Chesapeake Energy Corp. completed its acquisition of Vine Energy Inc. on Nov. 1, making Chesapeake the largest producer in the Haynesville Shale, according to the Oklahoma City-based company.

“We are pleased to integrate the outstanding Vine operations and assets into our portfolio, strengthening our position in the Haynesville Shale with over 900 additional drilling locations, immediately improving our free cash flow profile and accelerating a significant return of capital to our shareholders at a time of favorable natural gas prices,” commented Nick Dell’Osso, Chesapeake’s newly appointed president and CEO, in a company release.

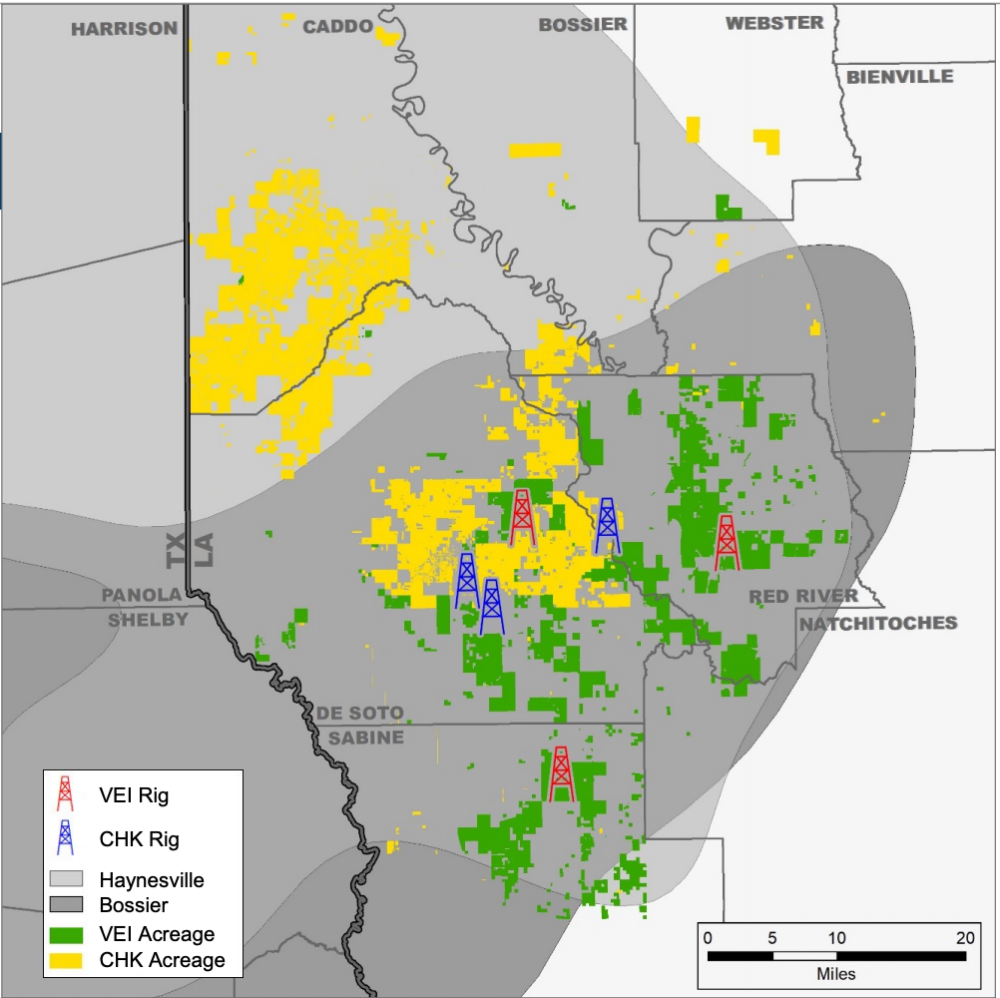

Chesapeake had previously announced the acquisition of Vine in August in what the company called a “zero premium” transaction valued at approximately $2.2 billion. The deal was expected to increase Chesapeake’s Haynesville exposure to 348,000 net acres with pro forma second-quarter net production of 1.58 Bcf/d, according to a research note by Tudor, Pickering, Holt & Co.

Based in Plano, Texas, Vine Energy first entered the Haynesville in 2014 through the acquisition of Royal Dutch Shell Plc’s position by its predecessor, which was backed by private equity firm Blackstone Energy Partners. According to its website, Vine held 227,000 net effective acres in the Haynesville Basin in northwest Louisiana at the time of the announced agreement with Chesapeake.

The acquisition of Vine also adds roughly 370 premium drilling locations with greater than a 50% rate of return at $2.50 gas, Chesapeake said in its August release. The company added it expects the deal will be accretive to operating cash flow per share and free cash flow per share, with $50 million in savings projected on operating and capital synergies.

As part of the agreement, Vine stockholders were set to receive fixed consideration of 0.2486 of a share of Chesapeake common stock plus $1.20 cash for each share of Vine common stock issued and outstanding immediately prior to the closing of the merger, with cash to be received in lieu of any fractional shares.

Upon closing, Chesapeake shareholders were projected to own approximately 86% of the combined company with Vine shareholders holding the remaining 14%. Additionally, Chesapeake’s board had approved an increase on the common dividend of 27% to $1.75 per share on expected cash flow accretion, an August company release said.

As a result of the merger, Vine common stock will no longer be listed for trading on the New York Stock Exchange and its reporting obligations under the Securities Exchange Act of 1934 will be suspended.

J.P. Morgan Securities LLC was financial adviser to Chesapeake for the transaction. Latham & Watkins LLP and Richards Layton & Finger served as its legal adviser and DrivePath Advisors was the company’s communications adviser. Citi served as lead financial adviser to Vine and Kirkland & Ellis LLP was its legal adviser. Weil, Gotshal & Manges LLP is Blackstone’s legal advisers. Houlihan Lokey also served as a financial adviser to the Vine board of directors.

Recommended Reading

Exxon, Chevron Tapping Permian for Output Growth in ‘24

2024-02-02 - Exxon Mobil and Chevron plan to tap West Texas and New Mexico for oil and gas production growth in 2024, the U.S. majors reported in their latest earnings.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Private Equity: Seeking ‘Scottie Pippen’ Plays, If Not Another Michael Jordan

2024-01-25 - The Permian’s Tier 1 acreage opportunities for startup E&Ps are dwindling. Investors are beginning to look elsewhere.

Permian E&P Midway Energy Partners Secures Backing from Post Oak

2024-02-09 - Midway Energy Partners will look to acquire and exploit opportunities in the Permian Basin with backing from Post Oak Energy Capital.