Justin Carlson is co-founder and chief commercial officer of East Daley Analytics in Colorado.

After a winter wipeout, natural gas prices have plummeted to the $2/MMBtu level. Will the next handle on the Henry Hub contract be $3 or $1?

For clues, East Daley Analytics is watching producer activity in the Haynesville Shale in Louisiana and East Texas.

Gas prices have fallen 70% since the fourth quarter as a mild winter and steady production growth have taken their toll. U.S. working gas in storage was about 330 Bcf above the five-year average in mid-April, according to the U.S. Energy Information Administraion (EIA). The front-month Henry Hub contract has traded in a relatively tight range between $2 and $2.20/MMBtu since mid-March as the market looks for direction.

In our latest Macro Supply and Demand Forecast, East Daley estimates Lower 48 residue gas production averaged 97.7 Bcf/d during the third quarter, a gain of 4.5 Bcf/d year-over-year. We view the current supply trajectory as unsustainable given high storage inventory and difficult upcoming demand comparisons to the 2022 summer.

We previously made the case for sub-$2/MMBtu natural gas prices in 2023 in order to slow supply growth and keep gas production from exceeding storage facility limits later this fall. Indeed, within the producing basins, gas prices have already fallen under $2/MMBtu.

Are we near a market bottom, or will there be more downside ahead?

We’re monitoring rig counts closely, particularly in the Haynesville Shale play in East Texas and northern Louisiana, where we see producer decisions as key for tapping the brakes on supply growth. Chesapeake Energy and Comstock Resources, two of the leading E&Ps in the Haynesville, have guided to lower rigs later this year.

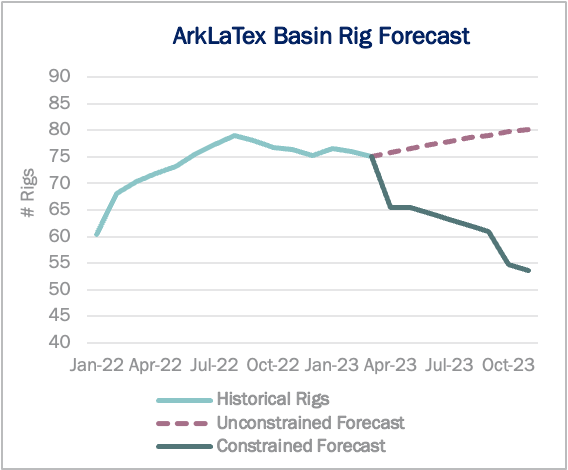

While these Haynesville producers have guided to cuts, there’s not much evidence of a change in course yet by the upstream. Rig counts in the ArkLaTex Basin have averaged 76 so far in 2023 and held at 74-76 rigs in April, according to Blackbird BI data.

In the “balanced” scenario of our forecast, ArkLaTex rig counts must start dropping soon to avoid an oversupply problem later this year.

We estimate drilling in the ArkLaTex to fall by about 10 rigs during the second quarter from current activity, sliding toward a count of 60 rigs this summer to help balance season-ending storage inventories. We also assume a significant build-up of drilled but uncompleted wells in our forecast as producers defer completions in a weak price environment.

Haynesville growth likely to be sticky

Hitting the brakes on growth won’t be easy, with supply gains likely to prove sticky. Just look to the example of Comstock to understand the challenge ahead.

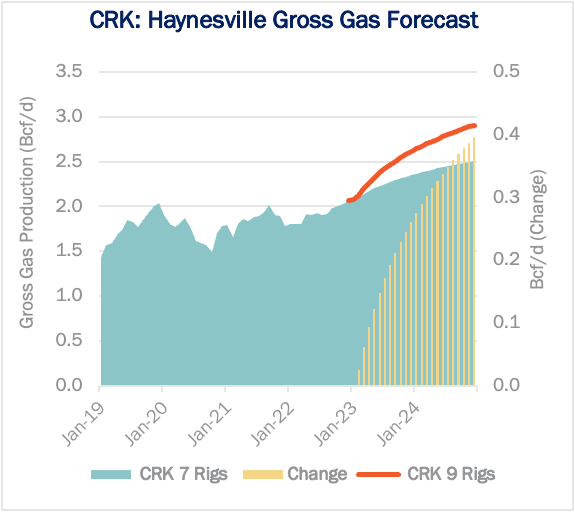

In the E&P’s 2023 guidance, Comstock said it plans to run seven rigs in the Haynesville, down from nine. While guiding to lower rigs, Comstock also reported impressive results from its Western Haynesville exploratory play in East Texas. The E&P drilled two wells with initial production of 42 MMcf/d and 37 MMcf/d, the company disclosed. Comstock said the new wells were so productive that Legacy Reserve, the third-party gas processor, took its Bethel plant offline to upgrade capacity and handle future growth.

Comstock also said it would drop the two rigs from its legacy operations while continuing to run two rigs in the productive Western Haynesville extension. Other operators are also likely to high-grade drilling programs as they lay down rigs, keeping production elevated.

Scenarios. (Source: East Daley Analytics)

Figure 2 shows a forecast of Comstock’s production in the Haynesville. By moving to a seven-rig program, we estimate its Haynesville gas production would be about 260 MMcf/d lower by year-end than if the E&P were to continue running nine rigs in the play. The loss of the two rigs grows to a production delta of about 400 MMcf/d production year-end 2024.

Nevertheless, our forecast also shows Comstock will continue to grow its gas production in the future while running just seven rigs.

By contrast, we anticipate Haynesville supply as a whole will need to move into decline in the back half of 2023 to keep the U.S. gas market in balance. If our outlook is correct, then more urgent action will be needed by the upstream to avoid imbalances down the road.

Recommended Reading

Petrobras to Step Up Exploration with $7.5B in Capex, CEO Says

2024-03-26 - Petrobras CEO Jean Paul Prates said the company is considering exploration opportunities from the Equatorial margin of South America to West Africa.

Exxon Versus Chevron: The Fight for Hess’ 30% Guyana Interest

2024-03-04 - Chevron's plan to buy Hess Corp. and assume a 30% foothold in Guyana has been complicated by Exxon Mobil and CNOOC's claims that they have the right of first refusal for the interest.

The OGInterview: How do Woodside's Growth Projects Fit into its Portfolio?

2024-04-01 - Woodside Energy CEO Meg O'Neill discusses the company's current growth projects across the globe and the impact they will have on the company's future with Hart Energy's Pietro Pitts.

NAPE: Turning Orphan Wells From a Hot Mess Into a Hot Opportunity

2024-02-09 - Certain orphaned wells across the U.S. could be plugged to earn carbon credits.

Texas Earthquake Could Further Restrict Oil Companies' Saltwater Disposal Options

2024-04-12 - The quake was the largest yet in the Stanton Seismic Response Area in the Permian Basin, where regulators were already monitoring seismic activity linked to disposal of saltwater, a natural byproduct of oil and gas production.