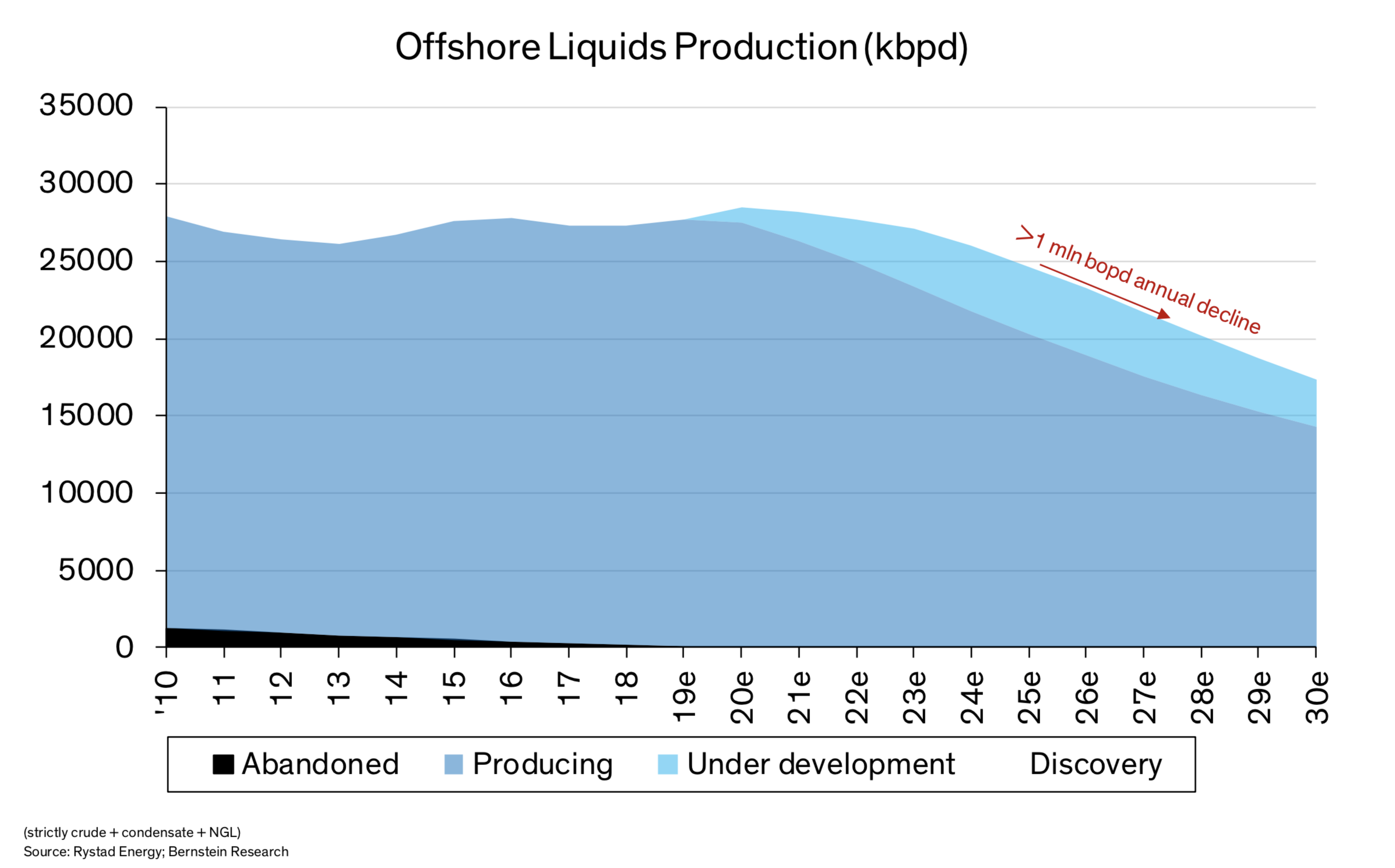

The Bernstein analysts expect that after a peak is reached next year in supply, offshore output will fall by more than 1 million bbl/d annually. (Source: Shutterstock.com)

At least one oil and gas firm has cast a cautionary eye on the long-term outlook for global offshore oil supply.

In an Oct. 28 report, Bernstein Research analysts led by Bob Brackett questioned the view that long-term underinvestment in long cycle, or offshore, projects will eventually be the impetus for a rejuvenation in activity and investment as supply falters. The analysts noted that they expect global offshore production, which is about 27 million barrels of oil per day (bbl/d), to peak in 2020. However, given current underinvestment, they think “it might be a decade [if ever] before it returns to those levels.”

Some of the most significant factors in this scenario are commodity prices that continue to bump around $60 a barrel Brent. Climate change concerns are also driving an increasing focus on renewables by the oil giants who historically have had the muscle to fund major deepwater projects.

“If the historic trend of oil price driving capex holds, $60/bbl Brent yields trivial growth. $80-$100/bbl is needed to incent growth,” the Bernstein analysts wrote. “And if discipline is even stronger (i.e., what we hear investors want and Shell’s example above), then an even higher price is needed.” The reference to Royal Dutch Shell Plc involves the major’s departure from a Kazakh project that offered “double-digit IRR…given the long cycles.”

In late September, Moody’s analysts said that they expect low-carbon energy investment to become more significant for the global integrated oil and gas sector, with Shell, Total SA, BP Plc, Equinor ASA and Repsol SA leading the way. “Production costs and capital spending are likely to tick up after bottoming out in 2018, but the sector will remain leaner and more capital efficient than it was before the 2015 oil price crash,” according to the Moody’s report.

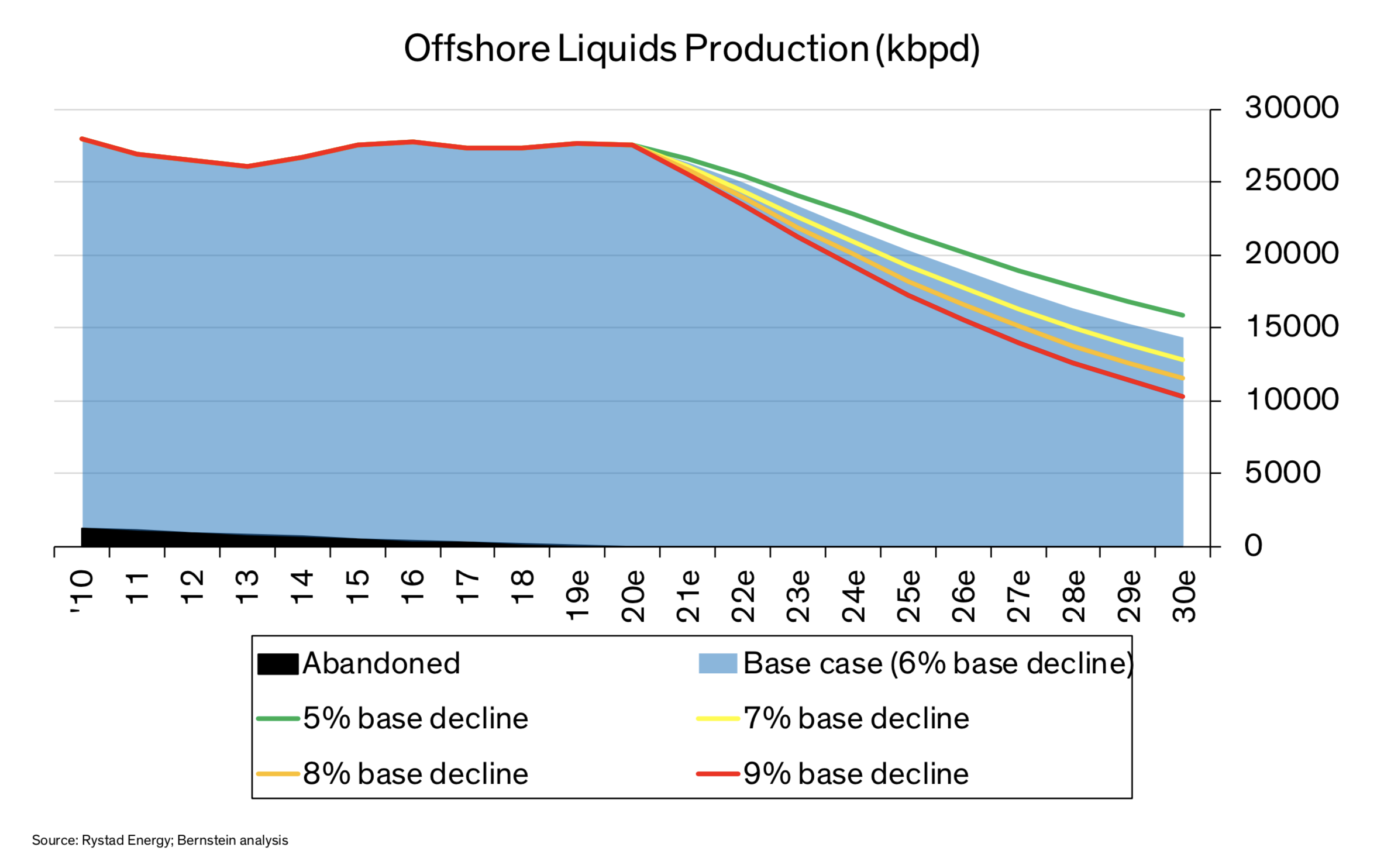

The Bernstein analysts expect that after a peak is reached next year in supply, offshore output will fall by more than 1 million bbl/d annually. This includes the assumption that producing fields decline by about 6% annually. The long-term bet on new final investment decisions (FIDs) being able to replace these losses is a shaky one due to current commodity price trends, the investment community’s focus on capex discipline, climate change pressures and other forces.

Looking at the various water depths defining offshore activity, the Bernstein analysts said that they don’t think shallow-water global production will “ever rise to its previous high.” They view deepwater oil production from 400 ft to 5,000 ft as also having peaked. “That leaves ultradeepwater projects (greater than 5,000 feet) which account for all growth but remain less than 10 MMbbl/d by 2030,” the Bernstein analysts wrote.

Unless commodity prices rise sharply, the capex won’t be there for offshore projects to make FID plans a reality. “To move all commercial discoveries to FID requires around doubling annual offshore greenfield capex from today,” the Bernstein analysts pointed out.

“The sheer number of projects required is large…who has the capacity, capital and desire to manage them all?” the analysts continued.

Overall, Bernstein noted that OPEC offshore liquids production comprises 40% of global offshore production, and they expect it to peak this year, including the development discovery pipeline. As for non-OPEC offshore output, it is also expected to top out next year, including development projects.

Recommended Reading

EQT’s Toby Rice: US NatGas is a Global ‘Decarbonizing Force’

2024-03-21 - The shale revolution has unlocked an amazing resource but it is far from reaching full potential as a lot more opportunities exist, EQT Corp. President and CEO Toby Rice said in a plenary session during CERAWeek by S&P Global.

Watson: Implications of LNG Pause

2024-03-07 - Critical questions remain for LNG on the heels of the Biden administration's pause on LNG export permits to non-Free Trade Agreement countries.

Venture Global Seeks FERC Actions on LNG Projects with Sense of Urgency

2024-02-21 - Venture Global files requests with the Federal Energy Regulatory Commission for Calcasieu Pass 1 and 2 before a potential vacancy on the commission brings approvals to a standstill.

Belcher: Election Year LNG ‘Pause’ Will Have Huge Negative Impacts

2024-03-01 - The Biden administration’s decision to pause permitting of LNG projects has damaged the U.S.’ reputation in ways impossible to calculate.

Despite LNG Permitting Risks, Cheniere Expansions Continue

2024-02-28 - U.S.-based Cheniere Energy expects the U.S. market, which exported 86 million tonnes per annum (mtpa) of LNG in 2023, will be the first to surpass the 200 mtpa mark—even taking into account a recent pause on approvals related to new U.S. LNG projects.