the purchase price of the Chief acquisition, the company release said. Both transactions are expected to close by the end of first-quarter 2022. Upon closing, Chesapeake’s newly simplified portfolio will include refocused positions in the Marcellus, Haynesville and Eagle Ford shale plays.

“Having centered Chesapeake around our highest performing assets, our team can now integrate these assets into our portfolio, achieve the valuable synergies available to us and enhance cash flows through executing our business,” Dell’Osso added in the release.

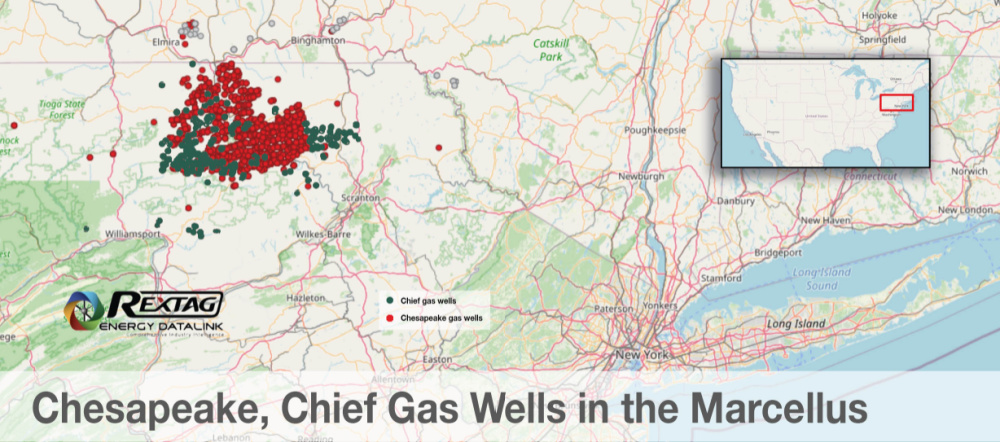

The Chief and Tug Hill assets, which Dell’Osso said “fit like a glove” to Chesapeake’s existing position in the northeast Marcellus Shale, include 113,000 net acres producing 835 MMcf/d and extend Chesapeake’s drilling inventory to more than 15 years at current activity levels.

“The acquisition checks all the boxes,” Dell’Osso said. “It lengthens our premium inventory, further focuses our capital allocation, provides operational efficiencies, is accretive to free cash flow per share, allows us to grow our base dividend, preserves our balance sheet strength and improves our GHG (greenhouse-gas) emissions metrics.”

Upon closing of the transactions, Chesapeake plans to operate two rigs on the acquired Marcellus properties during 2022, resulting in a total of nine to 11 gas-focused rigs and two to three oil-focused rigs.

Chesapeake said it will maintain a disciplined capital reinvestment strategy, anticipating a 2022 reinvestment rate of approximately 47%. At current commodity strip prices, this preliminary capital program is anticipated to generate between $3.4 billion and $3.6 billion in total adjusted EBITDAX.

Alongside the deal news, Chesapeake also announced plans to increase its annual base dividend by approximately 14% from $1.75 to $2 per share beginning in second-quarter 2022, reflecting the cash flow accretion of the Chief acquisition, according to its release. The company also expects to maintain the $1 billion common stock and warrant repurchase program which is expected to be executed by the end of 2023.

For the Chief acquisitions, RBC Capital Markets is financial adviser to Chesapeake. Shearman & Sterling LLP is serving as its legal adviser and DrivePath Advisors is its communications adviser.

J.P. Morgan Securities LLC is financial adviser and Gibson, Dunn & Crutcher LLP is legal adviser to Chief and Tug Hill. Akin Gump Strauss Hauer & Feld LLP is also serving as legal adviser to Tug Hill and its affiliates.

Recommended Reading

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

President: Financial Debt for Mexico's Pemex Totaled $106.8B End of 2023

2024-02-21 - President Andres Manuel Lopez Obrador revealed the debt data in a chart from a presentation on Pemex at a government press conference.

Shell’s CEO Sawan Says Confidence in US LNG is Slipping

2024-02-05 - Issues related to Venture Global LNG’s contract commitments and U.S. President Joe Biden’s recent decision to pause approvals of new U.S. liquefaction plants have raised questions about the reliability of the American LNG sector, according to Shell CEO Wael Sawan.

Green Swan Seeks US Financing for Global Decarbonization Projects

2024-02-21 - Green Swan, an investment platform seeking to provide capital to countries signed on to the Paris Agreement, is courting U.S. investors to fund decarbonization projects in countries including Iran and Venezuela, its executives told Hart Energy.