Callon Petroleum Co. adjusted its guidance following close of its noncore asset sale in the Permian Basin on June 13, which could bring in proceeds of up to $310 million.

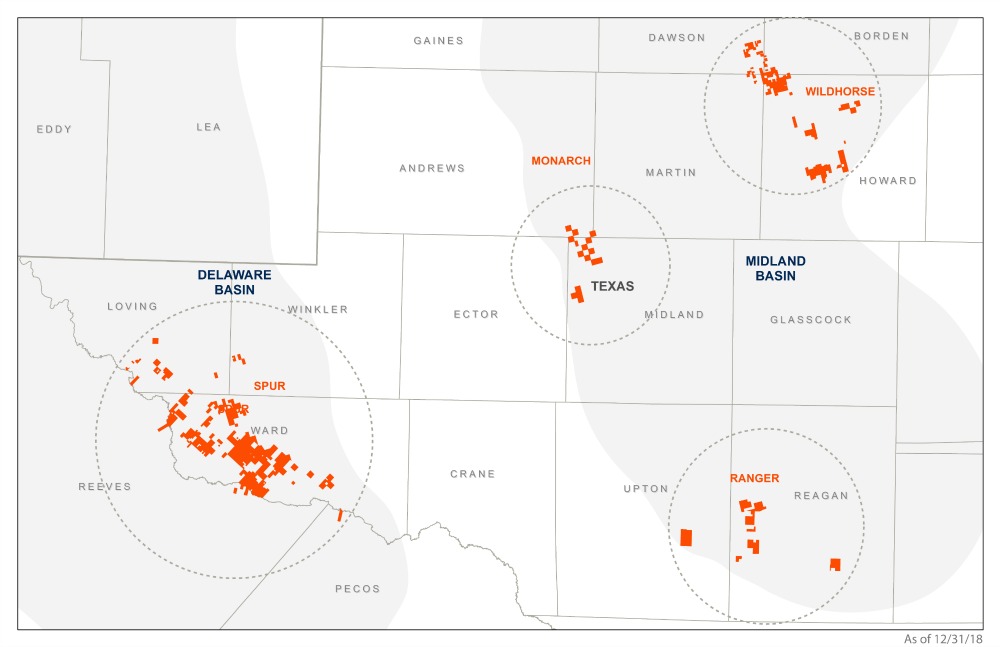

The sale, which Callon had announced in early April, comprised the company’s Ranger asset located in the southern Midland Basin of Reagan and Upton County, Texas, where Callon hadn’t been as active.

The sale included 66% working interest in 9,850 net Wolfcamp acres. Callon said daily production averaged 4,000 barrels of oil equivalent per day (boe/d), 52% oil, in February.

As a result, Callon reduced its 2019 total production guidance by 4.3% to between 38,000 and 39,500 boe/d from 39,500-41,500 boe/d. Meanwhile, the company only reduced its implied oil production guidance by 3.1% to between 29,600 and 31,200 barrels per day (bbl/d) from 30,400-32,4000 bbl/d.

Gabriele Sorbara, principal and senior equity analyst for Williams Capital Group LP, said the revised guidance is light to the firm’s prior estimates adding he believes Callon management remains conservative.

“We reaffirm our Buy rating, and [Callon Petroleum] remains our top small-cap pick as we have a high conviction [Callon] can execute on its program, narrow its outspend and ultimately cross over to a free cash flow generative model,” Sorbara said in a research note on June 13. “[Callon] also trades at half a turn discount to peers on EV/EBITDA with an elevated short interest.”

Callon, which recently moved its headquarters to Houston from Natchez, Miss., is a pure-play Permian Basin company. At year-end 2018, the company operated roughly 85,000 net acres in the Midland and Delaware basins, according to the Callon website.

Plans for the proceeds from the Ranger sale included paying down debt. The company also said it would consider retiring preferred stock.

Joe Gatto, Callon president and CEO, said in a statement on June 13: “We remain on a clear path to attain the various objectives we have outlined for investors. This transaction is a meaningful step forward on our deleveraging goals which will also be advanced by our cash flow generation in coming quarters.”

On June 13, Callon also confirmed the buyer of the Ranger asset was Houston-based independent Sequitur Energy Resources LLC.

A subsidiary of Sequitur agreed to purchase Callon’s Ranger asset for $245 million in cash. The agreement also included up to $60 million in contingent payments tied to oil prices over the next three years.

Sequitur is a privately-held oil producer primarily focused in the southern Midland Basin. The Houston-based company’s primary focus area in the basin consists of roughly 77,000 net acres, mostly located in Reagan, Irion and Crockett counties, Texas, according to Sequitur’s website.

Late last year, Sequitur CEO Scott D. Josey told Hart Energy’s Oil and Gas Investor that the southern Midland’s reputation as a gas-heavy area often ignores the oil.

“Our Reagan County acreage is low GOR [gas-oil ratio] and 80%-plus oil,” he said. “Our Irion County assets are around 30% oil, but those wells come online initially with production at around 80% oil.”

RELATED: The Once And Future Permian Feat. Sequitur Energy

Sequitur runs two rigs, one in Irion and the other in Reagan. The company also holds acreage in the Buda Rose play in East Texas plus ownership of Houston-based valve manufacturer Chromatic Industries.

The Ranger asset sale had an effective date of Jan. 1.

Jefferies LLC was exclusive financial adviser to Callon in connection with the divestiture. Vinson & Elkins advised Sequitur’s subsidiary, Sequitur Permian LLC. The law firm’s corporate team was led by partner Danielle Patterson and associates Mike LeFevre and Kara Chung.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

NAPE: Chevron’s Chris Powers Talks Traditional Oil, Gas Role in CCUS

2024-02-12 - Policy, innovation and partnership are among the areas needed to help grow the emerging CCUS sector, a Chevron executive said.

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.