Cogent Midstream’s Big Lake Natural Gas Processing Complex is located in the Midland Basin. This photo shows Big Lake I and II. (Source: Cogent Midstream)

Canes Midstream LLC established a position in the Permian’s southern Midland Basin with the recent closing of its acquisition of Cogent Midstream LLC, where Canes CEO and Co-founder Scott Brown previously served as president.

“I was with these assets at inception and am excited to return and continue to grow them,” Brown commented in a company release on May 25.

Founded in 2019, Canes Midstream is a Dallas-based midstream oil and gas company backed by EIV Capital and Denham Capital. Prior to founding Canes Midstream, Brown served as president of Lucid Energy Group I, a predecessor to Cogent Midstream.

“We are thrilled to expand our partnership with Canes and are confident Scott’s familiarity with the team and assets position the Cogent system to be the midstream provider of choice in the area,” said Greg Davis, partner at EIV. “With fresh capital, Canes will continue to expand the system and support Permian production growth.”

Cogent Midstream owned and operated the Midland Basin assets formerly operated under the name Lucid I. The company, also headquartered in Dallas, was backed by growth capital commitments from EnCap Flatrock Midstream.

Cogent is not affiliated with Lucid Energy Group, which owns and operates assets in the Delaware Basin of southeast New Mexico.

Canes Midstream’s acquisition of Cogent Midstream was announced as closed in a company release on May 25. However, according to its website, Canes acquired Cogent on Feb. 25. Terms of the transaction weren’t disclosed.

“With our newer facilities and the significant capital invested by Cogent to date, we are well positioned to grow the system and provide best-in-class midstream services to our existing and future customers,” Brown added in the release. “I believe Canes will be the preferred midstream service provider in the southern Midland Basin.”

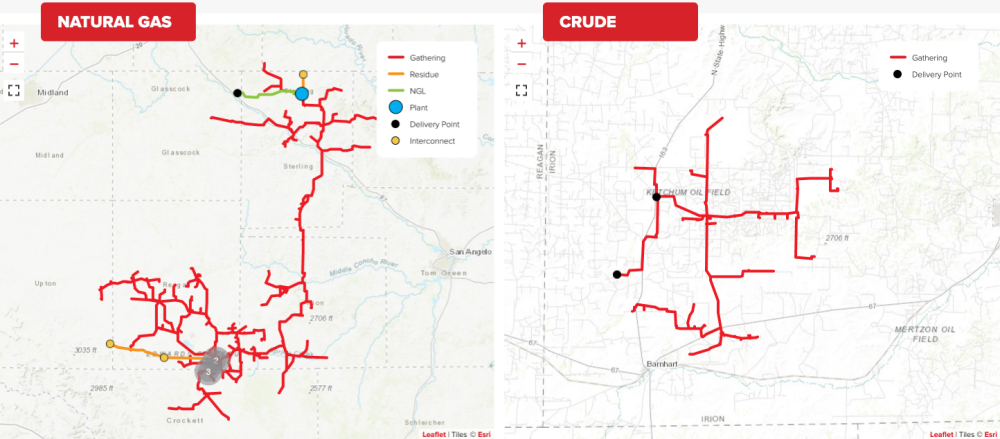

The Cogent assets, located in the southern Midland Basin, include 520 MMcf/d of processing capacity, over 800 miles of pipelines, 42 compressor stations, a crude oil gathering system and substantial acreage dedications from a diverse group of Midland Basin-focused producers. The Cogent system spans 10 counties in the Midland Basin, with the bulk of the infrastructure in Reagan and Irion counties, Texas.

James Obulaney, managing director of Denham, also commented, “Canes, via this acquisition, is well positioned to drive differentiated outcomes for area producers. We look forward to supporting Scott and team as they grow this tier-1 system to service new and existing customers in the Permian Basin.”

Founded in 2009, EIV Capital is a Houston-based private equity firm specializing in providing growth equity to the North American energy industry. Meanwhile, Denham Capital is an energy, resources and sustainable infrastructure-focused investment firm with more than $12 billion of invested and committed capital across multiple fund vehicles since inception, and offices in London, Boston, Houston, Toronto, Jersey City and Perth.

Wells Fargo Securities LLC was exclusive financial adviser and Sidley Austin LLP was corporate counsel to Canes for the transaction. BofA Securities served as exclusive financial adviser to Cogent.

Recommended Reading

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-21 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.