Joe Gatto, president and CEO of Callon, said the Ranger divestiture will streamline the company’s focus on three core operating areas in the Permian across the Midland and Delaware sub-basins. (Source: Hart Energy/Shutterstock.com)

[Editor's note: This story was updated at 1:55 p.m. CST April 10.]

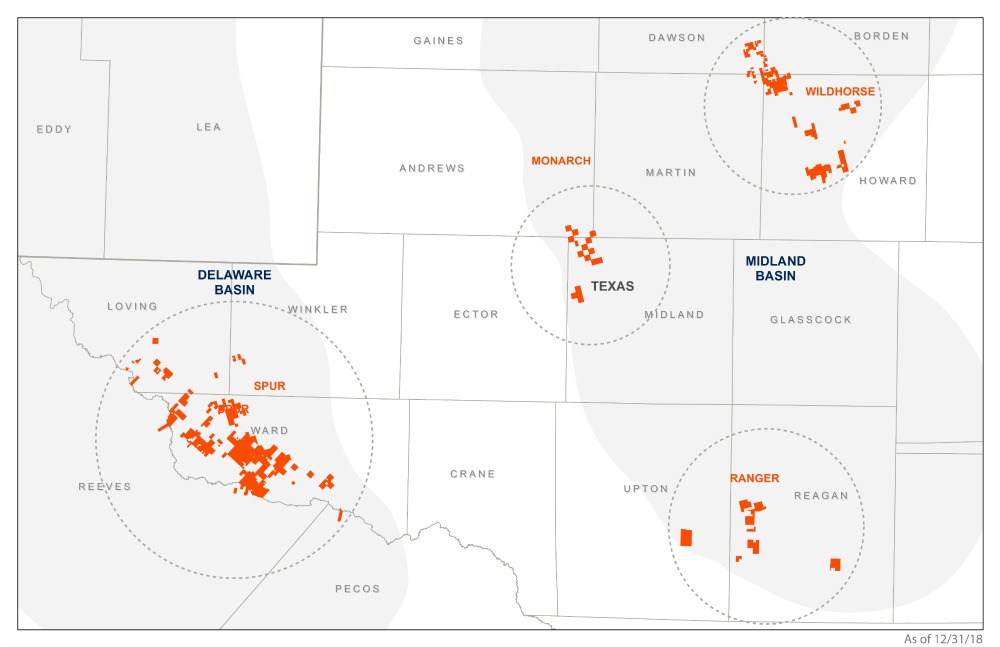

Callon Petroleum Co. said April 8 it will cash in noncore assets in the Midland Basin for possible proceeds of up to $320 million as the Permian producer works to optimize its position in the prolific basin.

An undisclosed company agreed to buy Callon’s position in the Ranger operating area in the southern Midland Basin for $260 million cash plus the possibility of up to $60 million in incremental cash payments tied to oil prices.

The Ranger operating area, comprising 66% working interest in 9,850 net Wolfcamp acres, where Callon hasn’t been as active. Daily production from the Callon’s assets in February averaged about 4,000 barrels of oil equivalent per day (52% oil).

Analysts with Seaport Global Securities LLC are fans of the deal and they expect the market will be too, said Mike Kelly, senior analyst with the New York-based investment bank.

“[Callon Petroleum] essentially shed tier 2 acreage that it had no near-term intention of developing and inks a surprisingly high price of $14,000/acre,” Kelly said in a research note on April 9. “Importantly, pro forma for the deal, [Callon’s] debt and valuation metrics improve with $260 million-plus of cash coming in the door.”

As of a result of the sale of its Ranger position, Callon CEO Joe Gatto said the company’s operations will be streamlined into three core operating areas in the Permian across the Midland and Delaware sub-basins.

“We are actively optimizing our operations, which we believe will reduce capital intensity and increase returns on capital for our shareholders,” Gatto said in a statement on April 8.

In addition to the pending Ranger divestiture, Callon completed a strategic trade during first-quarter 2019, which Kelly called “solid blocking and tackling.”

Callon picked up two incremental long-lateral DSUs in northwest Howard County, Texas, in exchange for low working interest properties in Midland County, Texas. The trade resulted in a net increase of roughly 167 net acres to Callon’s Midland Basin leasehold position and generated $14 million in cash proceeds to the company, according to the company press release.

“Our resulting asset base is now well-positioned for the efficient, large pad development model that we are increasingly deploying across our portfolio,” Gatto said.

The Ranger divestiture includes over 80 currently producing horizontal wells that have been drilled since 2012 and 70 net, delineated locations that exceed Callon’s internal threshold of an IRR of greater than 25% at strip pricing.

In addition to the initial cash proceeds of $260 million from the divestiture, Callon could also receive incremental cash payments of up to $60 million based upon future commodity prices with upside participation starting at the $60 per barrel West Texas Intermediate level.

Callon plans to use proceeds from the sale to accelerate its debt reduction initiatives. The company will also consider retiring preferred stock.

Jefferies LLC was exclusive financial adviser to Callon in connection with the Ranger divestiture transaction.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Report: Crescent Midstream Exploring $1.3B Sale

2024-04-23 - Sources say another company is considering $1.3B acquisition for Crescent Midstream’s facilities and pipelines focused on Louisiana and the Gulf of Mexico.

For Sale? Trans Mountain Pipeline Tentatively on the Market

2024-04-22 - Politics and tariffs may delay ownership transfer of the Trans Mountain Pipeline, which the Canadian government spent CA$34 billion to build.

Energy Transfer Announces Cash Distribution on Series I Units

2024-04-22 - Energy Transfer’s distribution will be payable May 15 to Series I unitholders of record by May 1.

Balticconnector Gas Pipeline Back in Operation After Damage

2024-04-22 - The Balticconnector subsea gas link between Estonia and Finland was severely damaged in October, hurting energy security and raising alarm bells in the wider region.

Wayangankar: Golden Era for US Natural Gas Storage – Version 2.0

2024-04-19 - While the current resurgence in gas storage is reminiscent of the 2000s —an era that saw ~400 Bcf of storage capacity additions — the market drivers providing the tailwinds today are drastically different from that cycle.