Callon will acquire Percussion Petroleum’s Delaware assets for $475 million and offload its Eagle Ford assets to Ridgemar for $655 million. (Source: Shutterstock)

Callon Petroleum Co. signed two definitive agreements on May 3, engaging in acquisitions and divestitures valued at $1.13 billion in an effort to streamline its operations. The E&P will add to its Delaware Basin portfolio while exiting its position in the Eagle Ford Shale.

In its Permian Basin agreement, Callon will acquire the membership interests of Percussion Petroleum Operating II LLC in a cash and stock transaction valued at approximately $475 million. The transaction calls for potential contingency payments of up to $62.5 million based on WTI prices.

Percussion will receive $265 million of cash and a maximum of 6.46 million shares of Callon common stock. Callon will own 100% of Percussion’s interests.

In the Eagle Ford, Callon agreed separately to sell all its assets to Ridgemar Energy Operating LLC for $655 million in cash and potential contingent payments of up to $45 million, also based on WTI prices. Ridgemar, backed by Carnelian Energy Capital Management LP, will acquire 100% of Callon’s wholly owned subsidiary, Callon (Eagle Ford) LLC.

The transactions are subject to customary terms and conditions and are expected to simultaneously close in July 2023, both with an effective date of January 1, 2023.

Callon said that the deals will streamline and focus operations, accelerate debt reduction and allow for the initiation of a shareholder return program in third-quarter 2023.

Joe Gatto, Callon president and CEO, said the company is positioned to capture value from Percussion’s assets, which he said are complementary to its core Delaware position.

“The combined transactions strengthen our capital structure, improve our margins and lengthen our top-tier Permian inventory,” Gatto said in a press release. “In addition to improving our net asset value proposition, we will achieve our near-term total debt milestone and intend to initiate a capital return program for shareholders at closing."

Gatto said the strategic Eagle Ford exit “funds our Delaware expansion and focuses our people, capital and operations on our premium Permian position.”

Delaware, Eagle Ford M&A

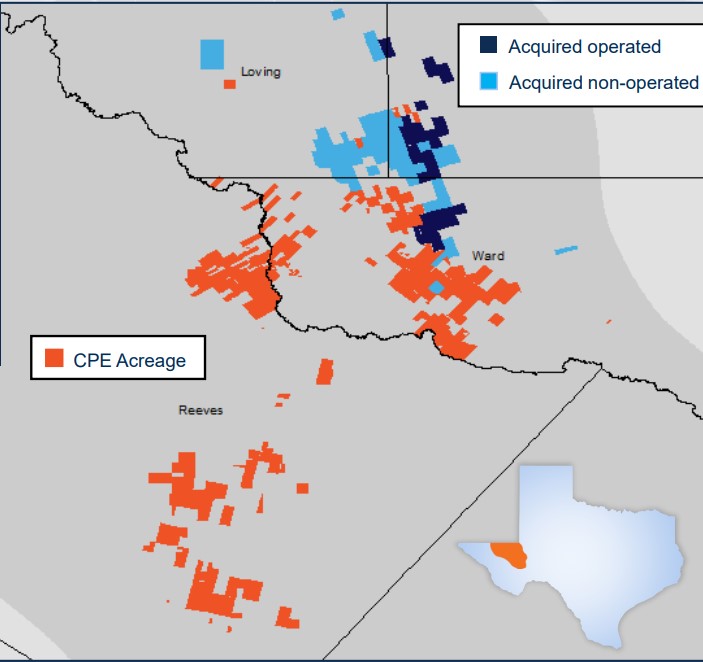

The Percussion acquisition adds approximately 18,000 net acres in Ward, Winkler and Loving counties, Texas, and approximately 70 high-return well locations in the 3rd Bone Spring, Wolfcamp A and Wolfcamp B. Average lateral lengths are nearly 10,000 ft, with additional prospectivity in emerging zones, Callon said.

The acreage is largely contiguous with Callon's existing core positions in the Delaware and “will benefit from the company's subsurface and operational expertise in the area,” the company said in a press release.

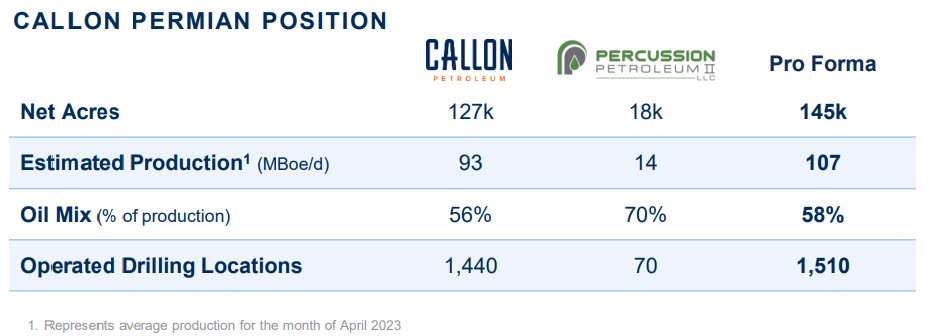

Estimated production from Percussion's assets for April 2023 average approximately 14,100 boe/d, of which approximately 70% is oil.

Callon agreed to assume Percussion's existing contingent payment liabilities of $12.5 million for calendar year 2023 and $25 million each for calendar years 2024 and 2025 if WTI Nymex oil prices average more than $60/bbl.

Callon's Eagle Ford assets are comprised of approximately 52,000 net acres. As of April, estimated production averaged approximately 16,300 boe/d, of which 71% was oil.

Ridgemar agreed to pay Callon contingent payments of $20 million if oil prices average between $75 and $80/bbl WTI Nymex in 2024. The payment goes up to $25 million if WTI Nymex oil prices are $80/bbl or higher in 2024.

Callon’s Permian pro forma

Callon said the company’s post-transactions operations will be focused on its 145,000 net acre Permian position. The company said it would have an inventory of more than 1,500 “high-quality locations” in a concentrated Permian position.

The deal also increases Callon’s Permian oil-weighting. The company estimated that its operating costs per boe will drop by approximately 5% in the second half of 2023, with savings in G&A and LOE.

Callon additionally said the Percussion deal is “attractively prices at next 12 months EV/ EBITDA, excluding the impact of contingency payments.”

“The deal will be immediately accretive to key financial metrics, including absolute and per share adjusted free cash flow and operating margins,” Callon said in the press release. “In addition, the transaction is also expected to improve the conversion rate of EBITDAX to adjusted free cash flow through capital efficiencies.”

Callon also said it expects to accelerate toward its targeted total debt of $2 billion, with total debt “below $1.9 billion at closing.”

Callon additionally said the board had authorized a $300 million share buyback program over a 24-month period. The buyback is subject to the closing of the transactions.

RBC Capital Markets is serving as the sole financial adviser to Callon on the acquisition of Percussion. JP Morgan Securities LLC is serving as the sole financial adviser to Callon for the Eagle Ford divestiture. Haynes and Boone LLP and Kirkland & Ellis LLP are serving as legal advisers to Callon for the transactions.

Recommended Reading

Brett: Oil M&A Outlook is Strong, Even With Bifurcation in Valuations

2024-04-18 - Valuations across major basins are experiencing a very divergent bifurcation as value rushes back toward high-quality undeveloped properties.

Marketed: BKV Chelsea 214 Well Package in Marcellus Shale

2024-04-18 - BKV Chelsea has retained EnergyNet for the sale of a 214 non-operated well package in Bradford, Lycoming, Sullivan, Susquehanna, Tioga and Wyoming counties, Pennsylvania.

Triangle Energy, JV Set to Drill in North Perth Basin

2024-04-18 - The Booth-1 prospect is planned to be the first well in the joint venture’s —Triangle Energy, Strike Energy and New Zealand Oil and Gas — upcoming drilling campaign.

PGS, TGS Merger Clears Norwegian Authorities, UK Still Reviewing

2024-04-17 - Energy data companies PGS and TGS said their merger has received approval by Norwegian authorities and remains under review by the U.K. Competition Market Authority.

Energy Systems Group, PacificWest Solutions to Merge

2024-04-17 - Energy Systems Group and PacificWest Solutions are expanding their infrastructure and energy services offerings with the merger of the two companies.