Rio de Janeiro, Brazil : Aerial view of Christ and Botafogo Bay in Rio de Janeiro, Brazil. (Source: Shutterstock.com)

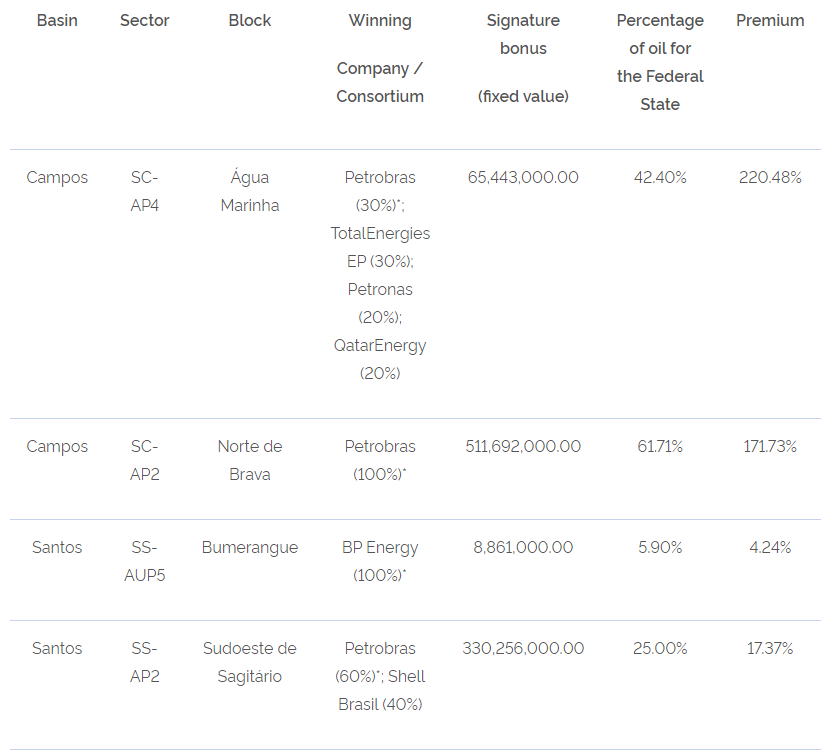

Brazil’s oil regulator, the National Petroleum, Natural Gas and Biofuels Agency (ANP), auctioned four blocks in the Santos and Campos basins in its first cycle permanent production sharing offer (OPP), generating signature bonuses of R$916,252,000 ($176 million), which represented 72% of the maximum possible.

The four blocks, including Água Marinha and Norte de Brava in the Campos Basin and Bumerangue and Sudoeste de Sagitário in the Santos Basin, will require investments of around R$1.44 billion ($277 million) related to the exploration phase of the contracts alone, the ANP said Dec. 16 in a press release on its website.

Companies acquiring blocks in the round included Brazil’s state-owned Petrobras, TotalEnergies, Petronas, QatarEnergy, BP Energy and Shell Brazil.

“The most notable winner was BP, which picked up Bumerangue, the highest risk award of the round,” Welligence Energy Analytics wrote Dec. 16 in a post on LinkedIn.

“The involvement of large international companies is encouraging, but most of the acreage awarded was lower risk, including areas with extensions of existing discoveries,” Welligence said. “This reflects the sector reluctance to engage in high-risk exploration and the underwhelming results of recent pre-salt exploration – the ANP may need to continue refining its terms.”

As in previous rounds under ANP’s sharing regime, the signature bonuses – an amount paid in cash by the companies that win areas in the bidding process – were fixed and determined in the public notice, the ANP said. The criterion for choosing the winning companies was the oil surplus for the union.

Signing of the contracts is expected to take place by Apr. 28, the ANP said.

“Today we had a good result for Brazil… which will result in economic activity, jobs and income for Brazilians,” ANP Director-General Rodolfo Saboia said in the press release.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.