The new ADCC pipeline will support Cheniere Energy’s plans to ramp up total liquefaction capacity on the Texas Gulf Coast as it will connect the Whistler Pipeline to its Corpus Christi Liquefaction Facility. Pictured is a panorama aerial view of Corpus Christi Harbor Bridge with row of oil tanks and wind turbines farm in distance. (Source: Shutterstock.com)

Subsidiaries of Whistler Pipeline LLC and Cheniere Energy Inc. will move forward with the construction of the ADCC Pipeline, a new joint venture (JV) pipeline which will send natural gas from the Permian Basin to the Texas Gulf Coast for export as LNG.

The pipeline will support Cheniere’s plans to ramp up total liquefaction capacity on the Texas Gulf Coast. Cheniere currently boasts liquefaction capacity of approximately 45 million tonnes per annum (mtpa). Over the near- and long-term, the company plans to ramp up to around 60 mtpa and 90 mtpa respectively.

RELATED:

Cheniere Unveils ‘20/20 Vision,’ Eyes $4 Billion Share Buyback

WhiteWater Midstream LLC, an owner of Whistler Pipeline, announced the new JV ADCC pipeline with Cheniere Energy on Sept. 19 in a press statement.

The ADCC Pipeline will be a new 42-inch pipeline that will span approximately 43 miles from the terminus of the Whistler Pipeline to Cheniere’s Corpus Christi Liquefaction Facility.

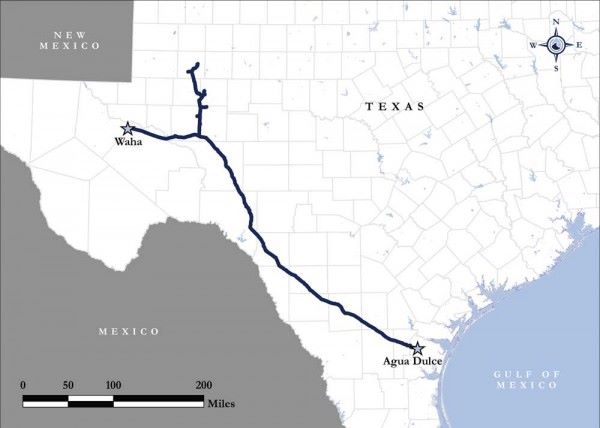

The Whistler Pipeline is a 42-inch intrastate pipeline that spans approximately 450 miles and transports natural gas from the Waha Header in the Permian Basin to Agua Dulce, Texas. An approximately 85-mile 36-inch lateral provides connectivity to the Midland Basin.

The ADCC Pipeline is expected to start service in 2024 and initially transport up to 1.7 Bcf/d of natural gas, pending receipt of customary regulatory and other approvals, WhiteWater said. The pipeline is designed to be expandable to 2.5 Bcf/d.

WhiteWater didn’t reveal details related to the cost of the ADCC Pipeline or give dates related to its future expansion.

RELATED:

The Rise of Associated Gas in the Permian

The Whistler Pipeline is owned by a consortium including MPLX LP, WhiteWater and a JV between Stonepeak and West Texas Gas Inc.

WhiteWater is an Austin, Texas-based infrastructure company. The company is partnered with multiple private equity funds including but not limited to Ridgemont Equity Partners and First Infrastructure Capital.

Recommended Reading

Thanks to New Technologies Group, CNX Records 16th Consecutive Quarter of FCF

2024-01-26 - Despite exiting Adams Fork Project, CNX Resources expects 2024 to yield even greater cash flow.

Cheniere Energy Declares Quarterly Cash Dividend, Distribution

2024-01-26 - Cheniere’s quarterly cash dividend is payable on Feb. 23 to shareholders of record by Feb. 6.

Marathon Petroleum Sets 2024 Capex at $1.25 Billion

2024-01-30 - Marathon Petroleum Corp. eyes standalone capex at $1.25 billion in 2024, down 10% compared to $1.4 billion in 2023 as it focuses on cost reduction and margin enhancement projects.

Humble Midstream II, Quantum Capital Form Partnership for Infrastructure Projects

2024-01-30 - Humble Midstream II Partners and Quantum Capital Group’s partnership will promote a focus on energy transition infrastructure.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.