The transaction with Centennial Resource Development firmly establishes WaterBridge as the largest pure-play water midstream company in the industry, said David Capobianco, CEO of the company’s financial backer Five Point Energy. (Source: WaterBridge Resources LLC)

Centennial Resource Development Inc. agreed to divest produced water infrastructure in the Permian Basin in a $225 million sale to WaterBridge Resources LLC.

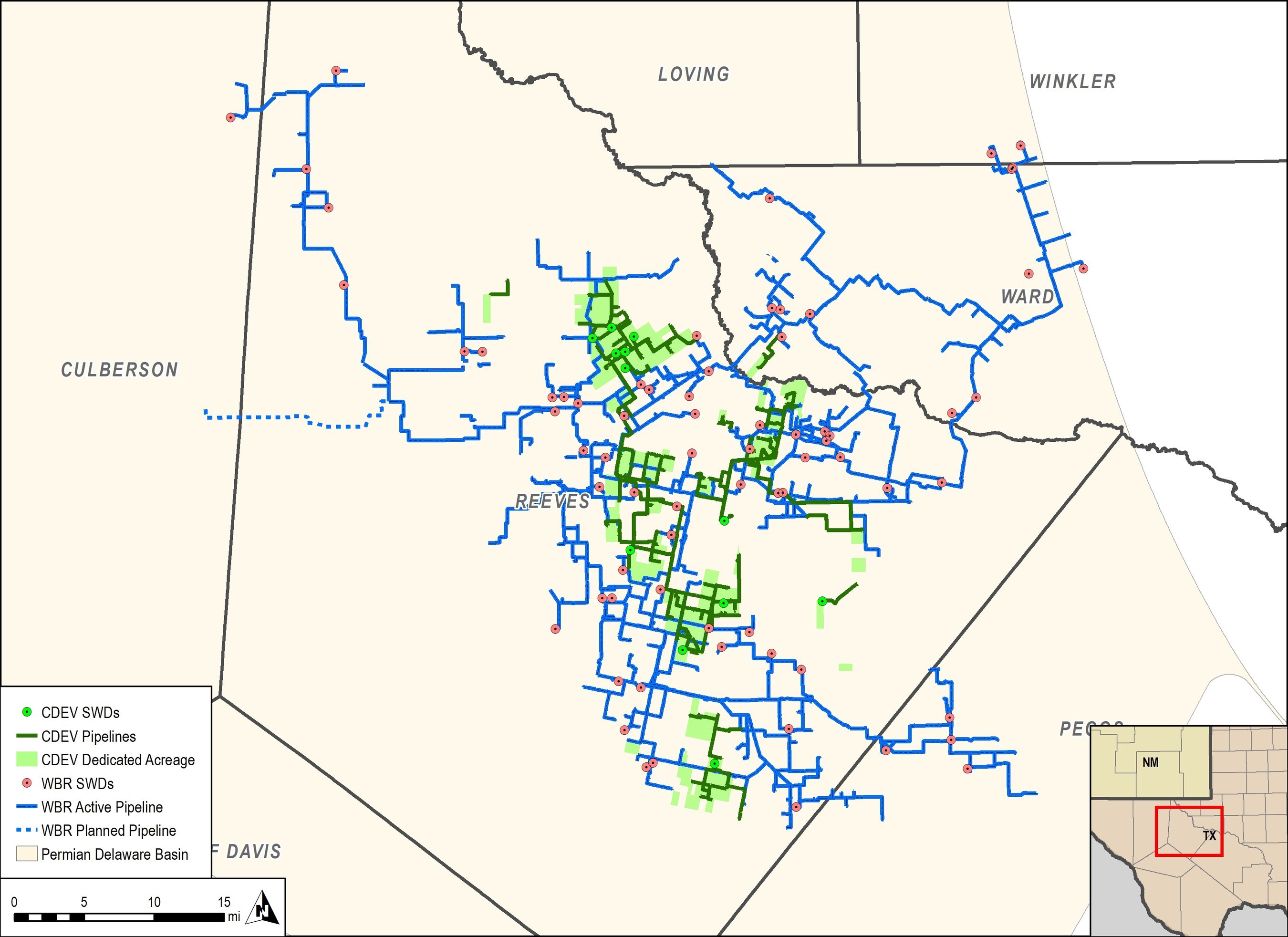

The divested water infrastructure assets, located in the southern Delaware Basin, currently dispose of approximately half of the company’s gross produced water in Texas. Centennial has roughly 80,100 net acres in the Delaware Basin located in Reeves County, Texas, and New Mexico’s Lea County.

“This transaction represents a significant premium to Centennial’s current trading valuation and will essentially offset any outspend this year, assuming current prices,” said Centennial CEO Mark Papa in a statement on Feb. 24. “It also significantly reduces the amount of infrastructure capex needed to maintain and grow these assets in the future.”

RELATED:

Mark Papa To Retire From Centennial Resource Development

WaterBridge, described as a long-standing partner of Centennial’s in its news release, already has historically disposed of nearly half of the company’s produced water volumes in Reeves County.

Centennial expects the combination of the divested assets with WaterBridge’s broader southern Delaware system will provide significant flexibility and additional capacity to service the company’s water disposal needs. The company said it will pay a market disposal rate on incremental water volumes that WaterBridge does not already gather and dispose, and these incremental costs are incorporated into Centennial’s 2020 lease operating expense guidance.

The divested assets expand WaterBridge’s produced water network in the southern Delaware Basin to nearly 2 million barrels per day of handling capacity, according to a separate release by WaterBridge on Feb. 25.

WaterBridge is backed by Five Point Energy LLC, which sold a 20% minority equity stake in the company to affiliates of Singapore’s sovereign wealth fund GIC in May 2019. Though the terms of the transaction weren’t disclosed, the Houston-based private equity firm said the transaction’s purchase price implied a roughly $2.8 billion enterprise value of WaterBridge.

“In 2016, Five Point Energy funded the formation of WaterBridge with a well-defined strategy of being a first mover in progressively addressing the produced water needs of the Permian Basin,” said David Capobianco, CEO of Five Point and chairman of the WaterBridge board, in a statement. “With the addition of Centennial’s produced water handling assets to WaterBridge’s network, the company has expanded the capabilities of its system and firmly established itself as the largest pure-play water midstream company in the industry.”

Upon closing of the transaction, WaterBridge will have over 600,000 acres operated by over 23 blue-chip producers under long-term dedication in the southern Delaware Basin. WaterBridge's extensive integrated water infrastructure network includes 1,140 miles of large-diameter pipelines and 87 handling facilities.

Payment for Centennial’s assets consists of $150 million in cash at closing and an additional $75 million payable to Centennial on a deferred basis upon meeting certain incentive thresholds. Centennial said it plans to use proceeds from the sale to repay borrowings under its revolving credit facility.

Barclays acted as exclusive financial adviser to Centennial in connection with the transaction. Winston & Strawn LLP served as WaterBridge’s legal adviser.

Recommended Reading

US Finalizes Big Reforms to Federal Oil, Gas Drilling

2024-04-12 - Under the new policy, drilling is limited in wildlife and cultural areas and oil and gas companies will pay higher bonding rates to cover the cost of plugging abandoned oil and gas wells, among other higher rates and costs.

New US Rules Seek to Curb Leaks From Drilling on Public Lands

2024-03-27 - The U.S. Interior Department finalized rules aimed at limiting methane leaks from oil and gas drilling on public lands.

CEO: Linde Not Affected by Latest US Green Subsidies Package Updates

2024-02-07 - Linde CEO Sanjiv Lamba on Feb. 6 said recent updates to U.S. Inflation Reduction Act subsidies for clean energy projects will not affect the company's current projects in the United States.

CERAWeek: Energy Secretary Defends LNG Pause Amid Industry Outcry

2024-03-18 - U.S. Energy Secretary Jennifer Granholm said she expects the review of LNG exports to be in the “rearview mirror” by next year.

Hirs: LNG Plan is a Global Fail

2024-03-13 - Only by expanding U.S. LNG output can we provide the certainty that customers require to build new gas power plants, says Ed Hirs.