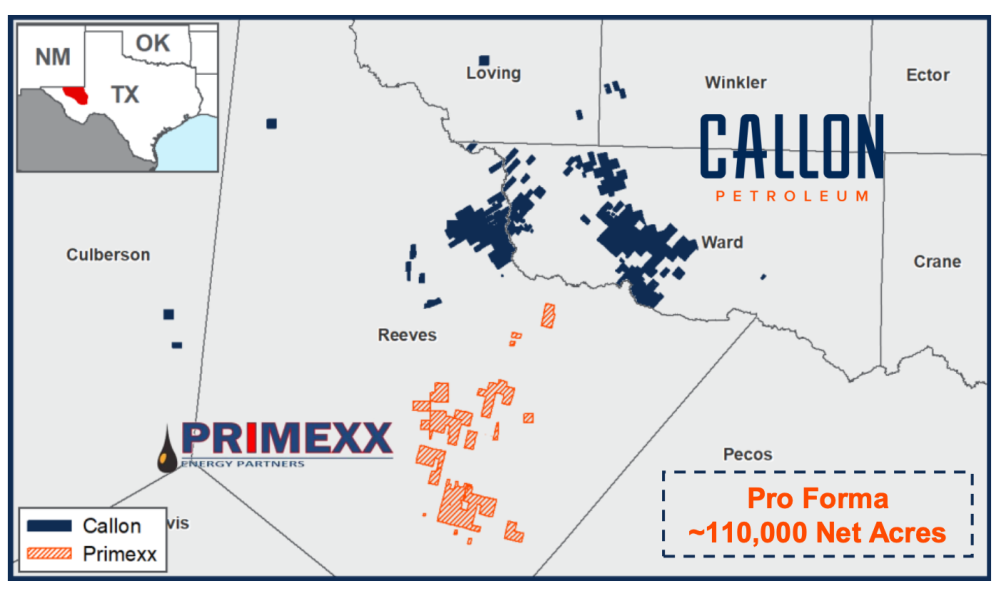

The acquisition of Primexx Energy Partners will increase Callon Petroleum’s Delaware Basin position to over 110,000 net acres, the company said. (Source: Hart Energy)

Callon Petroleum Co. is set to grow its position in the Permian Basin through the acquisition of Primexx Energy Partners in a cash and stock transaction valued at approximately $788 million.

In an Aug. 4 release, Callon announced the agreement to acquire the leasehold interests and related oil, gas, and infrastructure assets of Primexx, a private oil and gas operator in the Delaware Basin with a contiguous footprint of 35,000 net acres in Reeves County, Texas. Primexx’s net production in the second quarter was about 18,000 boe/d (61% oil).

“The Primexx transaction checks every operational and financial box on the list of compelling attributes of consolidation,” commented Joe Gatto, president and CEO of Callon, in the company release.

“The asset base adds substantial current oil production and a top-tier inventory to our Delaware portfolio, and fits squarely into our model of scaled, co-development of a multizone resource base.”

The acquisition of Primexx will increase Callon’s Delaware Basin position to over 110,000 net acres, according to the company release. Callon, based in Houston, also has positions in the Midland Basin and Eagle Ford Shale.

Callon last added on to its position in 2019 with the acquisition of Carrizo Oil & Gas Inc. The all-stock transaction, valued at $2.7 billion, included the assumption of $1.96 billion of net debt and preferred stock.

Since the Carrizo acquisition, Callon has worked to accelerate debt reduction including through the sale last year of overriding royalty interest in substantially all Callon-operated oil and gas leaseholds to a private investment vehicle managed by private equity firm Kimmeridge Energy. At the time, Callon also issued $300 million of principal value second lien secured notes to Kimmeridge.

Concurrently with the Primexx announcement on Aug. 4, Callon said Kimmeridge agreed to convert their remaining portion of the Callon second lien senior notes that were issued in 2020 into common shares after the close of the Primexx transaction. The equitization further advances the company’s deleveraging timetable and saves nearly $20 million per year in interest costs.

“The infusion of over $550 million of equity from the acquisition and Kimmeridge’s exchange further heightens the overall benefits, immediately reducing leverage metrics and creating a visible path to net debt to adjusted EBITDA of below 2.0x next year,” Gatto added in the release.

The acquisition consideration for the Primexx deal includes $440 million in cash and 9.19 million shares of Callon stock. Callon said in the release that the cash portion of the purchase price can be financed using available capacity under the current credit facility with near-term repayment coming from forecasted free cash flow and proceeds from in-process divestiture initiatives. The company plans to also look “opportunistically” to the debt capital markets to term out all or a portion of the cash payment in lieu of credit facility borrowings.

The transaction is expected to close early fourth-quarter 2021, subject to customary closing conditions and regulatory approvals.

Citi is exclusive financial adviser and Gibson Dunn & Crutcher LLP is legal adviser to Callon for the Primexx acquisition. RBC is serving as exclusive financial adviser and Kirkland & Ellis LLP is serving as legal adviser to Primexx.

Recommended Reading

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

CEO: Magnolia Hunting Giddings Bolt-ons that ‘Pack a Punch’ in ‘24

2024-02-16 - Magnolia Oil & Gas plans to boost production volumes in the single digits this year, with the majority of the growth coming from the Giddings Field.

Endeavor Integration Brings Capital Efficiency, Durability to Diamondback

2024-02-22 - The combined Diamondback-Endeavor deal is expected to realize $3 billion in synergies and have 12 years of sub-$40/bbl breakeven inventory.