Source: BW Offshore

BW Offshore aims to achieve first oil at the Dussafu development, which targets the Gamba and Dentale sandstones offshore Gabon, by second-half 2018, the company said during an update.

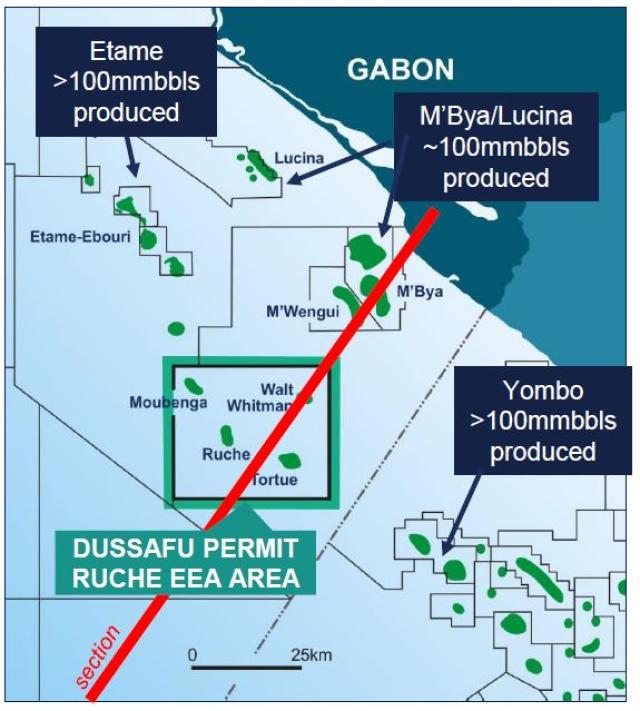

The project will initially develop the Tortue discovery; however, there are several other smaller discoveries and more than a dozen prospects nearby that could add upside to this Atlantic Margin presalt play.

Tortue Phase 1, which secured approval from Gabonese authorities in December 2017, includes two subsea horizontal production wells with a provision for gas lift and sand control. One well will target the Gamba reservoir, while the other will target the deeper Dentale. The water depth is 115 m (377 ft), which company executives said makes the project easier to develop.

The company also plans to drill one appraisal well, which will be located on the west side of the field, in hopes of finding additional resources.

“It’s a good time to be doing an oil and gas development,” Lin Espey, managing director for BW Energy, said during the presentation.

He pointed out that all of the major goods and services for the development have been tendered, with costs coming in below previous estimates.

Costs for subsea equipment and drilling rigs came in between about 40% and 50% below previous estimates, while support vessels were between 50% and 60% lower and flexibles were between 20% and 30% lower than previous quotes, according to BW Offshore.

The Borr Norve jackup arrived in Gabon on Jan. 5 and began loading equipment, and the rig is expected to reach its drilling destination by the end of January to begin drilling activity, Espey said, adding subsea trees and equipment also have arrived.

In addition, the FPSO mooring equipment was preinstalled in December 2017 and the contract for the FPSO BW Adolo is being finalized with expected mobilization to Gabon by first-half 2018 followed by subsea tieback installation. Given the typical waxy quality of crude offshore Gabon, the FPSO unit will have excess processing and heating capacity, Espey said.

Gross capital investment for the initial two-well Phase 1 is between $160 million and $170 million, BW Offshore said. Estimated peak production will be between 10,000 bbl/d and 15,000 bbl/d for Phase 1, which targets more than 15 MMbbl of gross resources.

Eyeing up to 45 MMbbl of incremental gross Tortue upside reserves, Phase 2 would involve two more wells per drilling phase starting in 2019, the company said.

Recently released results from an assessment conducted by Netherland, Sewell & Associates show the Gamba and Dentale D6 formations have about 15.9 MMbbl of proved reserves, 23.5 MMbbl of proved and probable reserves and 31.4 MMbbl of proved, probable and possible reserves, the company said. The assessment covered only Phase 1 and Phase 2.

Further upside is evident from nearby existing discoveries, namely in the Ruche Exclusive Exploitation Authorization (EEA). The 850-sq-km (328-sq-mile) EEA also contains the Ruche, Walt Whitman and Moubenga presalt oil discoveries, he said.

“We like the exploration prospectivity the Ruche EEA contains,” Espey said. “We have a lot of prospects that have been identified. We’re going through a process of reevaluating and high-grading them.”

The target formations are the same—Gamba and Dentil—at a target reservoir depth between 2,500 m and 3,500 m (8,202 ft and 11,483 ft), he said, adding that many of the prospects are adjacent to existing discoveries, which should aid in development, tying them back and putting them online.

All are in water depths of less than 100 m (328 ft).

BW Offshore acquired the Dussafu production-sharing contract after completing a deal with Harvest Natural Resources in April 2017.

Dussafu is operated by BW Energy, a joint venture between BW Group and BW Offshore. Partners are Panoro Energy and Gabon Oil Co. (transaction pending).

Recommended Reading

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-21 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.