Roughly a month after completing its acquisition of HighPoint Resources, Bonanza Creek announced the agreement on May 10 to acquire Extraction Oil & Gas in an all-stock merger, which is expected to close third-quarter 2021. (Source: Shutterstock.com)

Bonanza Creek Energy Inc. agreed on June 7 to acquire privately held Crestone Peak Resources LLC in an all-stock merger transaction, tacking on another acquisition in the Denver-Julesburg (D-J) Basin.

The acquisition—Bonanza Creek’s third so far this year—represents the company’s strategy to position itself as the modern-day E&P business model, according to President and CEO Eric Greager. The initiative is tied to the formation of Civitas Resources Inc., which will be formed upon closing of its merger with Extraction Oil & Gas Inc. only announced last month.

“Our combination with Crestone is just one early marker of what we hope to achieve as Civitas, as we establish ourselves as the preferred consolidation partner in the D-J Basin and work toward becoming one of the top energy producers in the nation,” said Greager, who will also serve as president and CEO of Civitas based in Denver.

Roughly a month after closing its acquisition of HighPoint Resources, Bonanza Creek announced the agreement on May 10 to acquire Extraction Oil & Gas in an all-stock merger. At the time, Enverus’ Andrew Dittmar said the creation of Civitas places Bonanza Creek “in the driver’s seat” for any remaining consolidation in the D-J Basin.

“While there are few remaining DJ-focused public operators (PDC Energy being a rare exception), there are numerous private E&Ps across the basin some of which may welcome an exit opportunity,” said Dittmar, who serves as senior M&A analyst at Enverus.

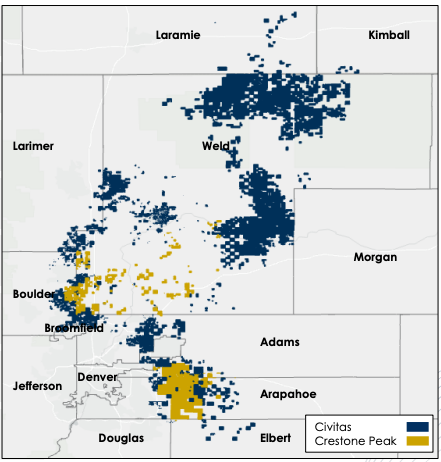

With the addition of Crestone, Civitas will operate across more than half a million net acres, with leasehold positions in all key areas of the D-J Basin. The company will also have an estimated production base of approximately 160,000 boe/d and year-end 2020 proved reserves of more than 530 million boe.

The market cap of Civitas from the combination of Bonanza Creek and Extraction is about $2.6 billion. However, the acquisition of Crestone Peak is expected to boost the enterprise value of Civitas—previously estimated at $3.2 billion—to $4.5 billion. Additionally, the companies expect the acquisition of Crestone to further advance Civitas’ ESG strategy, which includes becoming Colorado’s first net-zero oil and gas producer.

“Over the past five years of our investment in Crestone, the company has demonstrated its commitment to operational strength and efficiency, along with its introduction of innovative sustainability practices,” said Michael Hill, managing director and Americas head of sustainable energy at Canada Pension Plan (CPP) Investment, Crestone’s primary shareholder.

“The combination of Crestone with Civitas creates a stronger platform in the D-J Basin with significant free cash flow and the potential to continue value creation,” Hill added in a statement.

CPP Investments will become Civitas’ largest shareholder and will designate one member to the Civitas board, increasing the size of Civitas’ board of directors to nine from eight. Benjamin Dell, managing partner of Kimmeridge Energy Management Co. LLC who was appointed as Extraction’s chairman following the company’s emergence from bankruptcy in January, will remain as Civitas chairman upon closing.

The Crestone transaction, which includes the exchange of 100% of the equity interests in Crestone for approximately 22.5 million shares of Bonanza Creek common stock, is subject to the consummation of the Bonanza Creek/Extraction merger. Upon completion of the transaction, Bonanza Creek and Extraction shareholders will each own approximately 37% of Civitas. Crestone shareholders, including CPP Investments, will own roughly 26% of Civitas.

The companies expect to close the Crestone transaction immediately following the Bonanza Creek/Extraction merger in the fall of 2021.

J.P. Morgan Securities LLC is financial adviser and Vinson & Elkins LLP is legal adviser to Bonanza Creek. Meanwhile, Extraction tapped Petrie Partners Securities LLC as financial adviser and Kirkland & Ellis LLP as legal adviser. As for Crestone, the company retained Jefferies LLC and TD Securities (USA) LLC as its financial advisers and Gibson, Dunn & Crutcher LLP as legal adviser with Jefferies serving as lead financial adviser.

Editor’s note: This story was updated to clarify the estimated enterprise value of Civitas.

Recommended Reading

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.

ARM Energy Sells Minority Stake in Natgas Marketer to Tokyo Gas

2024-02-06 - Tokyo Gas America Ltd. purchased a stake in the new firm, ARM Energy Trading LLC, one of the largest private physical gas marketers in North America.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

Vital Energy Again Ups Interest in Acquired Permian Assets

2024-02-06 - Vital Energy added even more working interests in Permian Basin assets acquired from Henry Energy LP last year at a purchase price discounted versus recent deals, an analyst said.

DNO Acquires Arran Field Stake, Continuing North Sea Expansion

2024-02-06 - DNO will pay $70 million for Arran Field interests held by ONE-Dyas, and up to $5 million in contingency payments if certain operational targets are met.