Believe it or not, the midstream sector is in decent shape for 2016. If you believe it, you’re probably in the sector.

“The midstream is still reasonably bullish, maybe fl at to slightly down but not significantly down,” Regina Mayor, KPMG LLP’s Houston-based national sector leader for U.S. energy and natural resources, told Midstream Business. “Most of the MLP executives that I’ve spoken with in recent months are still pretty bullish about not just feeding off of their dropdowns, but making specific organic investments in and of themselves within the MLP structure to satisfy unitholder requirements and to further boost their stock prices.”

Don’t believe it? You must be an investor.

“The midstream segment continues to argue that it should be relatively insulated from commodity price fluctuations,” Christopher Click, Dallas-based principal for KPMG, told Midstream Business. “It’s about transportation, and you still have to get the hydrocarbons from where they are found and produced to where they are consumed. We’re still lacking the infrastructure to meet the basic supply-demand balances.

“Now, does the market buy completely into that argument?” he asked. “No. We’re seeing that in midstream stock price fluctuations.”

Too busy for a downturn

“At this stage it’s still difficult to tell with any precision what the capital expenditures will be like in 2016,” Jim Rebello, global head of energy M&A for Duff & Phelps Corp., told Midstream Business. “Generally, the commodity environment is not great. But midstream—some of the larger projects that were started—they’ll be completed. There are firm commitments on funding for those projects so that distorts the capital spending a little bit.”

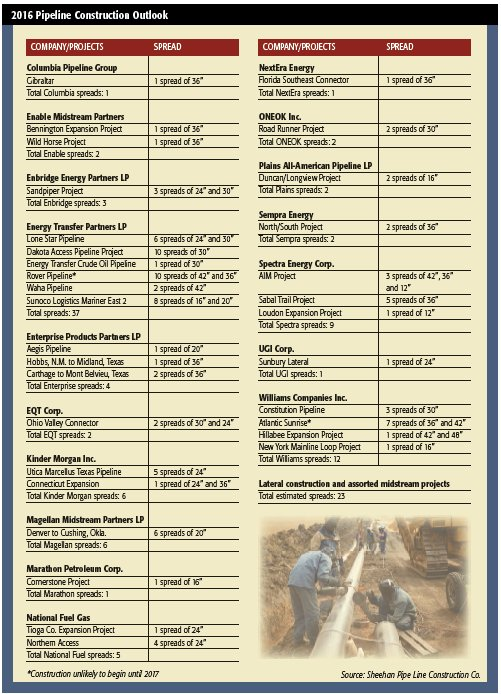

In fact, until last November, planned capital expenditures for 2016 on natural gas pipeline projects appeared to be so firm that executives at Tulsa, Okla.-based Sheehan Pipe Line Construction Co. were discussing what they needed to do to ensure that sufficient equipment and work force would be available. Delays in securing permits from the Federal Energy Regulatory Commission for two major projects, Energy Transfer Partners LP’s Rover Pipeline and The Williams Cos.’ Atlantic Sunrise Pipeline, have eased those concerns, but the possibility of a packed schedule already looms over 2017.

It’s not that a builder like Robert Riess, president and CEO of Sheehan, is unaware that the industry is in the grip of a tenacious downturn. But from the viewpoint of where the earthmover meets the earth, he hasn’t felt it yet and doesn’t expect that he will for the next four to five years.

“I think these projects have been well thought out,” he told Midstream Business. “They’re basically all subscribed and committed. One of these big pipeline jobs is three or four years in the planning between permitting, securing pipe, buying right of way, long before it ever gets to the actual construction phase. By the time it gets to us as a pipeline contractor, there is probably about a 95% certainty that job’s going to go.”

Even with the postponement of two projects involving 17 spreads of pipeline, or about 14% of the expected workload for the year, pipeline contractors still have more than 100 spreads on tap. Deferments are not cancellations, so pushing work into the next year or even following year extends a descriptor that many may have abandoned but not Riess: boom.

“I think that 2016 will still be a good year,” he said. “I just don’t think it will be what was originally projected. I think 2017, 2018 and 2019 are going to be just going wild as a result of some of this stuff pushing back. There’s still a tremendous amount of gas up in the northeast locked in the Marcellus and Utica that we simply can’t deliver to the market because we just don’t have the takeaway pipelines to get it anywhere.”

‘Near the bottom’

The outlook for midstream is tied directly, to a large extent, to what producers decide to do, especially with what SNL Financial estimated to be 5,000 drilled but uncompleted wells. From what he’s heard, Rebello leans toward those wells being completed in the first half of the year, as E&Ps seek to push both cash flow and production to blunt the blow from their spring borrowing basis redeterminations in the first quarter.

“That could potentially mean an increase in production and, depending on where you are, then there is the need for midstream capital investment to get that product to market,” he said. “So it’s a very, very interesting time. I would say the midstream outlook generally is stronger for the first half of the year than it is for the second half of 2016 if commodity prices continue to trade where they are today.”

For Michael Underhill, founder and chief investment officer of Wisconsin-based Capital Innovations and author of “Handbook of Infrastructure Investing,” much depends on the ability to forge ahead with projects through the gloom.

“When you look at what’s going on right now, the bearishness, the negativity in the energy space—in 25 years in this business, I haven’t seen it this bad,” he told Midstream Business. “So we know we’re getting near the bottom. If you have financial discipline to continue with the projects, I think that’s the best solution for low oil prices.”

As an industry veteran, he’s experienced this before, but that doesn’t make it any more fun.

“It doesn’t feel good when oil is at this price,” he said. “It makes you sick to your stomach when you’re investing but this is the kind of thing where you have to have financial discipline and conviction and cash. You have to come in and really take a good hard look at companies and say, ‘Here is our entry point and here’s where we want to go.’”

Export potential

Another source for optimism is the emergence of potential new markets for crude oil following the late-year lifting of the export ban.

“I think that’s one example of a potential bright spot that you could see increased capex with respect to certain export assets and export infrastructure,”

Click said. “I don’t think that it’s going to be a sufficient growth avenue that it necessarily changes the shape of the overall curve, but it definitely could be a potential bright spot. There are companies moving to invest in those sorts of liquids export facilities.”

Houston-based ConocoPhillips and NuStar Energy LP of San Antonio were the first to take advantage when they sent the first tanker loaded with an undisclosed volume of crude from the Port of Corpus Christi, Texas, on the last day of 2015. The two signed a deal with international trader Vitol to provide light oil and condensate from the Eagle Ford, but liquids exports are not exclusively bound to the Gulf Coast. Enterprise Products Partners LP was close behind with a shipment during the first week of 2016.

“Some of those liquids export facilities are in different locations, not just the Gulf Coast, so there’s movement afoot to try to get more of the hydrocarbons out of the Marcellus into the New York Harbor and Philadelphia export locations, for example,” Mayor said. “I could see the lifting of the crude export ban accelerating some of those conversations and some of those investments, which would be a bright spot.”

‘Shakeout year’

In the near term, however, things are looking a little rough.

“I think what you’re going to see is a dispersion of returns—haves and have nots, if you will,” said Underhill. “That [oil] price distress is starting to cause M&A activity.

“I think it will be a shakeout year,” he said. “I think you’re going to see more volatility in oil price. I think you’re going to see more volatility in merger and acquisition in the sector, so as a result, you’ll see different types of transactions, whether they be stock-for-stock deals, but you’ll also see other types of creative deals that are trying to de-lever companies and satisfy debt holders.”

Click agreed.

To Thine Own Assets Be True

2016 might be the year of the corporate gut check.

Christopher Click, Dallas-based principal for KPMG LLP, advises each client to think hard about the kind of identity to pursue.

“I think it gets back to this theme around 2016 being the year where each specific company case is slightly different,” he told Midstream Business. “There are some companies that have established a business model that provides them with a particular advantage, especially in a disruptive year such as 2016.”

Click tries to guide clients toward one of four basic models:

• Pure play: a company focuses on a particular basin or other geographic element and gains its advantage by securing access to the most attractive opportunities in that area;

• Value chain: Click cited Enterprise Products Partners LP as an example. That company has gained access to the entire liquids value chain and positioned itself to make money even in difficult periods like this one;

• Customer segments: tailoring a company’s approach to meet the needs of a particular customer base has been historically effective for many; and

• Size: realizing an advantage of scale, either in a particular area or across a broader value chain, can position a company to be more resilient to the ups and downs of the market.

“Some clients have found that discussion helpful as they think through, ‘What is my source of competitive advantage? What

is the business model that I feel like I’m running that’s differentiated vs. my competitors?’” Click said. “I think that theory applies even more so in a downturn or during a choppier period such as we find ourselves in now.”

It starts with a company acknowledging its unique nature.

“I think sometimes people view midstream as purely a pipeline and tolling type of a business,” said Regina Mayor, KPMG Houston-based national sector leader for U.S. energy and natural resources. “What Chris and his team have helped their clients understand is, different players are competing based on different strengths. It’s not a one-size-fits-all approach to the industry.”

“One of the things that jumps out is that 2016 is not going to be a one-size-fits-all year for the midstream sector,” he said. “There will be winners and losers. There are some companies that are better positioned than others and you see some of that reflected in their capex budgets.”

Winners, Click said, include those that enjoy the advantages of scale, such as MLPs with strong general partner support. Balance sheet strength is also a plus, along with a presence in the sweet spots.

“You need to be in an area where, on a relative basis, there will be more growth than others, be it the Permian, be it the Marcellus,” he said. “Do you have an asset base that’s exposed to some of these bright spots like export facilities, or like natural gas usage and power generation?”

Rebello is also an enthusiast of rich geography as a way to attract investment.

“It’s all going to come down to the ability to attract capital,” he said. “It’s not going to matter whether you’re big or small, it’s the economics of the project. If you’re in the right geography, you’ll be able to attract capital and make capex to complete those. It’s less about the overall entity and more about where are these projects that you’re trying to finance, and that’s what’s going to drive the ability to raise capital to execute on these projects.”

Underhill, whose firm subadvises the Sprott Global Infrastructure Fund, which invests in infrastructure securities, including midstream stocks, cited Kinder Morgan’s merger, and how the midstream giant was punished by the equity markets for taking on so much debt. Going forward, he expects different strategies to make deals happen.

“I think you’re going to find investors want CFOs of these companies—publicly traded partnership companies—to be a little bit creative and not so highly leveraged,” he said. “You can do stock swaps, you can do other types of structured transactions. 2016 is going to be the year for deal creativity in the MLP midstream space.”

And with markets subject to wild mood swings, Underhill speculates that business as usual could easily swerve into the territory of business as unusual.

“Hunters could become the hunted with the fall in valuations and players outside of midstream could enter the M&A space,” he said.

Bold moves

Mayor, too, is struck by forward-looking trends in the acquisition of midstream assets by downstream players. These deals include the purchase of MarkWest by MPLX, Phillips 66 investing $1.5 billion in its DCP Midstream joint venture and PBF Energy Inc. buying assets from ExxonMobil Inc.

“It’s a bold move to take more market share within a highly lucrative and stable revenue source part of the business, given the exposure to commodity price that many of the companies are experiencing,” she said.

Is this a trend that could drive capital expenditures?

“For sure,” Mayor added. “You’ve got different types of owners of assets coming into play that are less vulnerable to current crude prices—your power companies, your downstream players. I think those are some interesting moves.”

In particular, Mayor likes that they are happening during a period of disruption.

“Some of the bold moves on the combinations have been very interesting to watch and some of the bold moves into new types of hydrocarbons, to nontraditional players have been interesting to watch,” she said. “Those are the two things that I have found exciting about the midstream sector in 2015 and I would expect to continue to see that in 2016.”

Managing Stress In The Midstream Space

Toronto-based BMO Capital Markets draws a parallel between NASA’s white-knuckled Gemini 8 mission in 1966 and the current turmoil experienced by the energy industry.

The mission of astronauts Neil Armstrong and David Scott was to rendezvous and dock with the Agena spacecraft, which had been launched earlier. Much like the meteoric ascent of the oil and gas industry during the shale revolution, the complicated mission proceeded relatively smoothly. But 27 minutes after Gemini 8 docked with Agena, the two connected spacecraft “began to go into a violent yaw and tumble,” according to NASA’s mission report.

Armstrong disengaged the capsule from the Agena target vehicle, but that only made it worse. One of the thrusters had short-circuited during docking and continued to fire, propelling the capsule into a tumble that may have exceeded one revolution per second. Armstrong remained calm, regained control of the capsule by firing all thrusters and the two astronauts ultimately returned safely to Earth, surviving the first true emergency in space. Armstrong, of course, returned to space as commander of Apollo 11 and became the first human to walk on the moon.

BMO’s point: The OPEC commitment to market share and China’s slower growth are creating a feeling of Gemini’s “death roll” for the industry. By remaining calm and making difficult decisions like the crew in the capsule and the team at Mission Control, energy executives can find their way through this tough period as well.

BMO listed these challenges for the midstream:

• Slower growth means a higher yield, which makes it harder for MLPs to grow;

• Continuing trend of consolidation of large MLPs burdened with high incentive distribution rights payments; and

• The dangers posed for certain highly leveraged MLPs with higher interest rates. BMO noted the market struggles encountered by the entire sector already and warns of greater risks the longer this environment persists.

So what’s a midstream player to do? BMO analyzed the 76% dividend cut announced by Kinder Morgan Inc. near the end of last year for answers.

The reduction from 51 cents per share to 12.5 cents per share saves the company $3.4 billion a year in distributable cash flow that can be used to fund projects. It also triggered a rise in Kinder’s stock price by 6.8% immediately following the announcement.

What provoked the move was the cost of capital, BMO said. A prolonged stock price decline meant that Kinder no longer had the resources to efficiently fund its backlog of projects. The company elected to protect its investment-grade rating, making the return of capital to shareholders a lower priority. While the decision may have been painful, it relieves the company of the need to tap equity or debt markets in the foreseeable future.

And here’s the upshot, in BMO’s view: the dividend cut opens the door for dividend/distribution cuts at other midstream companies wondering how to fund their own project backlogs.

“Time will tell how investors feel about this transaction,” said BMO in its analysis, “but with current equity yields at multiyear highs, few MLPs can accretively fund their growth projects.”

Recommended Reading

CAPP Forecasts $40.6B in Canadian Upstream Capex in 2024

2024-02-27 - The number is slightly over the estimated 2023 capex spend; CAPP cites uncertain emissions policy as a factor in investment decisions.