Tellurian Inc. executive chairman Charif Souki has sold almost 25 million shares in his company. (Source: Shutterstock)

Tellurian Inc. executive chairman Charif Souki has shed almost 25 million shares in his company, which owns the Driftwood LNG LLC project, as concerns mount about the project’s future amid a search for $3.5 billion in equity from third parties.

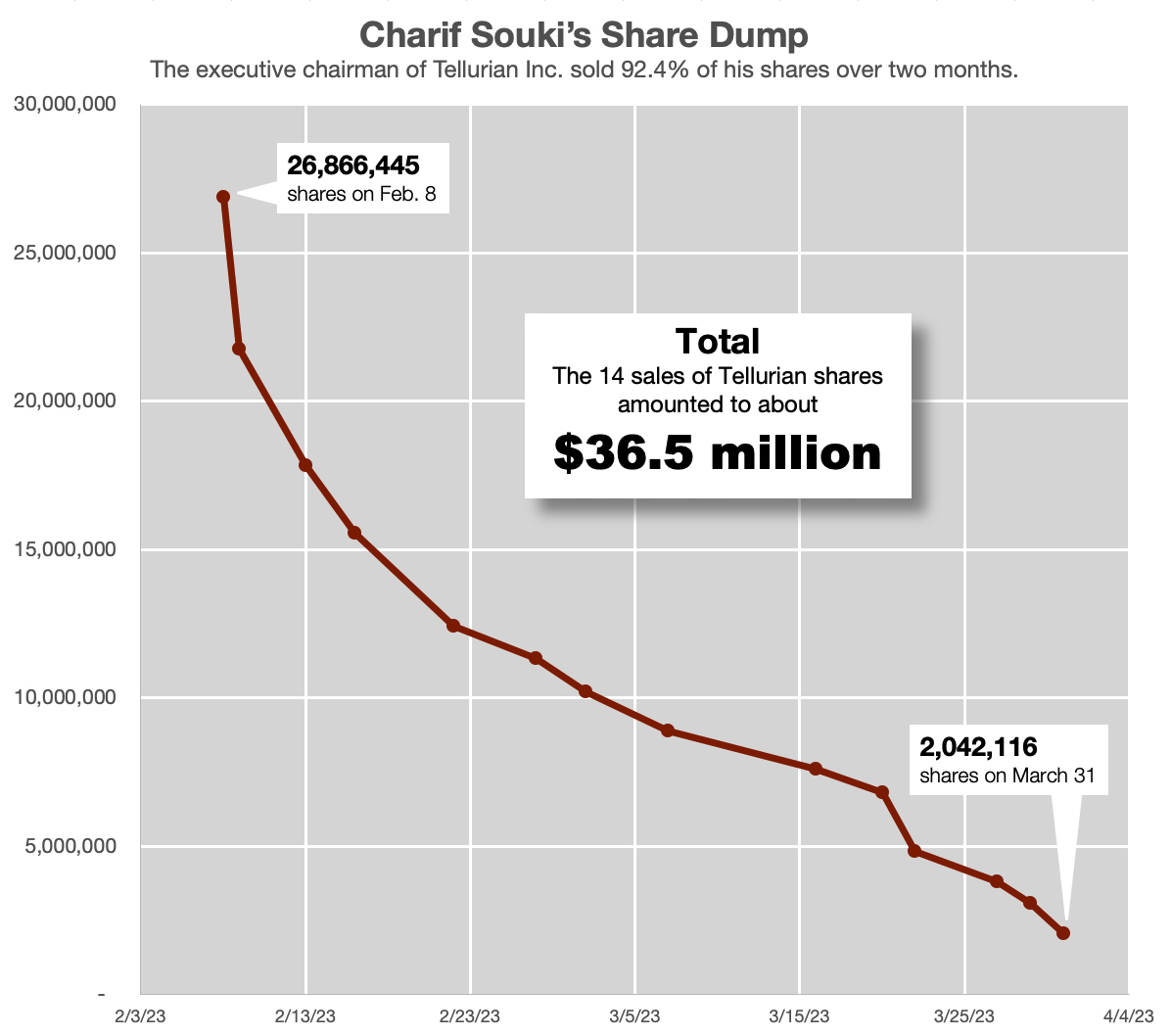

Souki’s shareholding in Tellurian was almost 2 million on March 31, down 92% versus almost 27 million on Feb. 8, according to data from online broker eTrade.

Executives from Tellurian’s media and investor relations teams didn’t respond to emailed requests from Hart Energy seeking details around Souki’s share divestments.

Important SEC Disclosures

According to Securities and Exchange Commission (SEC) documents, the reporting person (Souki) previously pledged 25,000,000 shares of common stock of Tellurian as part of a collateral package to secure a loan for certain real estate investments.

The loan agreement, dated April 27, 2017, was entered into by Souki, as borrower, Wilmington Trust, National Association, as administrative agent, and various lenders (the "loan agreement"), according to the SEC.

On Feb. 7, pursuant to the Loan agreement and other loan documents, Wilmington exercised its right as administrative agent to become a substituted shareholder and caused the pledged shares to be transferred into its account.

Driftwood LNG

Driftwood LNG is a two-phase development located on the west bank of the Calcasieu River, south of Lake Charles, Louisiana. Phase I is a two-plant development to provide 11 million tonnes per annum (mtpa) by early 2026 ,while Phase II is a three-plant development to provide another 16.6 mtpa.

RELATED

Exclusive: Tellurian’s Souki Says Partners—Not Off-takers—are the Issue

Tellurian’s Driftwood LNG Saga Continues

Driftwood and other U.S.-based liquefaction projects under construction aim to boost U.S. LNG exports to global markets impacted by lower energy exports from Russia after its invasion of Ukraine in early 2022.

Construction work related to Phase I continues to move forward with up to 250 people on site, Tellurian executive vice president and Driftwood Assets president Samik Mukherjee said in an April 5 video on the company’s website.

Recommended Reading

The OGInterview: How do Woodside's Growth Projects Fit into its Portfolio?

2024-04-01 - Woodside Energy CEO Meg O'Neill discusses the company's current growth projects across the globe and the impact they will have on the company's future with Hart Energy's Pietro Pitts.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.

Equinor Receives Significant Discovery License from C-NLOPB

2024-02-02 - C-NLOPB estimates recoverable reserves from Equinor’s Cambriol discovery at 340 MMbbl.

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.