[Editor's note: A version of this story appears in the November 2019 edition of Oil and Gas Investor. Subscribe to the magazine here.]

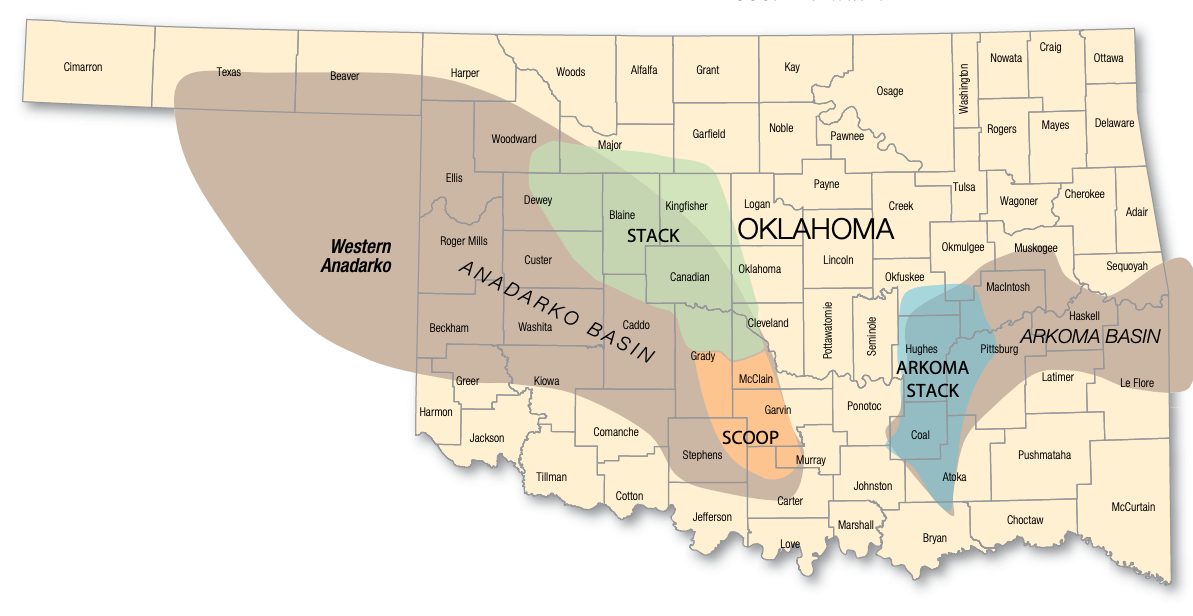

The rig count in the Anadarko Basin has fallen from about 175 in 2018 to about 90 in August. Several operators are reporting getting more work done with less iron in the field—rather than diminished interest in the basin—as spud-to-TD days fall precipitously.

Continental Resources Inc.’s “row development” and Encana Corp.’s “cube development” have rigs essentially marching across leasehold. The “marching” part isn’t metaphorical either, as the rigs actually “walk.”

Meanwhile, in the western Arkoma gas-liquids play, shallow decline rates have enabled operators to rig down for a while without affecting cash flow. They were seeing half-priced NGL prices entering autumn.

expectations, Continental Resources Inc.’s 75-contiguous section SpringBoard project in the northern Scoop is exceeding operational expectations, said Jack Stark, president.

And, in the western Anadarko Basin, FourPoint Energy LLC continues to shift its program within its nearly 750,000 net acres, drilling on demand whatever commodities the market values most.

SpringBoard

In the southern Anadarko Basin—in the Scoop area—Continental is landing in the Woodford and Springer as well as testing laterals in the Sycamore, which is the age equivalent of the Stack’s Meramec and sits between the Springer and Woodford.

Continental announced its Scoop-Woodford play in 2012 and the Scoop-Springer in 2014. In May of 2018, it announced the 75-square-mile SpringBoard project at the northern end of the Scoop.

Through the second quarter of 2019, SpringBoard has made some 5 million barrels (bbl) of oil, gross. Resource potential is estimated at up to 400 million barrels of oil equivalent (MMboe), gross.

The E&P has an average of 75% working interest in SpringBoard. EURs in the project are expected to average some 1.3 MMboe from the Springer, about 80% oil; from the Woodford, between 1 and 1.5 MMboe, about 70% oil.

The concentrated development means more than 90% of production to date is connected to a network of pipe. Some 60 wells were online in the project by mid-August: 46 Springer; 14 Woodford.

Another 30 wells were expected to be online by year-end. Estimated total locations in the project area are 85 Springer wells and up to 250 Woodford and Sycamore wells.

Initially, Continental estimated it would add 16,500 bbl to daily net oil production by the end of third-quarter 2019. In the second quarter, it was already averaging 15,000 barrels per day (bbl/d), and new estimates were for 18,000 by the end of the third quarter. The revised estimate is an average of 22,000 bbl/d in this quarter.

The Springer’s thickness is between 15 and 90 feet; the Sycamore, 150 to 200; the Woodford, 125 to 200.

In a placement plan Continental calls “row development,” the 75-contiguous-section area is also exceeding operational expectations, said Jack Stark, Continental president. “It’s just been an exceptional project for us.”

First, “the reservoir rocks themselves are pretty darn exceptional,” Stark said. “They’re delivering every bit as well as or better than we anticipated.” The completion recipe is essential, “but if you don’t have the best rock, you’re not going to get the best results.”

Continental began leasing in the area it named “Scoop” in the Anadarko Basin in 2008. “It was a very tough economic time,” Stark noted. “You had the fallout in the financial institutions. But we managed to lock up really what we consider to be the core.”

Pat Bent, senior vice president of operations, said SpringBoard “is an operational dream, when you think about having the opportunity to have that contiguous of an acreage position.”

Continental moved in with 14 rigs initially, landing wells side by side across the entire play.

“You think about the optimization opportunities,” Bent said, “looking at what the rig next to you did, being able to optimize on that—not only in the Springer but in the Woodford as well.”

Row development

Drill days for Springer wells have declined from 46 to about 32. Woodford-well cycle time fell from about 55 days to an average of about 23 by this summer. The team, led by Tony Barrett, vice president of exploration, determined the pressure profile in Scoop would accommodate a no-set casing design for the Woodford program.

Bent said, “No-set refers to the intermediate casing string. You still have a full string of production casing, but you’re able to eliminate the intermediate casing, and that was a $1 million savings [per well].”

Further operational savings have pared Woodford costs by an additional $2 million. Continental plans to exit 2019 with 12 rigs across Oklahoma, seven fewer than were budgeted.

Stark said, “The well count for the year doesn’t change. It’s just the number of rigs we need to get that done has been reduced.”

As for completions, the SpringBoard team, through mid-September, completed 22% more lateral feet than budgeted and at 17% less cost, Stark said. “So it gives you a good indication of not only the cycle-time efficiencies but the capital efficiencies that we’re achieving out of this.”

SpringBoard gas is shipped to the premium-price North Texas market. Water is shipped to Continental’s in-play recycling facilities. Bent said, “We can reuse that water for stimulation purposes, which minimizes our water use and cost.”

SpringBoard oil—“that’s our best netback,” Stark said—goes to an in-play CVR Energy Inc. refinery at Wynnewood. It receives a roughly $3/bbl premium to West Texas Intermediate (WTI).

“So everything just lines up really well in SpringBoard to make our operation one of the most efficient in Oklahoma,” Stark said.

Row-development wells are primarily 2-mile laterals. Bent said, “There were situations from the lease perspective where we had a few 1-mile wells, but that was the exception rather than the rule.”

Rigs drill from east to west. Stark said, “So this is true row development, as we are manufacturing the hydrocarbons from the reservoirs in a very uniform and methodical manner.”

The completion recipe can vary. Bent said, “It’s similar in nature. But, again, we try and optimize across all of our plays. So stage spacing, proppant loading, fluid loading vary slightly within that play—pad to pad and formation to formation.”

But they’re small changes, Barrett said. “Not big swings. ‘Tinkering’ is probably an accurate description.

casing design for

Woodford wells

in the Scoop has

resulted in a $1

million savings

per well, said Pat

Bent, Continental

senior vice

president of

operations.

“Throughout the testing and early development of our project areas, we find the right recipe for our completion and, in general, only make modest changes to the design unless we acquire new data that suggest a major change is warranted.

“The goal is always to maximize production from any given wellbore. Our next challenge is to try to find a way to do it cheaper that will enhance returns.”

Stack extension

In Blaine and Custer counties in the Stack-play westerly extension north of SpringBoard, Continental has two rigs drilling. The Meramec and Woodford are the targets; they’re deeper here in this overpressured area of the Stack. Five units had been completed this year through mid-September.

Stark said, “All five of those are outperforming our type curves. Two of the five—the Jalou and the Simba units—paid out in a little under a year. They were that good of performers.”

More recently, the three one-section wells from the oil-window Lugene unit had a combined initial rate of 9,270 boe/d, averaging 3,090 boe/d per well with 1,540 bbl/d of oil each.

The five wells from the condensate-window Tolbert unit had an initial rate averaging 3,740 boe/d with 1,180 bbl/d of oil each.

Spacing currently is four wells per zone, Stark said. “It will vary a bit from unit to unit. But that seems to be the model, and that’s what’s playing out.”

Two newer Stack units were being completed at press time—the Reba Jo and the Shulte. “Those are seven-well units where we’re developing two zones. We expect to have some very good results from those as well.”

These two units are in the oil window. In each, four wells are landed in the Upper Meramec; three, the Lower Meramec. Barrett said, “About 12 months ago, we began moving back more into the oil window, and that’s what you’re seeing now.”

Continental operates more than 40% of Stack wells that have had first-30-day IPs of greater than 1,500 boe/d. “It’s quite striking,” Barrett said. “We’ve said all along that zip code matters.”

EURs range up to 2 MMboe. Stark said, “They’re some of the biggest wells we have drilled in our careers. The reservoirs we’re tapping into here are great performers, giving us great economics, great returns.”

Continental’s overall Oklahoma oil production—including the Scoop and Stack—is up 35% year-over-year to more than 36,000 bbl/d. Its total Oklahoma production is up 10% year-over-year to more than 128,000 boe/d.

Stack core vs. fringe

So why the grumbling on Wall Street about the Stack? Is something wrong with it?

overpressured

Stack units

are delivering

enormous IPs.

“We’ve said all

along that zip

code matters,”

said Tony Barrett,

vice president of

exploration.

Stark said, “No, no, no. It’s a good question because you’ve heard a lot of mixed results [from some operators] out here. It has everything to do with geology.”

Continental added a map to its investor presentation, Barrett said, “because we got that question a lot from the investment community.” It indicates where the largest IP wells are in the Stack; they’re in the original core play and in the adjacent, westerly extension.

“What it shows is where you are in the play really matters. Geology does matter,” Barrett said.

The Stack play was introduced in 2013 by Newfield Exploration Co., now part of Encana Corp., in the original core in western Canadian and Kingfisher counties. Usually, a new play will draw other operators to see what they can do in their leasehold and pick up more land.

Early assumptions may be that the targeted rock is all the same, east to west, north to south. But the results aren’t.

“You’ve got Continental that’s knocking it out of the park,” Barrett said. “And some other people are struggling. But there is nothing wrong [with Continental’s share of the Stack].

“We’re in great geology. We’re highly overpressured. We’ve had a ton of success—four quarters of wells that are as good as most of us have ever drilled in our career.”

Stark said, “If you look at where Stack started [with Newfield] and then you look at what the investment community ultimately started to call Stack, it was a much bigger footprint.”

Areas on the periphery, particularly east of the original play, “just underperformed,” Stark said. “The results coming from our area farther to the west are looking very good.”

Continental discovered the Ames astrobleme conventional field in northern Oklahoma in the early 1990s, made a horizontal success on the Nesson Anticline later that decade, was an early entrant in the fracked horizontal Montana Bakken in the early 2000s, made an IPO-level company out of the fracked horizontal North Dakota Bakken, invented the Scoop play and led the westerly extension of the Stack.

What’s the secret? Stark said, “Basically, it’s being an early entrant in a play and really understanding the geology. It has enabled us to have dominant positions in core portions of these plays. Combined with our operational expertise, you have a winning combination.”

In Oklahoma in particular, Barrett added, “Continental has a 51-year history. We operated in a lot of these plays before horizontal. Our understanding of the basin, the rock and how to operate here are huge advantages for us as a company.”

Encana Stack

Encana purchased Stack founder Newfield Exploration in February for $5.5 billion in stock and $2.2 billion of debt assumption.

Newfield had been operating in the Anadarko since 2001 while Lower 48 exploitation was still vertical, except for the beginning of the fracked horizontal Bakken play.

Newfield began a horizontal program in the dry-gas area of the western Arkoma Basin Woodford in 2005. Beginning in 2011, it pieced together more than 265,000 net acres in the Anadarko, naming the play Stack, for liquids pay from tight Meramec and the Woodford. It revealed the position in 2013.

A distinct name for it was essential in differentiating it from the high-water-cut Mississippian Lime play to the north, according to other Stack operators. The Meramec is Mississippian Lime.

But, in the Stack, it sits under the Chester Shale, which is a barrier between the Meramec and the water. To the north, the Chester seal is eroded, thus the water cut there.

RELATED:

Encana Accelerates Transformation With New Name, Headquarters

Encana is now the largest Oklahoma oil producer at some 163,000 boe/d, 65% liquids, ending second-quarter 2019. It brought 89 Meramec wells online this year through August. Infill wells’ IRR is more than 50%.

Net leasehold in the state is some 360,000 acres. Capex toward its Oklahoma program this year is $850 million. It sold its gassy Arkoma Basin portfolio in August for $165 million.

As its Stack leasehold—focused in Canadian, Kingfisher and Blaine counties—has been HBPed, Encana has moved to pad development. The Meramec is still the primary target, but it’s been able to add deeper Woodford into units more often.

The current completion recipe is largely its 2018 version. “Generally speaking, the size of the job—the proppant per foot, the gallons per foot—hasn’t changed that much over the last, say, 12 months,” said Matt Vezza, Encana vice president and general manager, Anadarko operating area.

What has changed is that Encana brought enhanced completions to the play, accelerating the speed of completions. “We went from pumping our stimulations at 80 barrels a minute to 100 barrels a minute or more.”

Reducing time spent has cut frack-job costs, but it is also bringing first revenue closer to first spend. “You get through the ‘cubes’ quicker.”

Encana calls its pad development “cube development.” Completing cubes quicker is resulting in a faster learning cycle, Vezza said. “You can apply improvements to the next cube development and accelerate those learnings.”

What is the difference between cube and pad development? It’s several sections rather than a two-section rectangle. In one aerial image, four rigs are at work, side by side—like a zipper frack, but a zipper drill.

“Logistically, we set the location up differently,” Vezza said. “There’s a lot more efficiency in how we move equipment. That’s been a huge win.

months, Encana

Corp. has cut

Stack new-well

costs by $1.4

million, said

Matt Vezza, vice

president and

general manager,

Anadarko

operating area.

“Cube development isn’t just about the subsurface. It’s also a lot to do with how you manage logistics and supply chain at the surface.”

Costs per well have fallen by $1.4 million under Encana to $6.5 million. “We’ve experienced a significant amount of cost savings due to supply-chain management—how we self-source sand and chemicals—and how we set up the location.”

Encana is landing between six and eight wells per two-section unit. Putting two of these units together, “we’re completing from 12 to 16 wells. We drill them, we rig off, we complete them and, then, we move onto the next site.”

From the cube approach, the target is spud to first sales in 90 days.

Scoop and Score

Encana also gained leasehold and production from Newfield in the Scoop. All five of the rigs it had at work in Oklahoma in mid-September were drilling in the Stack, however.

Vezza said, “We do go into the Scoop from time to time. In fact, we plan to move rigs there soon. But, in 2019, about 85% of our activity has been in the Stack.”

FourPoint

president and

CEO, said the

company has

greatly reduced

drilling time

and costs.

Its Oklahoma rig count is down about three or four from 11 at year-end 2018. But the company hasn’t cut capex. Instead, with cube development, “we are more efficient, enabling us to run fewer and result in the same amount of production on an annual basis.

“We’re going to try to stay at around four or five rigs next year. We’re just getting more efficient all the time. We’re getting better at drilling. We’re getting better at completions; going from 80 barrels a minute to 100 just makes our cycle time so much quicker.

“Effectively, we’re turning on a similar number of wells, even though we’re at a lower rig fleet.”

Newfield had launched another Oklahoma play—the Score—in 2017. It’s named for testing laterals in the Sycamore, Caney and Osage. It’s put a couple of Osage wells in the Stack and, early this year, a couple of Caney wells in the Scoop.

Vezza said, “Those are good targets and it’s in our inventory. When we get back in the Scoop in a bigger way, especially the northern Scoop, [the Sycamore] would be something that we work into the plan.”

In the Stack, it’s landing only in the Meramec and Woodford right now. EUR from the Meramec is 1.3 MMboe on average, about two-thirds liquids.

7,500 feet of

hydrocarboncharged rock,

FourPoint Energy

LLC has “the

ability to chase

oilier zones, and

that’s what we’re

focused on,” said

Jacob Shumway,

vice president,

engineering.

In well placement, “we think you can fracture the entire Meramec no matter, really, where you place your wells. But geometry of that fracture will be a little bit different depending on where you place your well.

“So we think staggering offers an advantage of more effectively accessing and draining the resource in the Meramec.”

Stack logistics

Encana is using Permian and Anadarko completion services and products interchangeably. “We can contractually use our sand volumes between both basins,” Vezza said. “It creates economies of scale in contracting and utilization. You can get better rates and contracts.”

Although Encana isn’t taking sand from one basin to the other right now, being in both plays—each with in-basin mines—is resulting in a contract price that reflects an opportunity to transfer all of its business to mines in either basin. “It helps with managing risk,” Vezza said.

Prior to the merger, it might have been using in-basin sand; the completion provider was sourcing it. Today, it is self-sourcing sand and all of it is in-basin.

Before buying Newfield, Encana told The Street it would reduce well costs by $1 million post-merger. There was skepticism. “And then you see it happen literally right out of the gate,” Vezza said.

By mid-September, savings per well had further grown to $1.4 million.

Some Permian field personnel were moved to the Anadarko “and they are just phenomenal. The collaboration between the operational teams from across the assets has been remarkable. Our teams are working together to find efficiencies everywhere,” Vezza said.

“They know that, if they can save minutes, those minutes add up to hours and those hours add up to days. And they’re focused on doing it safely and doing it right. That translates into better wells and lower cost.”

There are more efficiencies to come, he added. “We really feel like we’re just getting started.”

Western Anadarko

Denver-based FourPoint Energy has nearly 750,000 net acres—most of it HBP—in the western Anadarko Basin where the Granite Wash, Cleveland and Lower Cleveland, aka the Marmaton, are the primary targets these days.

It has Tonkawa acreage too, but most of the Tonkawa inventory was developed by Chesapeake Energy Corp. prior to FourPoint taking in that portfolio in 2015.

“While we haven’t drilled a horizontal Tonkawa since last year, we are working on a number of locations to drill as part of our 2020 program,” said Brendan Curran, FourPoint vice president of geology.

“We have just been more focused on the Lower Cleveland and a couple of areas in the Granite Wash this year. The Tonkawa is probably the most mature of the plays on our footprint.”

Last year, FourPoint shifted rigs from the more gas-prone areas of the Granite Wash to the oily Cleveland and Lower Cleveland as gas-basis differentials increased.

Jacob Shumway, vice president, engineering, said, “We’ve made a concerted effort to increase our liquids mix.

“Given that we have more than 7,500 feet of hydrocarbon-charged rock, we have the ability to chase oilier zones and that’s what we’re focused on.”

The operator has more than 20 pay zones in its leasehold. Since 2014, FourPoint has made wells in 18 benches with “economic success in all of them,” Shumway said.

George Solich, president and CEO, said, “All gas-dominated basins have challenges in today’s commodity-price environment. But with a strong technical approach, FourPoint has been able to drill some of the best wells in our Midcontinent history by greatly reducing drilling time and costs, being very specific with well placement and optimizing our completions.”

FourPoint, whose founders have worked the western Anadarko in start-ups since 2000, is using a 4.0 drilling and completion model.

Having consolidated a great deal of acreage, “we hit the reset button” in 2016, said Scott Goodwin, vice president of operations, “and we brought new technology, better processes and better tools to the basin.”

Drilling times have been halved. “So we’re drilling wells twice as fast as we were just three years ago,” Goodwin said. “And we’re also doing that in a more challenging environment in terms of taking them from short to long laterals.”

Meanwhile, savings on completions and other services, including using in-basin sand, have resulted in overall savings of 30% of total well costs. On a cost-per-foot basis, 2016 started at about $900; currently, it’s about $620.

As the laterals are longer, the savings are further compounded. “That rolls up to millions of dollars of savings per well.”

Extended laterals

Tony Cristelli, vice president of land, said the Oklahoma Energy Jobs Act in 2017 has contributed to FourPoint being able to drill multisection laterals, while “other operators that previously held these Oklahoma assets were unable to capture those efficiencies.”

The law change permits multisection laterals in any formation—shale or not. Previously, extended laterals were allowed under a 2011 law in shale formations only.

law change

to allow

multisection

laterals in any

formation in the

state, FourPoint

immediately

began landing

extended laterals,

said Brendan

Curran, FourPoint

vice president,

geology.

Some of the western Anadarko play is in the Texas Panhandle, where extended laterals were already allowed, but a large portion of the play is in Oklahoma. Shumway said, “So [the Oklahoma law change] was a really big deal for us.

“Not having to drill two vertical portions of hole and now accessing twice the rock, you have an immediate cost savings.”

In 2018, 29 of its 43 new wells were extended laterals, Curran said. “FourPoint started executing those long laterals immediately [upon the law change]. We’ve continued to weight our program toward long laterals.”

The company is adding more leasehold where it is strategic. “We’re always in the market to some degree,” Cristelli said. “But, at this point, we’re focused on execution and return on invested capital through the drillbit.”

Inventory is 9,000 locations. Among them, between 500 and 1,000 are economic at current commodity prices, assuming at least a 20% rate of return. The stream is about 20% crude oil, 25% NGL and 55% gas.

Spacing, productivity

FourPoint had two rigs at work in September. “We started the year with five,” Goodwin said. “As our cycle times have continued to drop, we’re drilling more wells with fewer rigs.”

Completions tested are more than 2,500 pounds per foot in the play, but the main recipe is 1,000 to 1,200 pounds per foot.

Curran said, “We’re not dealing with rock that is quite as tight as the formations being exploited in the Bakken, Eagle Ford or Permian.” Within FourPoint’s leasehold, it has increased its completion intensity in some zones; in others, it hasn’t.

“I don’t know if I would call it larger fracks,” Curran said. “We’ve been doing a lot of work to optimize stage and cluster spacing and the right proppant per foot.” Results have improved well productivity between 10% and 40%.

In the Granite Wash, where FourPoint has landed wells in the past three years in six different zones, “you have pretty high rock quality. We haven’t had to pull the lever much on the frack size.”

adding leasehold

where it is

strategic, but,

“at this point,

we’re focused on

execution and

return on invested

capital through

the drillbit,” said

Tony Cristelli,

vice president,

land.

Wells are stacked there in about 3,000 feet of pay. Shumway said, “We didn’t have to worry too much about vertical communication.” Within the stratigraphy, “there are very good barriers between our target zones.

“We have quite a bit of breathing room here. But we’re also not trying to push the limits of getting less than maybe 150 feet of separation.”

FourPoint is averaging three Granite Wash wells per bench in a section, Curran said, “and we’re looking closely at additional benches we can add.”

There are more than 100 type-curve areas in FourPoint’s acreage; many of them are prolific, Goodwin said. A modern Wash well, for example, can be expected to make 20 million cubic feet (MMcf) and hundreds of barrels of condensate per day.

Wells in more liquids-rich plays, like the Lower Cleveland, have recently come on at more than 1,000 bbl/d of oil, he added.

Cristelli said the western Anadarko’s complexity has given FourPoint an advantage in producing it and in valuing bolt-on acreage. “Rigorous internal technical modeling has helped us pinpoint where we want to target opportunities—from both a development and transactional perspective.

“There is more variability in the geology out here than in [a shale play].”

Shumway said, “It takes more from a technical perspective to make sure you’re laying out your development plan appropriately.”

But, Cristelli added, “our portfolio yields optionality on the commodity-price environment. If we want a more oil-weighted program, we have the flexibility to do that.

“There are also abundant gas reserves; if we want to focus on a more gas-weighted program, we can transition to that as well.”

Solich said, “The Midcontinent region remains a world-class hydrocarbon resource with thousands of locations yet to be drilled.”

Liquids Arkoma

In the new Arkoma Basin play, Old Ironsides Energy LLC-backed Calyx Energy III LLC is landing horizontals in the Caney, Mayes and Woodford. The Caney is at about 3,000 feet, the bottom of the Woodford is at about 4,700 feet and the Mayes, which is age-equivalent of the Meramec, sits between.

“With all those zones, your recoverable gas per section is in kind of world-class numbers out there,” said Cal Cahill, president and CEO.

In this mostly three-county play—centered around Hughes County—in the western Arkoma, it’s wet gas. “But nobody wanted to mess with that in a horizontal because it’s so hard to get the gas to move [at normal pressure].

“We felt the technology had come along where we could come back here and try it.”

Tulsa, Okla.-based Calyx has 210,000 gross, 150,000 net, acres—in Hughes, Okfuskee, Okmulgee and McIntosh counties, about 60% HPB. The Caney covers the entire holding.

For the Mayes, it fracked two wells. The first was marginal with a 10% to 15% type of return. “I think it’s probably the oiliest well in the Arkoma. We’re seeing cums around 75,000 bbl.”

Calyx moved back into more of the Woodford wet-gas mode for the second well. “And early results are similar to what you would see on a Woodford.”

“Our first Caney, a 4,000-foot-lateral test was just a test. The one-section lateral shouldn’t have been enough to make a well. But that one actually is still producing today,” Cahill said. “That’s going to be about 2 Bcf, which was enough to get us our money back on a 4,000-foot well.

“So it’s been an encouraging play—challenging, but encouraging.”

While the formations are at a shallower depth than in the Anadarko, they’re cooked because they were deeper at one time—some 10,000 to 12,000 feet deeper. “It got thermally mature.”

Btu from the zones ranges from 1,260 to 1,300 for gallons per Mcf (GPM) of 5.4 to 7. “Most of the time, we’re about 50:50 liquids-gas.”

Calyx’s leasehold is about 20 miles northwest of the northern end of the former Newfield Arkoma property. There, production is dry gas. “Our southernmost acreage, we stopped at [the beginning of] dry gas,” Cahill said.

“We had to choose: Are you a dry-gas company or a wet-gas company? The plants are going to be built for the recovery of the liquids.”

The neighborhood pointed to Calyx doing better with wet gas. “If I have dry gas, I have to compete with the Haynesville, and they’re 23 to 27 cents closer to market than I am.”

Calyx designed its gas plant to handle 6.2 GPM. Tall Oak Midstream III bought it and finished construction of the gathering system and built a 200-MMcf plant. Other gas-processing facilities in the area are, at most, 2 GPM, if handling any liquids at all, Cahill said.

10-year model

Cahill has worked with the Old Ironsides team dating back to when the latter was part of Liberty Mutual Holding Co. and had 25% nonop interest in Calyx I’s assets.

For the current Calyx, Cahill was looking for private equity that could wait as long as 10 years. It was 2014, and Cahill didn’t think “the five-year [PE] model, with the volatility we anticipated coming up, was a good model.”

The Old Ironsides team was willing to go 10 years. In addition, “they were willing to allow us to not only have a gas company, but a pipeline company, plus a water company.” Cahill didn’t expect existing pipe in the area—as much as 60 years old—could handle the type of wells he was expecting.

“They would be between 5 and 10 MMcfe a day. So we had to lay pipeline.” In addition, building a water system would keep costs “as low as we felt we needed to develop this.”

Reusing water pared freshwater need by 5.4 MMbbl in 2018.

Calyx I and II had operated in northern Oklahoma where there is a high water cut. “You know the old belief that ‘if 30,000 bbl a day is good, then to inject 80,000 must be better.’ That didn’t work very well [in northern Oklahoma]. They ended up having issues.”

Calyx III picked the wet-gas area of the Arkoma in part because water isn’t as great an issue. It has two disposal wells; neither injects more than 15,000 a day. “And our intent is to try to put as little into disposal as possible.”

This depends on the frack schedule, though: There is a lot of flowback water after a zipper frack, but very little otherwise. “Typically, they’re probably working 20% of the time. It’s a timing thing—where you just got hit by too much water, so you have to put some in the ground.”

Calyx has 96% working interest in its wells. Production is between 105 and 120 MMcfe right now with an average Btu of some 1,250. In mid-September, it had a three-well frack underway. It dropped its rig in July and was expecting to rig back up at press time for some infill drilling.

drilling times

have been halved,

“so we’re drilling

wells twice

as fast as we

were just three

years ago,” said

Scott Goodwin,

vice president,

operations.

NGL prices

NGL prices have fallen precipitously this year. Cahill said, “It was getting crazy enough out there to reassess what we wanted to do. So we chose to settle back down.”

He doesn’t think the poor price will last as long as some forecasts. “I’m still bullish on liquids, even as horrible as they are right now.”

Laterals are two-section and up to 11,400 feet. “Being as shallow as we are, there’s a lot where you couldn’t even do that—get pipe in it. The farther you go like that, the more your well is not going to be level.

“You’re going to have some humps in it and all. Right now, I would say our sweet spot next year will probably be right around 10,000 feet.

“The rock is incredibly broken up in all the zones but more in the Caney and the Mayes than the Woodford. It just has more brittleness to it.”

Proppant has been as much as 1,500 pounds per lateral foot and, lately, closer to 900. “Now that’s a lot lower than other people. But, since we’re shallower, our fractures end up staying open longer.

“We’re in that massive sweet spot of where there’s relaxation. So the fracturing created with the formation of the basin has really splintered up the rock. It’s part of how we get our well costs as low as we are now.”

Water is about 35 barrels per foot, so one well is about 250,000 bbl of water and 7.5 to 9 million pounds of sand. In 2018, costs were about $425 per foot on a 10,000-foot lateral; this year, about $365. “So you’re looking at a 10,000-foot well at $3.6 million.

“We’re proud to be called a low-cost operator. There were many years they were calling us ‘cheap blank blanks,’ but this is kind of our MO. This is when we thrive.”

has concluded,

consolidation

among liquidsrich, PE-backed

western

Arkoma Basin

producers may be

promising, said

Luke Essman,

president and

CEO of Canyon

Creek Energy-

Arkoma LLC.

The average type curve is about a 7-Bcf well for the Caney and Woodford; for the Mayes, it’s early, but Calyx has defined at least 6 Bcf.

F&D is about 51 cents per Mcfe. “Part of our low costs is that we don’t haul water. Operating costs for water is less than 20 cents a barrel to handle. I lay my water pipeline when I’m laying the gas pipeline.”

Netback in August was about $2.10, “which is horrid. But, then, I have read that some operators over in the Permian—companies I really respect—have experienced minus-45-cent netbacks. So I can’t complain about my $2.10.”

Oklahoma legislation that permits extended laterals in any rock in Oklahoma has been a great help in the new Arkoma play, he added. “Our area has a lot faulting. So we need to be able to move around.

“The faulting is good, but you don’t want to cross too many big faults, if you don’t have to. So [the new law] gives us that ability to put up to three sections together, if that’s what we need to do. We had no doubt that we had a profitable play once that became available.”

Calyx expects by year-end 2020 to be making up to 175 MMcfe/d, including about 23,000 bbl/d of liquids. If a sale of the portfolio isn’t possible, “we’ll go into maintenance mode.

“Our declines are very, very flat—especially in the Caney, and it appears to be the same in the Mayes, but it’s a bit early before I say that—compared to what most people have to deal with.”

The production level can be maintained with 25 wells a year, he said. The Woodford decline rate is “a B Factor 1.5, which is still good.

“We have 10 years. We’ll keep going until somebody’s ready to buy it.”

Develop, rather than sell

Tulsa-based Canyon Creek Energy-Arkoma LLC entered the Arkoma in the spring of 2014, buying leasehold, selling leasehold, buying other leasehold. Luke Essman, president and CEO, said, “I guess it’s been kind of a rollercoaster of results in the basin, as you would expect from targeting new benches, new intervals within existing benches.

“And, then, applying modern development, modern completions—both on frack sizes, stage spacing, pumping, all parts of the completion.”

Backed by Vortus Investment Advisors, Canyon Creek operates currently in the wet Arkoma play. Recovery per lateral foot from the Woodford and the Mayes has improved a great deal.

“We’ve seen better liquids recovery [here] across the western edge of the basin, and that’s going to be principally in NGL barrels and some crude oil in production.”

Reduced NGL prices this year have affected the industry overall. “[Canyon Creek has] achieved quite a bit of our original thesis of what we could accomplish in the basin related to production.”

Rather, price “has moved against us,” Essman said.

Along the traditional private-equity timeline of a five-year exit target, Canyon Creek would be ready but for the anemic A&D market. Rather, it is transitioning from an “asset generator” model to a “develop mentality,” which is occurring amongst many private-equity-backed E&Ps.

“Our best rate of return that we see in creating enterprise value for investors is through development, if we’re not going to get significant upside for our asset in the A&D market.

“We’re an active oil and gas company; we can convert those undeveloped reserves to developed reserves and create cash flow and value that way.”

Encana got PV-10 PDP value for its Arkoma package, which is almost entirely in the dry-gas Arkoma Woodford. “With our drilling results around 30% rate of return, it’s good business for us to convert those results into PDP value if the mark is at a 10% rate.

“We’ll go through that development process because that’s good value-generation for our investors.”

Laterals, fracks

Canyon Creek is also landing two-section laterals, depending on faulting. The average length is 8,500 feet. Frack jobs have tested proppant and fluid of as little as 1,000 pounds and 1,200 gallons per lateral foot to up to 2,100 pounds and 2,500 gallons.

“We’re seeing diminished return as we increase our frack size and just don’t see that we need that large of frack to stimulate the rock efficiently.”

Instead, the greatest change is in how stages are being pumped, “what our rates are, what our timing of pumps are, the diversion that we can use in our fracks and even going as far as shutting in and pulsing our fracks to increase our stimulated rock volume from our activity,” Essman said.

“That’s where we’ve seen the biggest results. It’s not necessarily hitting it with a bigger hammer, but being more precise on how we’re fracking. What that process is is giving us better results.”

EUR for Canyon Creek in both the Woodford and Mayes is about 13 Bcfe for a 10,000-foot lateral, about half NGL and about 5% crude oil.

In the Mayes, Btu is similar across its leasehold and drilling speed is faster than in the Woodford. “It’s more homogeneous rock, so our bits react more favorably vs. the Woodford.

“We’re able to run quite a few of our laterals with one bit [in the Mayes]. It’s maybe three or four in [one] Woodford [lateral]. So that’s going to shave off three or four days of drilling.”

The shallow depth of the formations in the play area is “both a blessing and a curse in that it’s highly fractured, highly faulted.”

Pressure is normal, “right at or a little bit below bubble point for a lot of our production, which is why we get quite a bit of gas and NGL uplift but don’t see the oil production.”

$19 to $9

In January, Arkoma NGL pricing was 37% of WTI or about $19/bbl. “Today, we’re more at 22% of WTI, which is going to be $9 to $10,” Essman said.

With 50% to 60% of revenue coming from NGL sales, “it moved our economics significantly lower.” Meanwhile, over the years, Canyon Creek’s type curves have improved dramatically and costs have fallen.

“The baseline economics still stand. It’s just been a significant downward move in NGL pricing that has affected the basin,” Essman said.

“And that’s not on a differential basis at all; that’s just on top-line pricing coming out of the back of processing plants out of the Arkoma.”

Canyon Creek and other basin operators intending to exit have switched from that business model to “developing within cash flow, modestly growing production, working on capital efficiency. We’re now settling into our assets and are going through more repeatable development.”

Canyon Creek may be a consolidator in the basin instead. As the land grab has concluded, operators are collaborating. “The [play] parameters have been set; now it is more a focus on development going forward.”

Across all basins, as public companies have mostly suspended further acquisitions, Essman sees “quite a bit of opportunity that’s popping up that allows good operating teams to take advantage of development opportunities—and, potentially, acquisition opportunities—to build sustainable companies.

“It’s a change from what we saw over the last decade [of selling start-ups] generally to the public market. We’re all figuring out how to build sustainable companies with the assets.

“I continue to think we’re going to be successful with that and are well on our way to doing that.”

LLC isn’t seeing

frack hits

between the

Woodford and

Mayes during

completions,

said Nathaniel

Harding, cofounder and

president.

At the intersection

Oklahoma City-based Antioch Energy LLC is landing laterals in the new Arkoma play in the Woodford and Mayes and not currently in the Caney.

“We selected our acreage to have what we see as the best of all three, but there’s a lot of Caney development already going on,” said Nathaniel Harding, co-founder and president of the Outfitter Energy Capital-backed operator.

“So we just focused our current technical and intellectual firepower on Woodford and Mayes.”

The acreage is consolidated and majority controlled. It hosts some of the best Woodford wells in terms of IRR in the basin, he said.

“And you also have premium Mayes and Caney geology. Where those three intersect is where we drew our line and were very disciplined in putting together a focus position.”

At $2.15 natgas and with NGL prices halving this year, a number of wells in Antioch’s area are still at 45% to 65% IRR. EUR is more than 1 Bcfe per thousand lateral feet. A two-section well costs about $4.6 million.

“And the decline is very shallow. So that all makes for what we’re seeing as some of the best Woodford economics, including among all Woodford wells over the years in the [overall] basin.”

The shallow decline rate has allowed operators in the new Arkoma play to suspend drilling for months without affecting overall production greatly. It’s not a treadmill kind of play.

“That’s right,” Harding said. “We see three things that are unique to the Arkoma that make it possible to quickly build free cash flow.”

Capex is low as the wells are shallow. Cycle time from spud to first production can be as quick as two months. “Spud-to-spud cycle time for even 2-mile laterals is two weeks. And they frack really well.”

And, thirdly, the low decline. “You don’t have the treadmill effect of always trying to just replace your production. Because of those three technical characteristics, you’re able to build a free-cash-flow profile more easily than you can in most places.”

Non-interference

Woodford and Mayes laterals are landed in wine-rack format with three or four Woodfords and three or four Mayes wells, Harding said. “We’ve done different pilots, measuring different designs, all verifying that we do not have issues between the Woodford and Mayes, given certain completion-design parameters.”

“Even during completions, we won’t see frack hits between them.”

In the Caney, which is shallower than the Mayes, there is support for five wells per section. Between the two formations, there are a couple hundred feet of ductile gray shale.

“So you have plenty of separation both from completions and production. You have a barrier. You can really just do whatever you want with the Caney with no effect.

“You can space however you want. You can complete however you want with the Caney and have no effect on the Mayes.”

The Caney pays but, for Antioch, “it’s just a matter of our focus and our bandwidth,” thus landing in only the Mayes and Woodford for now. “But we want to double down in this play, so, certainly, in our future we would plan to develop Caney wells.”

Antioch is “in a good position because we had a relatively conservative approach on putting together our acreage. That turns out to have been wise in a financial environment that’s been really tough throughout the industry.”

Free cash flow is “really what this liquids-rich Arkoma is built for.” Besides the low capex, fast cycle time and low decline curve, “you’re in Oklahoma, where you have a good regulatory environment, services and institutional knowledge, and proximity to the Gulf Coast.

“That’s another upside story for why we want to be in the Arkoma: We’re able to get access to markets and have some of the best differentials in the Lower 48.”

Recommended Reading

Biden Administration Criticized for Limits to Arctic Oil, Gas Drilling

2024-04-19 - The Bureau of Land Management is limiting new oil and gas leasing in the Arctic and also shut down a road proposal for industrial mining purposes.

NAPE: In Basins Familiar to E&Ps, Lithium Rush Offers Little Gold

2024-02-07 - A quest for sources of lithium comes as the lucrative element is expected to play a part in global efforts to lower emissions, but in many areas the economics are challenging.

BWX Technologies Awarded $45B Contract to Manage Radioactive Cleanup

2024-03-05 - The U.S. Department of Energy’s Office of Environmental Management awarded nuclear technologies company BWX Technologies Inc. a contract worth up to $45 billion for environmental management at the Hanford Site.

FERC Says 32 Bcf/d in US LNG Capacity Approved, Not Yet Built

2024-01-29 - The FERC—which has jurisdiction over the siting, construction and operation of LNG export facilities in the U.S.—reported that 18 projects worth 32 Bcf/d of export capacity have obtained approval but are yet to be built.

US Customs Rules New Fortress’ FLNG Facility Does Not Violate Jones Act

2024-01-30 - New Fortress Energy’s FLNG facility offshore Mexico can now sell and deliver LNG to U.S. locations.