Black Stone Minerals said its management and the board of directors of the company’s general partner intend to evaluate increasing distribution levels after closing the transactions, expected in July. (Source: Hart Energy; Shutterstock.com)

Black Stone Minerals LP said June 4 it had entered agreements for the sale of Permian Basin assets with combined proceeds of $155 million earmarked to pay down debt and possibly boost distributions.

In a company release, Black Stone Minerals said it entered into two separate agreements to sell certain mineral and royalty properties from its Permian position for gross proceeds totaling approximately $155 million. The larger of the two agreements—worth about $100 million—involves Pegasus Resources LLC, a portfolio company of EnCap Investments LP.

Black Stone Minerals added that proceeds from the asset sales will be used to reduce the balance outstanding on the company’s revolving credit facility, therefore, accelerating the Houston-based company’s debt reduction goals. As a result, the company said management and the board of directors of its general partner intend to evaluate increasing distribution levels after closing the transactions, expected in July.

Driven by a reliance on E&Ps to generate revenue, a majority of publicly traded mineral companies, Black Stone included, recently slashed dividends and pulled guidances for the year as shut-ins and curtailed activity announced by U.S. shale producers created near-term uncertainty for the business.

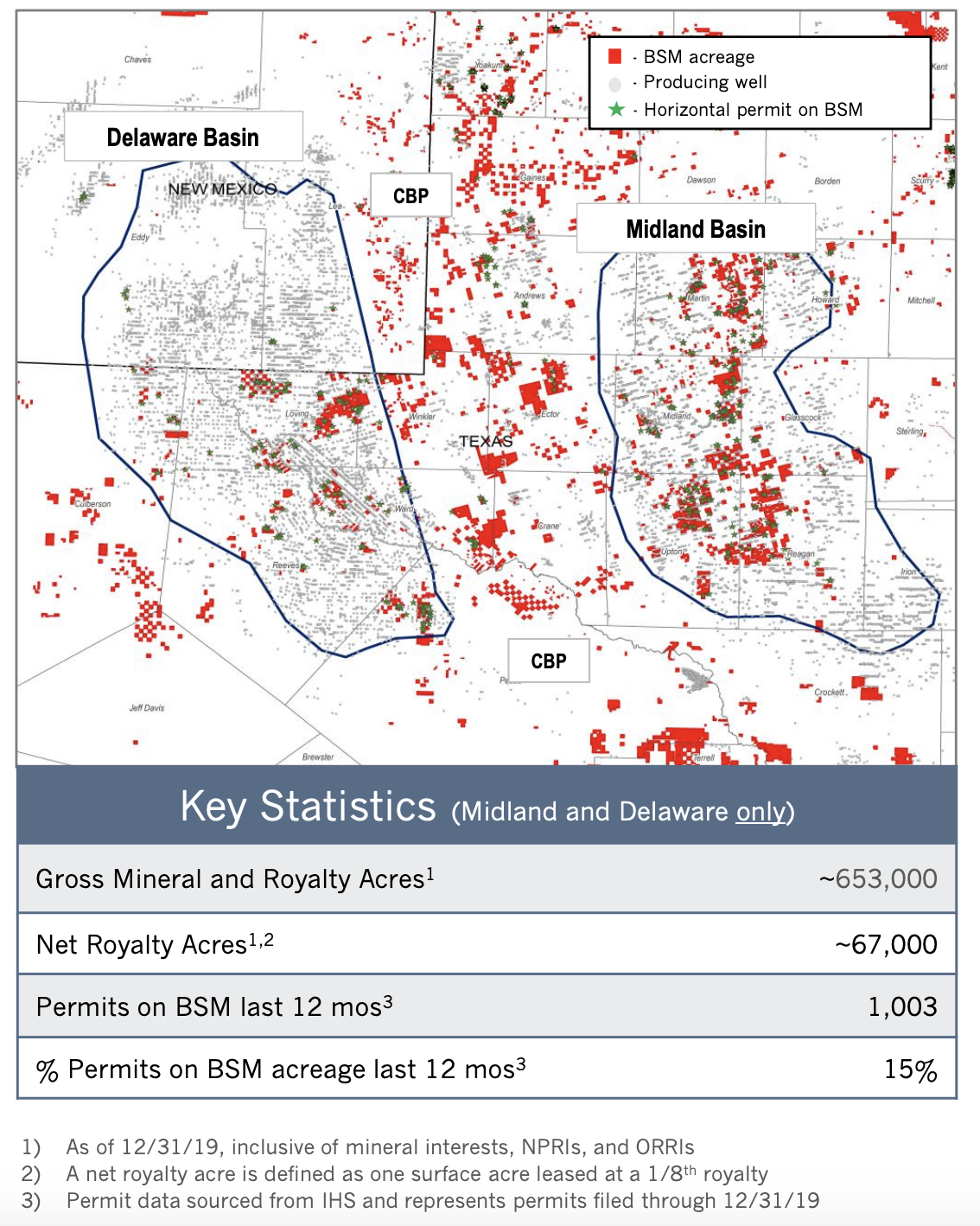

One of the largest mineral owners in the U.S., Black Stone Minerals has a portfolio of mineral and royalty interests across 41 states with concentrated positions in the Permian Basin, Haynesville and Bakken shale plays. The company said on April 22 that the reduction to its distributions were the result of its board’s decision to increase the amount of retained free cash flow for debt reduction and balance sheet protection.

“To the extent that we can get greater clarity around our producers’ plans for the year, we are happy to revisit those guidance measures, but for now, there is just simply too much uncertainty in the market and our crystal ball is frankly a little cloudier than usual,” Jeff Wood, Black Stone’s president and CFO, said during the company’s first-quarter earnings call on May 5.

Following closing of the two transactions announced on June 4, Black Stone expects its total debt levels to be under $200 million.

One of the transaction involves the sale of Black Stone’s mineral and royalty interests in specific tracts in Midland County, Texas to a private buyer for gross proceeds of approximately $55 million. The effective date of this agreement is May 1.

The other agreement involves the sale of a 57% undivided interest across parts of the company’s Delaware Basin position and a 32% undivided interest across parts of the company’s Midland Basin position to EnCap-backed Pegasus Resources for gross proceeds of approximately $100 million. The effective date of this transaction is July 1.

Production associated with the properties to be sold, in total, is estimated to be approximately 1,800 boe/d, according to the company release.

Recommended Reading

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.