Callon Petroleum first entered the Eagle Ford Shale in 2019 through its all-stock acquisition of Carrizo Oil & Gas. (Source: Hart Energy)

Upon closing of the Primexx Energy Partners acquisition that boosted its production outlook, Callon Petroleum Co. tacked on a $100 million cash sale in the Eagle Ford Shale.

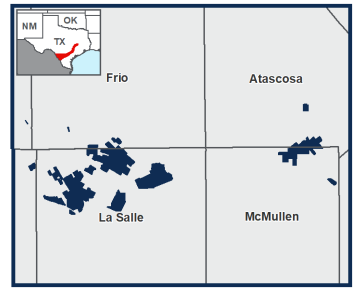

The divestiture of the Eagle Ford properties to an undisclosed buyer include approximately 22,000 net acres in northern La Salle and Frio counties, Texas. Net daily production from the properties, which Houston-based Callon said were noncore, was approximately 1,900 boe/d (66% oil) on average in the third quarter.

Callon first entered the Eagle Ford Shale in 2019 through its all-stock acquisition of Carrizo Oil & Gas. The company holds about 73,000 net acres producing 27,000 boe/d in the Eagle Ford, according to a recent company presentation.

In an Oct. 5 release, Callon noted the Eagle Ford asset sale increases total cash proceeds from the company’s 2021 divestiture program to over $140 million to date, within the guidance range for the year of $125 million to $225 million.

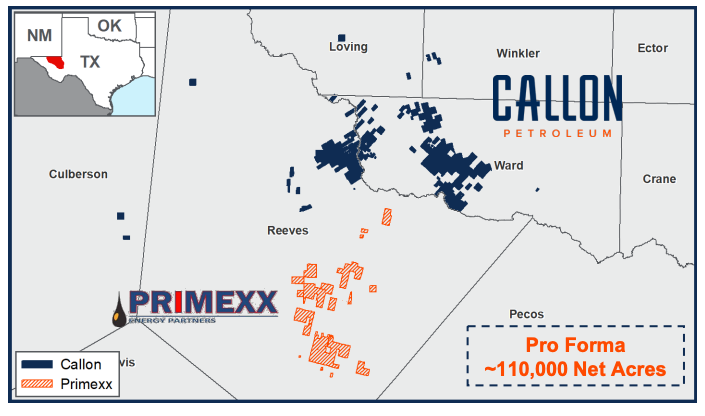

Separately, Callon also announced on Oct. 5 the closing of the acquisition of Primexx Energy Partners and its affiliates. The company paid roughly $788 million in cash and stock for the Primexx leasehold interests and related oil, gas and infrastructure assets in a transaction previously announced in early August.

“We are excited to get to work integrating this high-quality asset base into our Permian Basin operations, overlaying our life of field development philosophy on the acquired multizone resource base,” Joe Gatto, president and CEO of Callon Petroleum, commented in the company release.

The acquisition of Primexx, a private oil and gas operator with 35,000 net contiguous acres in Reeves County, Texas, increases Callon’s Delaware Basin footprint to over 110,000 net acres. Callon also has an acreage position in the Midland Basin of the Permian.

Gatto added that he expects a seamless transition given Callon’s deep subsurface expertise in the Delaware Basin and operational preparation.

During the fourth quarter, Callon intends to operate six drilling rigs and an average of 1.5 completions crews as the current Primexx development program is transitioned to larger scale development with increased project sizes targeting multiple landing zones. In addition to expanding the DUC inventory on the acquired Delaware assets, the company expects to place approximately 18 gross (15 net) wells on production in the quarter, all in the Permian Basin.

“As we look ahead into the coming quarters,” Gatto continued, “this latest acquisition provides a meaningful increase in free cash flow generation and is a catalyst for substantially improving the balance sheet.”

The Eagle Ford sale, according to the company release, will eliminate approximately $50 million in capex related to continuous drilling obligations over the next two years, allowing for capital redeployment by Callon to higher return projects.

The Eagle Ford transaction is anticipated to close in November.

Daily production for the fourth quarter, including the impact of the pending divestiture, is expected to be 110,000 to 112,500 boe/d (63% oil) and operational capital in the range of $150 million to $160 million.

For the third quarter, production has been above previous expectations due to strong well performance in the Delaware and Midland basins, the company added in its release. As a result, Callon said it raised third-quarter production guidance to 98,500 to 99,5000 boe/d (64% oil) from a previous range of 95,500 to 97,500 boe/d (64% oil). Operational capital for the quarter is currently estimated to be $120 million to $125 million.

Recommended Reading

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.

TechnipFMC Eyes $30B in Subsea Orders by 2025

2024-02-23 - TechnipFMC is capitalizing on an industry shift in spending to offshore projects from land projects.

NOV's AI, Edge Offerings Find Traction—Despite Crowded Field

2024-02-02 - NOV’s CEO Clay Williams is bullish on the company’s digital future, highlighting value-driven adoption of tech by customers.

Patterson-UTI Braces for Activity ‘Pause’ After E&P Consolidations

2024-02-19 - Patterson-UTI saw net income rebound from 2022 and CEO Andy Hendricks says the company is well positioned following a wave of E&P consolidations that may slow activity.

ProPetro Reports Material Weakness in Financial Reporting Controls

2024-03-14 - ProPetro identified a material weakness in internal controls over financial reporting, the oilfield services firm said in a filing.