The world is counting on blue hydrogen to help decarbonize sectors that rely heavily on fossil fuels, especially in instances in which electrification is not a viable option. Think aviation, shipping and industrial processes.

The technology is proven. It’s cheaper to produce compared to some alternatives—for now.

Many believe that blue hydrogen—produced from natural gas or methane, via steam methane reforming (SMR), coupled with carbon capture and storage (CCS)—can move the world closer to emission reduction goals on the road to net zero. This is in spite of objections from critics who say it is not as clean as green hydrogen, created from water via the electrolysis process that uses electricity generated from renewable resources, along with concern about losing its cost edge and fugitive emissions.

Still, blue hydrogen supporters say the low-carbon resource is worth pursuing. Using existing infrastructure and technology could help accelerate development of the resource.

“To spur the hydrogen economy, we must be open to exploring natural gas and hydrogen blended infrastructure,” Baker Hughes CEO Lorenzo Simonelli said during an energy transition conference in June. “Without the right infrastructure, we will not achieve a hydrogen economy. Today, we have technology ready to deploy with little to no major upgrade of current turbomachinery equipment, which will help enable the hydrogen economy.”

Hopes are high on hydrogen’s ability to decarbonize major sectors of the economy and generate electricity. However, the promise of a burgeoning hydrogen economy could go unfulfilled without greater demand.

Making moves

Companies, including those known for their oilfield services and natural gas production, have already jumped into action working together and independently.

Baker Hughes, for example, is tapping natural gas to provide hydrogen-ready, turbo-compression pipeline technology in Greece. It is supplying gas turbines and compressors capable of running on a blend of natural gas and hydrogen.

In the U.S., the energy services company is providing advanced hydrogen compression and gas turbine technology for global projects underway by Air Products, which is also developing a $4.5 billion blue hydrogen complex in Louisiana. Developers say the proposed project will capture and sequester 95% of the process facility’s CO2 emissions, permanently sequestering over 5 million tons (MMton) per year of CO2 in Louisiana.

The project is one of several blue hydrogen initiatives underway in the U.S. as the nation works to reduce emissions and advance major clean hydrogen initiatives. This includes awarding $8 billion for regional clean hydrogen hubs to establish regional networks of hydrogen producers, consumers and infrastructure to speed adoption of hydrogen.

Indications from proposals submitted to the Department of Energy’s $8 billion H2Hubs program show developers don’t overwhelmingly favor one feedstock over another. Targeted feedstocks include fossil fuels with CCS, renewables and nuclear.

While each comes with its own set of advantages and disadvantages, success may come down to carbon intensity and economics.

The most common form of hydrogen produced today is gray, which like blue hydrogen is produced from natural gas or methane but with no carbon capture involved.

Only 1% of hydrogen is produced as blue hydrogen globally, according to DNV.

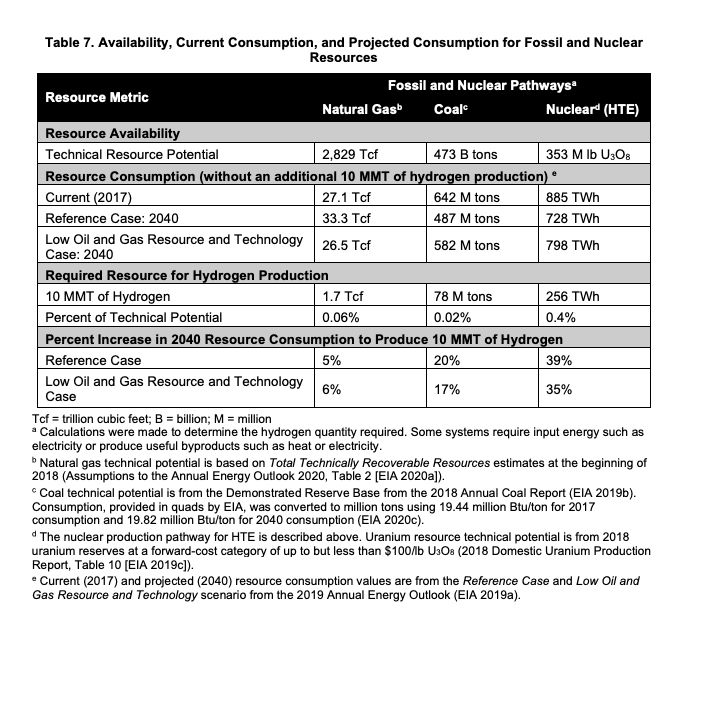

However, the potential is great, particularly in the U.S. where there’s an abundance of natural gas. A 2020 resources assessment by National Renewable Energy Laboratory shows about 167 scf of natural gas would be needed to produce 1 kg of hydrogen via SMR with a production efficiency of 73%. About 1.7 Tcf of natural gas would be needed to produce 10 MMton of hydrogen.

Facing challenges

According to the Center for Strategic and International Studies (CSIS), producing hydrogen from fossil fuel feedstocks—such as natural gas or methane—with emissions intensity at or below 2 kg of CO2 equivalent at the production facility is possible with processes such as SMR or auto-thermal reforming. Hydrogen is considered clean, according to the Infrastructure Investment and Jobs Act, at this carbon intensity level.

“However, capturing the carbon dioxide at high efficacy and at reasonable cost will require innovation,” CSIS said in its July 29 hydrogen hubs report. “A key challenge for fossil fuel hydrogen will be the emissions associated with natural gas production and distribution. Even at high capture rates, CCS might not be effective for producing clean hydrogen after taking into account fugitive methane emissions, other upstream emissions, and carbon emissions outside of the CCS process stream, particularly under the least favorable assumptions for methane-leak rates and high global warming potential.”

High gas prices are also among factors.

Henry Hub front-month futures were trading at $7.84/MMBtu on Aug. 1, up 100% from a year earlier.

Rising gas prices come as demand increases due to heat waves, surging LNG exports and shifts away from coal-fired electric generation in parts of the world. Europe’s unprecedented energy crisis, as Russia squeezes flows of natural gas to the region following its invasion of Ukraine, is another factor.

Fears of near-term natural gas shortfalls also have emerged in other regions, including in Australia where the Australian Competition & Consumer Commission said Aug. 1 its LNG exporters must divert natural gas to domestic markets to avoid a potential 56 petajoules shortfall in 2023.

The short-term volatility comes as renewable costs fall.

Research shared in June by DNV indicates green hydrogen will reach cost parity with blue hydrogen within the next decade, becoming the cheapest form of production in most regions by 2050. By this time, grid-based electrolysis costs would have fallen to average about US$1.50/kg, if forecasts hold true.

‘Part of the equation’

Backers of blue hydrogen say it shouldn’t be counted out.

DNV also forecasts blue hydrogen costs will drop from US$2.5/kg in 2030 to US$2.2/kg in 2050. Costs are already US$2/kg in regions, such as the U.S., with access to cheap gas, it said.

“We absolutely think that blue hydrogen has to be part of the equation because there just isn’t enough renewable [energy] to make all the hydrogen out there,” Michelle Noack, global climate transition director for Dow, said during a June energy transition conference in New York. “There just isn’t from a practical standpoint.”

Today, nearly all of the world’s 90,000 ton per year of hydrogen produced is gray, but blue hydrogen, some believe, will have a bigger role in the shorter term.

Investments in blue hydrogen continue today as green hydrogen costs fall.

“I’m not worried about the investments that we’re making,” Noack said of Dow’s blue hydrogen investments in Europe and Canada, where it will convert cracker off-gas into hydrogen as a clean fuel to be used in the production of polyethylene and ethylene derivatives at its Fort Saskatchewan, Alberta, site.

“We’re not going wholesale and fixing every single cracker that we have right off the bat. We recognize that technologies are going to change. And frankly, hydrogen probably isn’t going to be the only way we go. … We’re expecting to have electrified crackers,” adding the company is working on the technology.

Hydrogen is one of four key verticals for Chevron Corp., which plans to spend about $2.5 billion in low-carbon hydrogen, according to media reports.

“We absolutely think that blue hydrogen has to be part of the equation because there just isn’t enough renewable [energy] to make all the hydrogen out there.” —Michelle Noack, Dow

“There’s going to be a lot of hydrogen opportunities. We’re color agnostic in general,” Chris Powers, vice president of CCUS for Chevron New Energies, told Hart Energy. “Blue hydrogen makes a lot of sense in a lot of jurisdictions coupled with CCS. You can take a relatively lower priced hydrocarbon feedstock, capture the CO2, and then you’ve got a nice low carbon intensity hydrogen stream. In other areas, especially as you look several years down the road as cost comes down, green hydrogen is going to make a lot of sense in areas where you’ve got abundant renewables.”

Developing a hydrogen market is less about defining and debating hydrogen colors, experts say.

“It’s more about what it takes to grow,” added Vimal Kapur, the former president and CEO of Honeywell Performance Materials and Technologies, who was recently promoted to Honeywell president and COO. The company has technology for blue and green hydrogen, including a catalyst-coated membrane technology released this year for green hydrogen production.

Speaking at the June conference, Kapur added there are some limitations on technology, utilization and policy. “I think [hydrogen] can be scaled rather quickly if we get into the mindset of [discussing] what’s missing versus trying to define the colors and keep debating [whether] this color is better.”

Addressing scale, demand

Regardless of the potential role hydrogen can play in the energy transition, the position of natural gas or which hydrogen production method dominates, demand and scale are key.

“There are multiple pieces of the value chain to put together. You’ve got to have pore space to put the CO₂. You’ve got to have a source of fuel, good supply, relatively low cost. For instance, gas coming from the Permian or Appalachia,” Powers said. “You’ve got to have an offtaker in a market to go to. It’s really about lining those three bits up; that’ll underpin FID [final investment decision] on a big project at scale. We as well as others are doing a lot of work to move some of those projects forward.”

Today hydrogen is used mainly in oil refining, fertilizer and industrial processes.

Policy support and incentives will be needed to spur more demand for hydrogen, which remains too expensive for widespread use today, according to DNV. That is starting to happen, including in North America, where Canada and the U.S. have unveiled hydrogen strategies with focus on production hubs and funding.

“The 2040s will be the decade of demand diversification as more hard-to-abate sectors will be forced to use hydrogen or its derivatives to decarbonize,” DNV said in its hydrogen report. “Although the cost of hydrogen will continue to fall and approach the US$1/kg to $2/kg range, uptake will mostly still be driven by the increased cost of the alternative because of carbon pricing, or by decarbonization mandates.”

To meet targets set in the Paris Agreement, hydrogen would need to meet about 15% of global energy demand by mid-century, according to DNV. It foresees slow uptake of hydrogen globally though, reaching 0.5% of the world’s energy mix in 2030 and 5% in 2050. In some regions, however, hydrogen’s share in the energy mix could be double these percentages.

“Much stronger policies are needed to scale beyond the present forecast, in the form of stronger mandates, demand-side measures giving confidence in offtake to producers and higher carbon prices,” the report said.

Bruce Niemeyer, vice president of strategic planning for Chevron, explained how the company is putting the pieces together with collaboration. It has partnered with Caterpillar Inc. to develop hydrogen demonstration projects in transportation and stationary power applications. The two are working with BNSF Railway Co. to confirm the feasibility and performance of hydrogen fuel for line-haul rail.

“We produce a lot of hydrogen every day in our current refining operations. … Caterpillar can build the engine that burns it, and BNSF has a use case to put it in a locomotive and create a hydrogen railway,” Niemeyer said. “It takes all of those pieces to come together. And the reason we are involved in this is we see an opportunity to lead, to bring those pieces together, because that’s ultimately all that’s required in order to turn hydrogen from a concept into reality.”

Recommended Reading

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Exxon, Chevron Tapping Permian for Output Growth in ‘24

2024-02-02 - Exxon Mobil and Chevron plan to tap West Texas and New Mexico for oil and gas production growth in 2024, the U.S. majors reported in their latest earnings.

After Megamerger, Canadian Pacific Kansas City Rail Ends 2023 on High

2024-02-02 - After the historic merger of two railways in April, revenues reached CA$3.8B for fourth-quarter 2023.

Shell’s CEO Sawan Says Confidence in US LNG is Slipping

2024-02-05 - Issues related to Venture Global LNG’s contract commitments and U.S. President Joe Biden’s recent decision to pause approvals of new U.S. liquefaction plants have raised questions about the reliability of the American LNG sector, according to Shell CEO Wael Sawan.

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.