Energy Transfer described the acquisition of Enable Midstream as a credit-accretive bolt-on with expectations for the deal to further its deleveraging efforts and generate over $100 million of annual cost efficiencies. (Source: Hart Energy)

CenterPoint Energy Inc. completed the sale of its stake in Enable Midstream Partners LP on Dec. 2, kicking off the Houston-based company’s exit from the midstream space.

“We are now firmly on an accelerated path to reducing our exposure to the midstream industry,” Dave Lesar, president and CEO of CenterPoint, commented in a company release on Dec. 2.

The sale was part of a previously announced $7.2 billion all-stock merger agreement with Dallas-based Energy Transfer LP that underwent an extended investigation by the Federal Trade Commission. The terms of the merger agreement, however, were approved earlier this year by Enable’s two largest unitholders, CenterPoint and OGE Energy Corp., which together owned approximately 79% of Enable’s outstanding common units.

Upon closing of the merger, CenterPoint received approximately 201 million Energy Transfer common units and $5 million in cash in exchange for its Enable common units and general partner interest, respectively. In addition, CenterPoint exchanged about $363 million of Enable Series A Fixed to Floating Non-Cumulative Redeemable Perpetual Preferred units for $385 million Energy Transfer Series G Fixed-Rate Reset Cumulative Redeemable Perpetual Preferred units.

The closing of the Enable and Energy Transfer merger also triggered the settlement of the previously announced contingent forward sale of 50 million Energy Transfer common units, or approximately 25% of CenterPoint’s total Energy Transfer common unit holding.

“This transaction aligns with our newly unveiled 10-year growth strategy that focuses on investing in the footprint of our pure-play regulated business,” Lesar added in the CenterPoint release.

As for Energy Transfer, closing of the transaction removes overhang though a rerate story remains longer-dated on few follow-on catalysts, according to analysts with Tudor, Pickering, Holt & Co. (TPH).

In a release announcing the transaction in February 2021, Energy Transfer described the acquisition of Enable Midstream, formerly based in Houston, as a credit-accretive bolt-on with expectations for the deal to further Energy Transfer’s deleveraging efforts and generate over $100 million of annual cost efficiencies.

“While deal close improves balance sheet metrics and earnings potential, we expect debt paydown to remain the primary use of FCF through 2022 as leverage tracks in the low-4s with material unit buybacks likely deferred until 2023 despite recent equity underperformance,” TPH analysts wrote in a Dec. 3 research note. “A lack of near-term catalysts necessitates comfort with our longer-dated rerate expectation but 2023 FCV/EV continues to screen near the top of the large-cap group at nearly 9% which opens the door to significantly increased capital returns over time.”

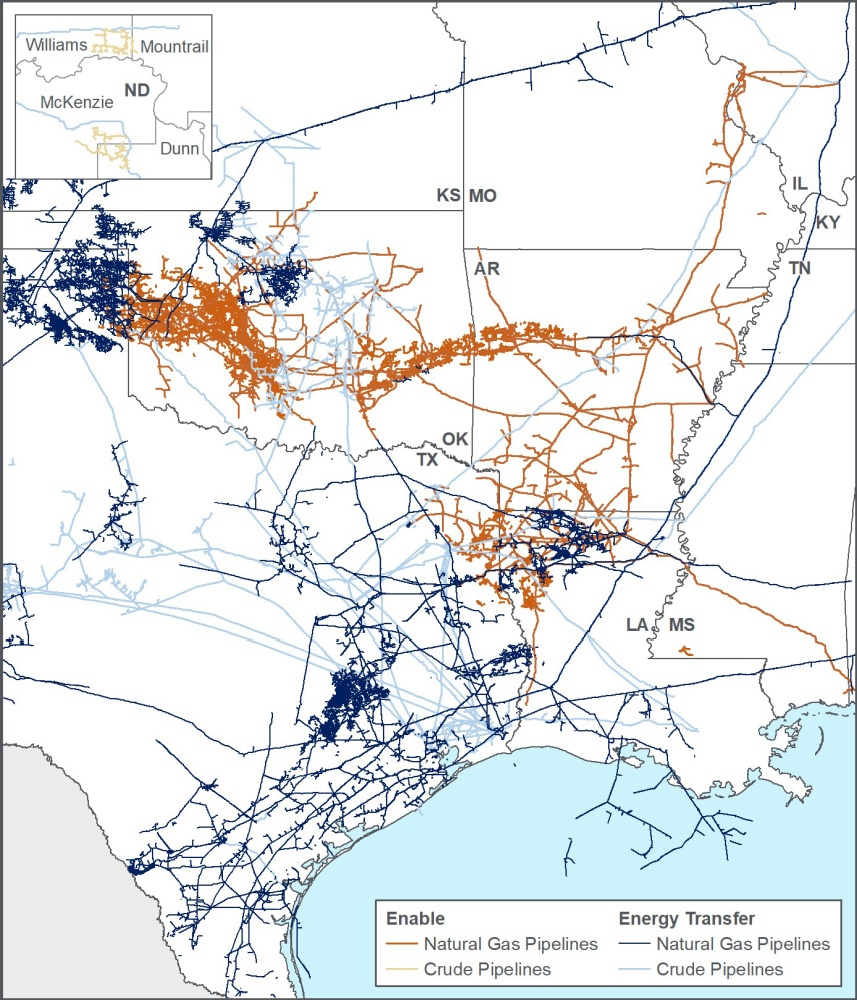

After the announced close of the Enable transaction, Energy Transfer said it now owns and operates more than 114,000 miles of pipelines and related assets in all of the major U.S. producing regions and markets across 41 states.

In particular, the company noted the addition of Enable’s natural gas gathering and processing assets in the Anadarko Basin in Oklahoma, along with intrastate and interstate pipelines in Oklahoma and surrounding states and the boost to Energy Transfer’s gas gathering and processing assets in the Arkoma Basin across Oklahoma and Arkansas, as well as in the Haynesville Shale in East Texas and North Louisiana.

As part of the terms of the merger agreement, Enable common unitholders received 0.8595 Energy Transfer common units for each Enable common unit. Additionally, each outstanding Enable Series A preferred unit was exchanged for 0.0265 Series G preferred units of Energy Transfer. The transaction also included a $10 million cash payment for Enable’s general partner.

Citi and RBC Capital Markets were financial advisers to Energy Transfer for the transaction and Latham & Watkins LLP acted as its legal counsel. Goldman Sachs & Co. LLC acted as financial adviser to Enable and Vinson & Elkins LLP provided the company with legal counsel. Intrepid Partners LLC was financial adviser and Richards, Layton & Finger PA provided legal counsel to Enable’s conflicts committee.

Recommended Reading

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.