The third-quarter price of the hypothetical NGL barrel averaged almost 50% higher than the same period last year, with movement in September resembling the tip of a chartable hockey stick that provided the increase.

The third-quarter price of the hypothetical NGL barrel averaged almost 50% higher than the same period last year, with movement in September resembling the tip of a chartable hockey stick that provided the increase.

It was the best month and quarter of the year for prices, and the best September and third quarter since 2014, when the oil and gas downcycle began.

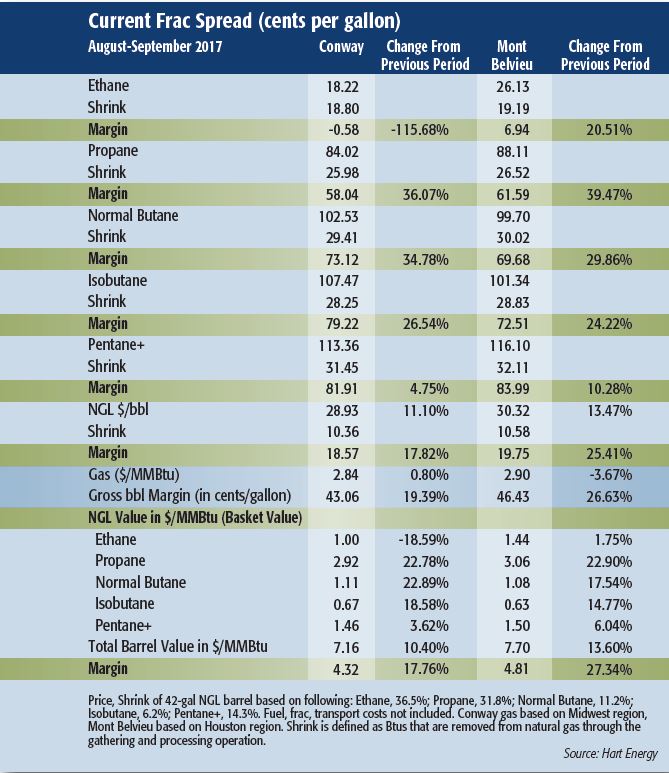

And while weekly average prices for all NGL tumbled at both the Mont Belvieu, Texas, and Conway, Kan., hubs, a softening of natural gas prices allowed margins for six of the 10 NGL to expand.

Geopolitical tension surrounding the independence referendum in Kurdistan will likely support a West Texas Intermediate crude oil price above $50 per barrel (bbl), En*Vantage Inc. believes, with Turkey threatening to halt oil exports through its territory and Iraq demanding an international boycott. Kurdistan produces about 600,000 barrels per day (Mbbl/d) of crude, so the expected protracted political negotiation could influence markets for some time.

Hurricane Harvey put a dent in ethane prices in the quarter, snuffing a slow but steady rally with its assault on the Gulf Coast and the concentration of ethylene plants in the region. Still, ethane was up 9.1% in the third quarter over the second quarter at Mont Belvieu, and the September price dipped only slightly. Conway prices slumped more sharply.

Factors that have buoyed ethane prices, despite the storm’s damage, are both current and anticipated increases in demand. Dow Chemical’s LHC-9 ethylene plant in Freeport, Texas, began operations in September. That facility has an estimated capacity of 90 Mbbl/d, En*Vantage said.

The other demand source is exports.

En*Vantage estimates that Enterprise Product Partners LP’s Morgan’s Point terminal on the Houston Ship Channel shipped about 130 Mbbl/d in September, an increase of about 117% over August.

The dramatic price rise of propane, which drove the hypothetical barrel above $30/bbl at both hubs during the quarter, was reflected in a 48.6% increase at Mont Belvieu and a 49.4% jump at Conway. In the past year, propane was up 69.5% at Mont Belvieu and 72.6% at Conway.

The quarterly price of isobutane surpassed $1 per gallon (/gal) at both hubs for the first time since fourth-quarter 2016. A similar trend held for condensate: C5+ reached $1.20/gal for an average weekly price in September at Mont Belvieu for the first time since February. Prior to that, the price had not hit that level since June 2015.

Butane topped $/gal for the third quarter at Conway and came less than half a cent short at Mont Belvieu. The monthly price was over $1/gal at both hubs for the first time since February.

Joseph Markman can be reached at jmarkman@hartenergy.com or 713-260-5208.

Recommended Reading

CEO: Linde Not Affected by Latest US Green Subsidies Package Updates

2024-02-07 - Linde CEO Sanjiv Lamba on Feb. 6 said recent updates to U.S. Inflation Reduction Act subsidies for clean energy projects will not affect the company's current projects in the United States.

Global Energy Watch: Corpus Christi Earns Designation as America's Top Energy Port

2024-02-06 - The Port of Corpus Christi began operations in 1926. Strategically located near major Texas oil and gas production, the port is now the U.S.’ largest energy export gateway, with the Permian Basin in particular a key beneficiary.

US Gas Producers’ Growth Tied to Export Markets

2024-01-25 - Over 70 U.S. gas producers supplying Cheniere Energy’s liquefaction facilities Gulf Coast liquefaction facilities understand the link between export markets and their success, the company’s executive vice president and chief commercial officer Anatol Feygin said.

Report: Biden to Announce Delay on New LNG Export Terminal Approvals

2024-01-25 - Sources say the White House plans to add climate change considerations to LNG export approval process.

Operators Urge Feds to Delay Impending Helium Reserve Sale

2024-01-24 - The government is opening sealed bids for the Federal Helium Reserve this week. Operators and stakeholders of the system worry that the helium supply chain could shut off after changing hands to a private owner.