Cenovus Energy Inc. started to make headway on its CA$10 billion debt reduction goal on May 18 with the sale of gross overriding royalty interests (ORRI).

Canadian royalty and infrastructure firm Topaz Energy Corp. agreed to buy the ORRI assets located in the Marten Hills area of Alberta. Cenovus had sold its Marten Hills oil assets to Headwater Exploration Inc. for CA$100 million in December but ended up retaining the royalty interest as part of the deal.

Cenovus received gross cash proceeds of $102 million from the royalty sale, which the company plans to use to reduce net debt. The transaction marks the first divestiture since Cenovus laid out plans to reduce net debt in January following close of its all-stock merger with Husky Energy.

“This transaction demonstrates our ability to strategically identify opportunities in our portfolio to accelerate the deleveraging process,” Cenovus President and CEO Alex Pourbaix said in a statement on May 18.

In addition to the sale of noncore assets, Pourbaix added Cenovus will continue to explore all options to create value for Cenovus shareholders and position its balance sheet for increasing shareholder returns.

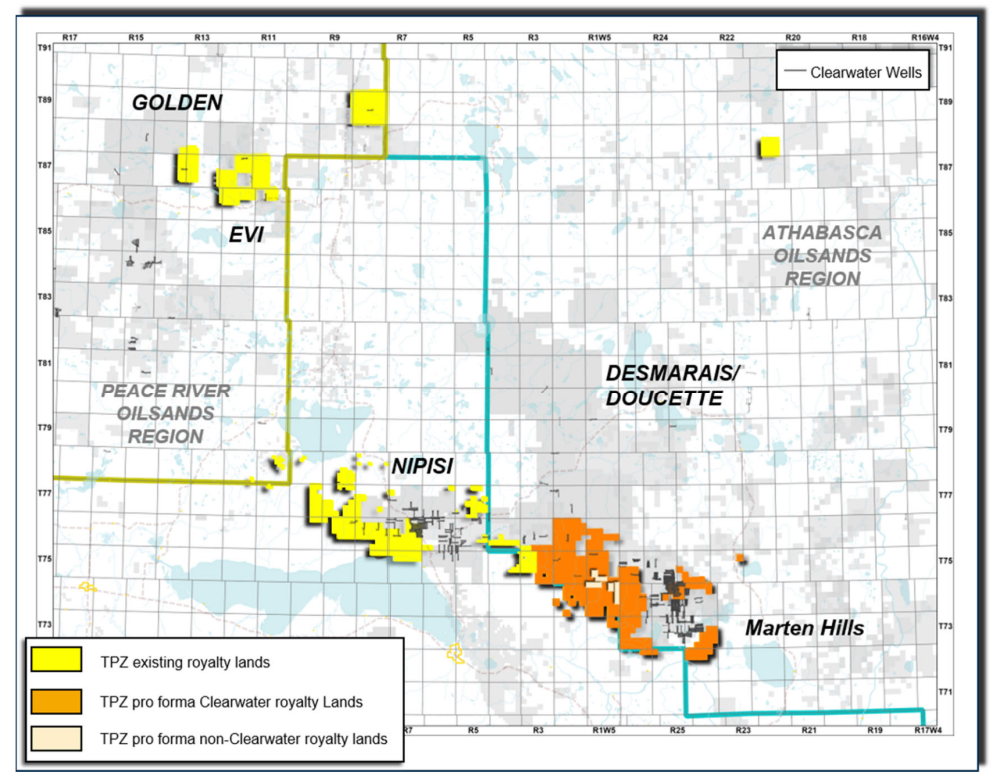

(Source: Topaz Energy Corp.)

Analysts with Tudor, Pickering, Holt & Co. said the sale of ORRI was seen as largely neutral for shares given the magnitude in Cenovus progressing toward the CA$10 billion net debt target. Cenovus had about CA$13 billion of net debt at the close of the Husky transaction, according to the TPH analysts.

“On current strip pricing, we model the CA$10 billion net debt threshold being achieved in the third-quarter 2021 timeframe, with the potential for incremental asset sales to accelerate this timeline,” the TPH analysts wrote in a May 19 research note.

In addition to its deal with Cenovus, Topaz also announced on May 18 the acquisition of gross ORRI in the NEBC Montney from Tourmaline Oil Corp. and working interest ownership in Tourmaline infrastructure for CA$245 million in cash.

Peters & Co. Ltd. is financial adviser to Topaz with respect to the Cenovus transaction. Burnet, Duckworth & Palmer LLP provided Topaz with counsel for the NEBC Montney and Cenovus acquisitions and an equity financing the company is planning to use to finance its purchases.