Carrizo Oil & Gas produced roughly 61,960 boe/d during the first quarter from larger scale projects in the Eagle Ford Shale and Delaware Basin. (Source: Hart Energy)

[Editor's note: This story was updated at 12:20 p.m. CDT July 15.]

Callon Petroleum Co. agreed July 15 to acquire Carrizo Oil & Gas Inc. in an all-stock transaction valued at $3.2 billion, gaining oil-weighted positions in the Permian Basin and Eagle Ford Shale.

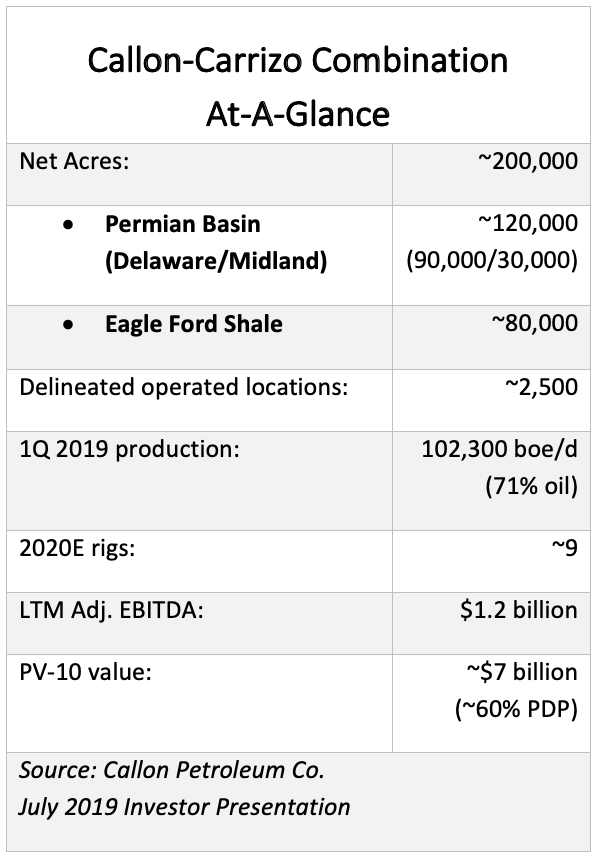

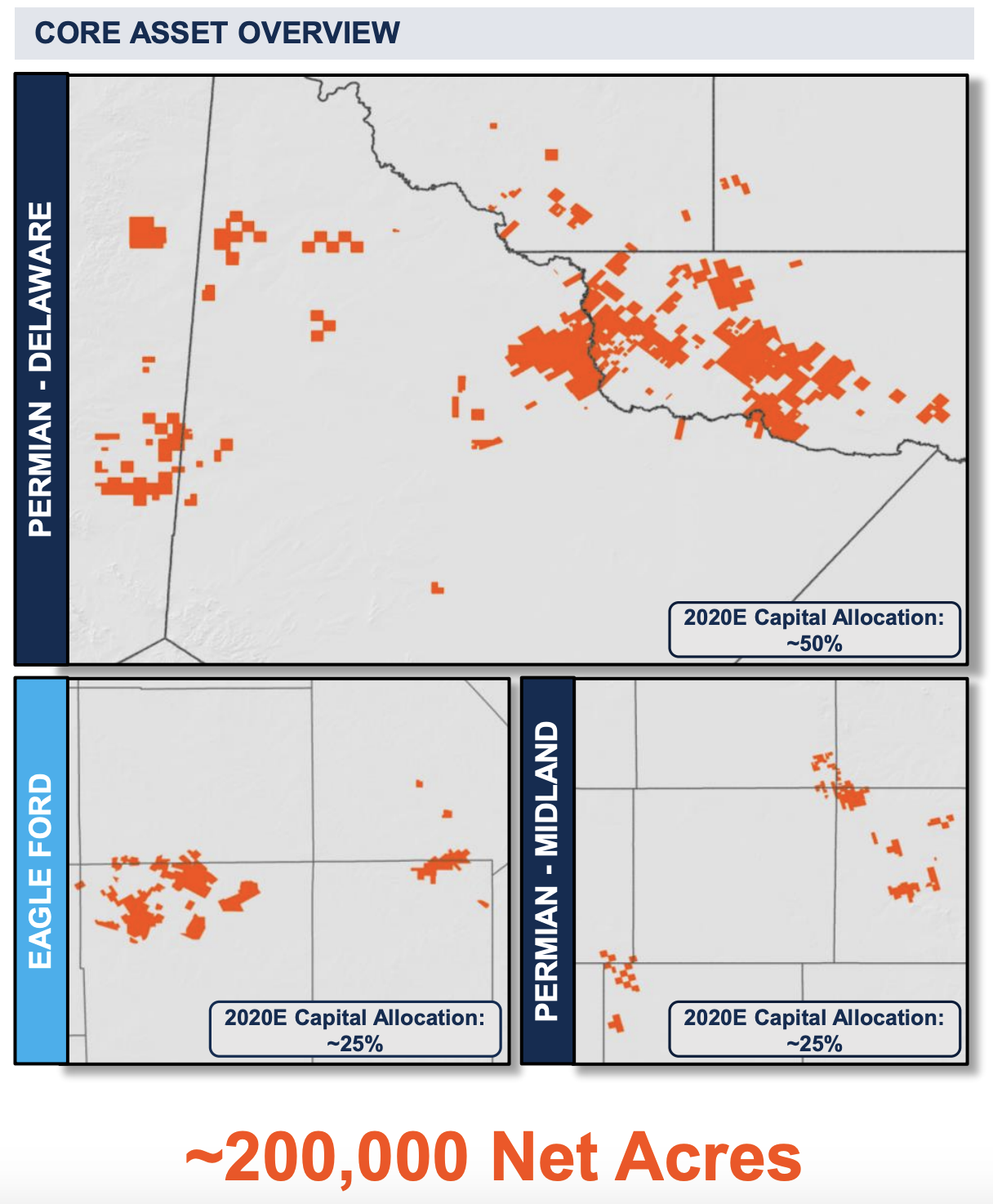

The companies, both based in Houston, said in a joint release that the combination will create a premier oil-weighted mid-cap with peer-leading capital efficiency and cash margins. Callon, currently a Permian pure-play, is set to have over 100,000 boe/d of pro forma production and 200,000 net acres in the Permian Basin and Eagle Ford Shale through its combination with Carrizo.

The companies, both based in Houston, said in a joint release that the combination will create a premier oil-weighted mid-cap with peer-leading capital efficiency and cash margins. Callon, currently a Permian pure-play, is set to have over 100,000 boe/d of pro forma production and 200,000 net acres in the Permian Basin and Eagle Ford Shale through its combination with Carrizo.

“We believe that Callon is the ideal partner for Carrizo,” S.P. “Chip” Johnson, president and CEO of Carrizo, said in a statement on July 15. “Through our combination, we bring together a strong foundation of Midland Basin and Eagle Ford Shale assets and overlay a substantial Delaware acreage position and value proposition that will be unlocked through an integrated plan of large-scale program development.”

Carrizo had previously faced activist investor demands that included exploring a merger or sale.

In a regulatory filing from early May, Lion Point Master LP disclosed a 5.1% stake in the company and said it acquired Carrizo’s shares because they are undervalued and represent an “attractive investment opportunity.” The firm also contended that shareholder value would be enhanced were Carrizo to pursue a potential merger or broader sales to other operators.

Carrizo’s asset base will add about 76,500 net acres in the Eagle Ford and 46,000 net acres in the Delaware within the Permian Basin. The company’s production, as of the second quarter, totaled 67,200 boe/d, 64% of which was oil.

As a result of the broader scale and scope, Callon is expecting an accelerated free cash flow generation and enhanced credit profile. Additionally, the companies have identified synergies from the combination generating a total of $850 million in net present value.

Deal Metrics

Assuming a $35,000 per flowing boe, the $3.2 billion price tag of Callon’s acquisition of Carrizo translates to a PDP value of about $2.35 billion, according to Mark Lear, equity analyst with Jefferies LLC. He added this leaves $850 million of implied undeveloped value.

“Placing $2,000/acre on the Eagle Ford (about $150 million), we estimate [Carrizo’s] remaining Delaware (some of which stretches out on the Culberson/Reeves County line) sold for about $15,000/acre including all Delaware acreage,” Lear wrote in a July 15 research note.

Analysts with Capital One Securities Inc. said the transaction values Carrizo at $13.12 per share, a 25% premium to the closing price of its stock on July 12.

The analysts also noted that the all-stock deal continues a theme of corporate M&A that accelerated last year as multiple E&Ps agreed to merge—topped by Concho Resources Inc.’s $9.5 billion acquisition of RSP Permian.

“We think the relative performance of [Callon’s] stock in the coming days, weeks and months will be critical in determining whether or not more corporate deals get consummated in the space, especially among SMID-caps,” Capital One analysts wrote in a July 15 research note. “If the market rewards [Callon], given the expected $100 million to $125 million of synergies and the accretion that the company anticipates, we think it will be more likely that other ‘would-be acquires’ will pursue consolidation.”

Shares of Callon Petroleum were trading at $5.38, down roughly 16% by mid-morning. Meanwhile, Carrizo was up 2% at $10.72.

Following the close of the transaction, Carrizo shareholders will own 46% of the combined company.

Under terms of the transaction agreement, Carrizo shareholders will receive a fixed exchange ratio of 2.05 Callon shares for each share of Carrizo common stock. The transaction value is comprised of $1.25 billion of equity plus the assumption of roughly $1.96 billion of net debt and preferred stock, according to Capital One.

(Source: Callon Petroleum Co. July 2019 Investor Presentation)

Outlook

The transaction, which requires approval from shareholders of both companies, is expected to close during fourth-quarter 2019.

Upon closing, the board of directors of the combined company will consist of 11 members, including Callon’s eight current board members and three to be appointed from the board of Carrizo. The combined company will be led by Callon’s executive management team and will remain headquartered in Houston.

Joe Gatto, president and CEO of Callon, said in a statement on July 15: “Together with Carrizo, we will accelerate our free cash flow, capital efficiency and deleveraging goals through an optimized model of large-scale development across the portfolio. … With a deep inventory of high rate-of-return well locations in well-established areas and substantial upside opportunities for organic inventory delineation, we will be able [to] drive differentiated growth deploying our life-of-field development model for many years to come.”

Based on initial plans for capital allocation within the combined portfolio, Callon forecasts its free cash flow breakeven crude oil price to progress to under $50 West Texas Intermediate by 2021, according to the joint company press release.

Callon’s pro forma acreage footprint includes about 2,500 total gross horizontal drilling locations. The company plans to expand large-scale development with “simultaneous operations” primarily in the Permian Basin. This will be balanced by shorter cycle and less capital-intensive projects in the Eagle Ford Shale.

Combined, Callon is expecting a total of nine to 10 drilling rigs and three to four completion crews working during the course of 2020, predominantly in the Permian Basin.

J.P. Morgan LLC is exclusive financial adviser to Callon and Kirkland & Ellis LLP is serving as its legal adviser. Additionally, JPMorgan Chase Bank NA and BofA Merrill Lynch provided underwritten financing to Callon to support the transaction. Meanwhile, RBC Capital Markets LLC and Lazard are financial advisers to Carrizo and Baker Botts LLP is its legal adviser.

Upon closing, the combined company is anticipated to have pro forma liquidity of more than $1 billion under a new underwritten credit facility combined with no near-term debt maturities.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.