Arial view of Atlantic LNG. (Source: Google Satellite)

The restructuring of the shareholder profile for Trinidad and Tobago’s four-train, 14.8 million tonnes per annum (mtpa) Atlantic LNG facility isn’t expected until late 2024, according to BP Plc.

The restructuring is key but will not solve Trinidad’s underlying problem: a lack of gas supply.

“The new structure is expected to be effective in October 2024 and will enable increased focus on operational efficiency and reliability and underpin future upstream investments,” the British oil giant announced Feb. 7 in a press release related to its quarterly conference call and webcast.

Negotiations between shareholders in Atlantic LNG’s four trains, especially BP Plc and Shell Plc, have been ongoing for a number of years.

Late last year, Atlantic LNG shareholders reached an agreement on substantial commercial terms for the consolidation of its operation into a single entity, Trinidad's Ministry of Energy and Energy Industries (MEEI) announced on Dec. 8.

The agreement “is a key milestone towards unlocking the energy future for Trinidad and Tobago,” BP said.

RELATED

Atlantic LNG Partners Ink Deal to Unitize Plant

Partners in Atlantic LNG include Shell, BP, The National Gas Company of Trinidad and Tobago Ltd. (NGC) and Chinese Investment Corp. in Train 1; Shell and BP in Train 2 and Train 3; and Shell, BP and NGC in Train 4.

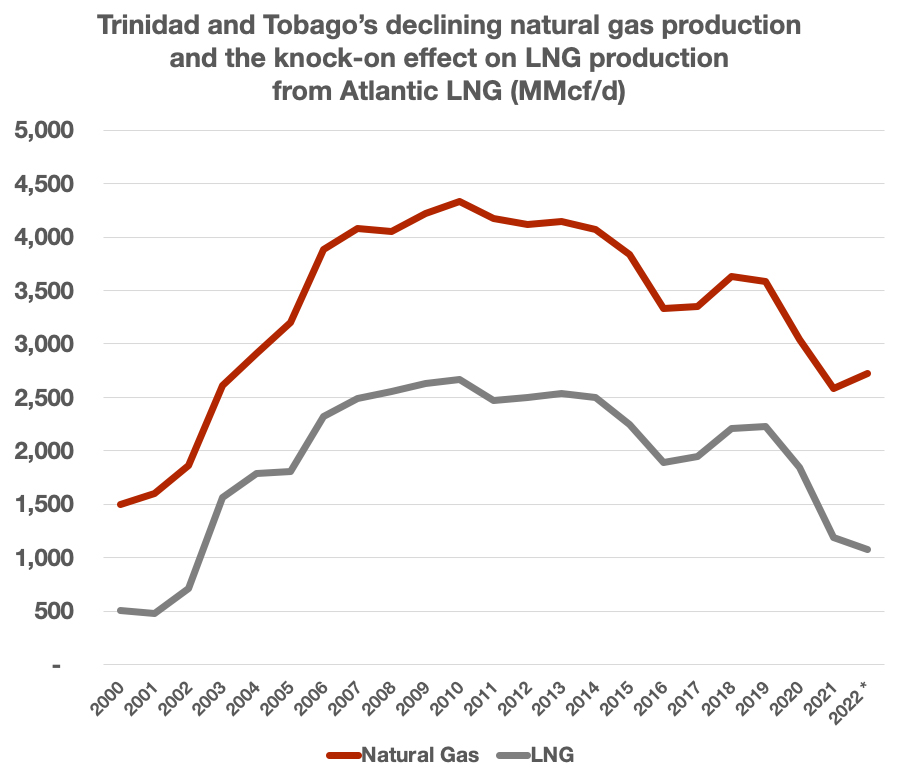

On an operational front, Atlantic LNG continues to operate with just three trains, owing to a scarcity of gas supply. Production at Train 1 has been halted since Dec. 2020, according to the most recent data from the MEEI.

Over the near-term, a number of gas developments in Trinidad are expected to add to the country’s existing gas production profile. Production reached 2,844 MMcf/d in September 2022 but is down from a peak of 4,515 MMcf/d in February 2010, according to MEEI data.

Additionally, plans to tap into Venezuelan gas production from that country’s Dragon field could also add to Trinidad gas supply profile.

But the Dragon gas is tied to geopolitical issues between the U.S. and Venezuela and could fall apart if the two parties differ on anything related to “free and fair” elections in Venezuela in 2024, which the U.S. believes could lead to a resolution of the country’s long-standing political uncertainties.

Recommended Reading

Drilling Tech Rides a Wave

2024-01-30 - Can new designs, automation and aerospace inspiration boost drilling results?

Tech Trends: Autonomous Drone Aims to Disrupt Subsea Inspection

2024-01-30 - The partners in the project are working to usher in a new era of inspection efficiencies.

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.